On January 1, 2023, The Blue Spruce Company received a 4-year promissory note that had a face value of $1,180,000, and a stated interest

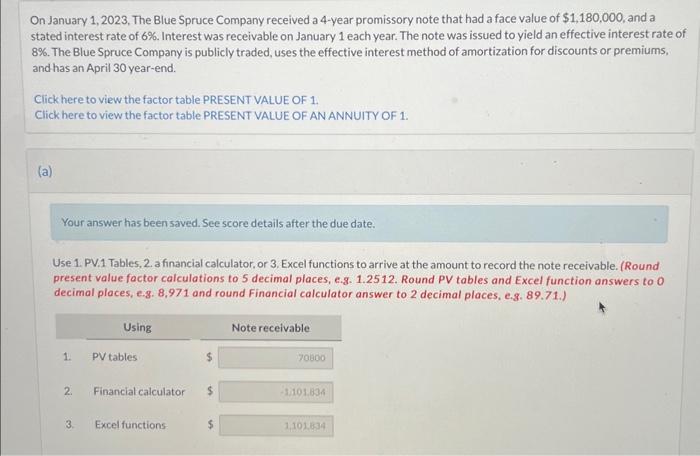

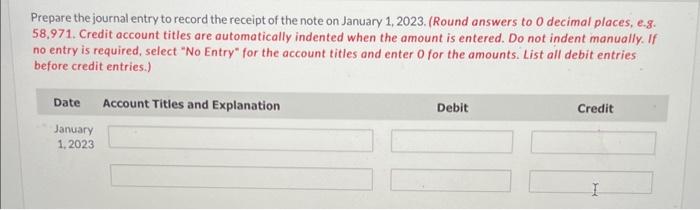

On January 1, 2023, The Blue Spruce Company received a 4-year promissory note that had a face value of $1,180,000, and a stated interest rate of 6%. Interest was receivable on January 1 each year. The note was issued to yield an effective interest rate of 8%. The Blue Spruce Company is publicly traded, uses the effective interest method of amortization for discounts or premiums, and has an April 30 year-end. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (a) Your answer has been saved. See score details after the due date. Use 1. PV.1 Tables, 2. a financial calculator, or 3. Excel functions to arrive at the amount to record the note receivable. (Round present value factor calculations to 5 decimal places, e.g. 1.2512. Round PV tables and Excel function answers to O decimal places, e.g. 8,971 and round Financial calculator answer to 2 decimal places, e.g. 89.71.) Using 1. PV tables Note receivable 70800 2. Financial calculator $ -1101.834 3. Excel functions $ 1,101.834 Prepare the journal entry to record the receipt of the note on January 1, 2023. (Round answers to 0 decimal places, e.g. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Date January 1,2023 Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount to record the note receivable we need to calculate the present value of both the principal and the interest payments using the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started