Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help Question 9 (3 points) On January 1, Rhyolite issued $400,000 of 8%,5-year bonds when the market rate of interest was 6%. The bonds

plz help

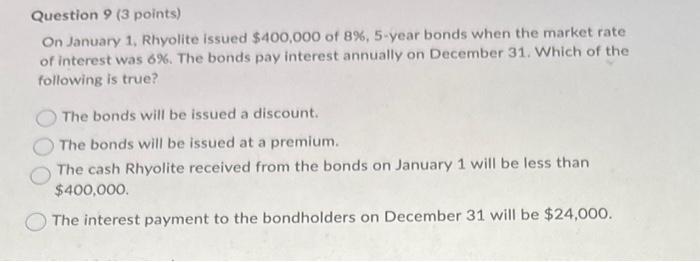

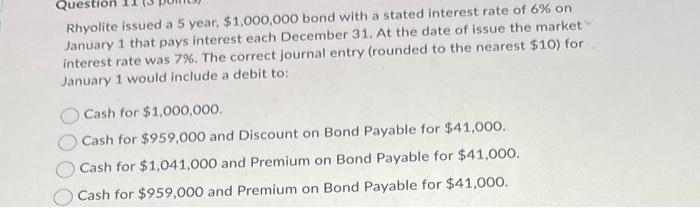

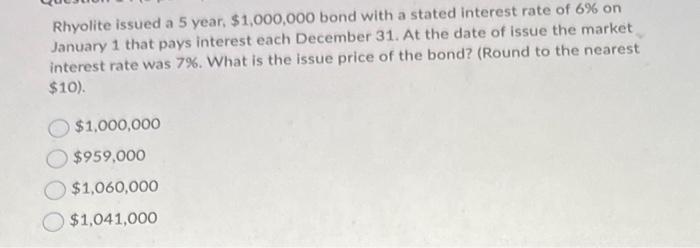

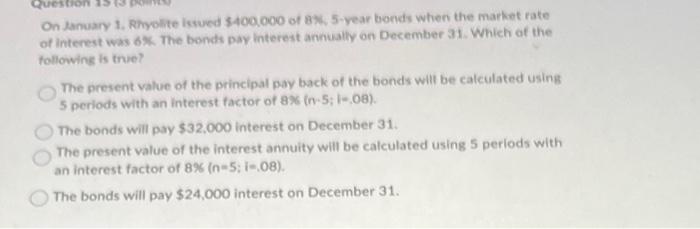

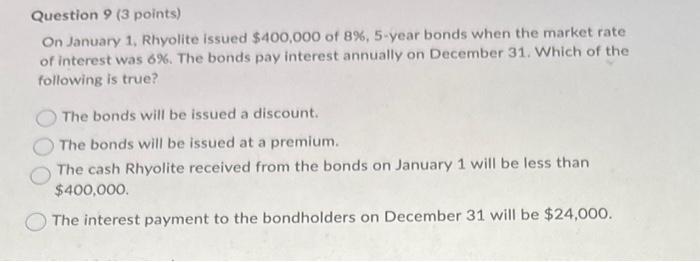

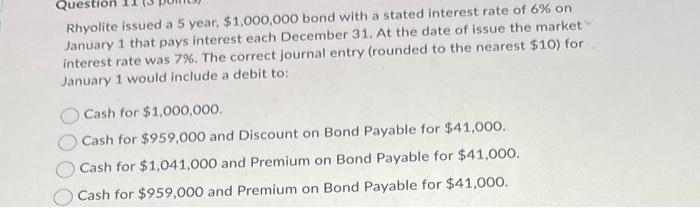

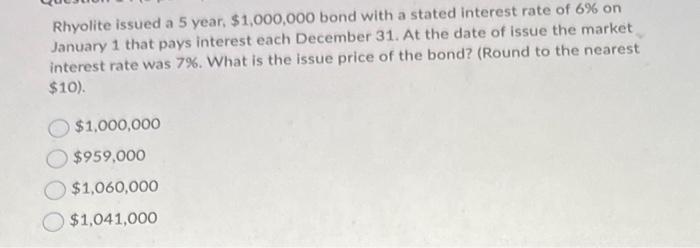

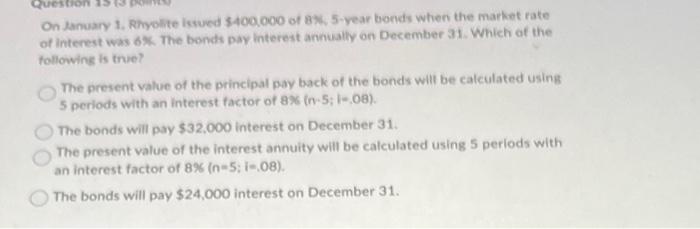

Question 9 (3 points) On January 1, Rhyolite issued $400,000 of 8%,5-year bonds when the market rate of interest was 6%. The bonds pay interest annually on December 31. Which of the following is true? The bonds will be issued a discount. The bonds will be issued at a premium. The cash Rhyolite received from the bonds on January 1 will be less than $400,000. The interest payment to the bondholders on December 31 will be $24,000. Rhyolite issued a 5 year, $1,000,000 bond with a stated interest rate of 6% on January 1 that pays interest each December 31 . At the date of issue the market interest rate was 7%. The correct journal entry (rounded to the nearest $10 ) for January 1 would include a debit to: Cash for $1,000,000. Cash for $959,000 and Discount on Bond Payable for $41,000. Cash for $1,041,000 and Premium on Bond Payable for $41,000. Cash for $959,000 and Premium on Bond Payable for $41,000 Rhyolite issued a 5 year, $1,000,000 bond with a stated interest rate of 6% on January 1 that pays interest each December 31. At the date of issue the market interest rate was 7%. What is the issue price of the bond? (Round to the nearest $10) $1,000,000$959,000$1,060,000$1,041,000 On January 1. Rhyolite lstued $400.000 of 8\%. 5-year bonds when the market rate of interest was 6%. The bonds pay interest annually on December 31. Which of the following is true? The present value of the principal pay back of the bonds will be calculated using 5 periods with an interest factor of 8%(n5;1=.08). The bonds will pay $32.000 interest on December 31. The present value of the interest annuity will be calculated using 5 periods with an interest factor of 8%(n=5; i =,08). The bonds will pay $24,000 interest on December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started