Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz!!!!! help!!!!! test!!!!! help me!!!!!! plz!!!!thx!!! Part Develop the Year 1 financial forecast income statement, balance sheet and statement of cash flows for Bennis Co.

plz!!!!! help!!!!! test!!!!! help me!!!!!!

plz!!!!thx!!!

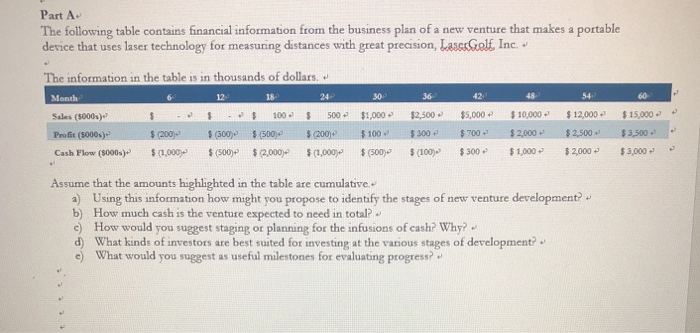

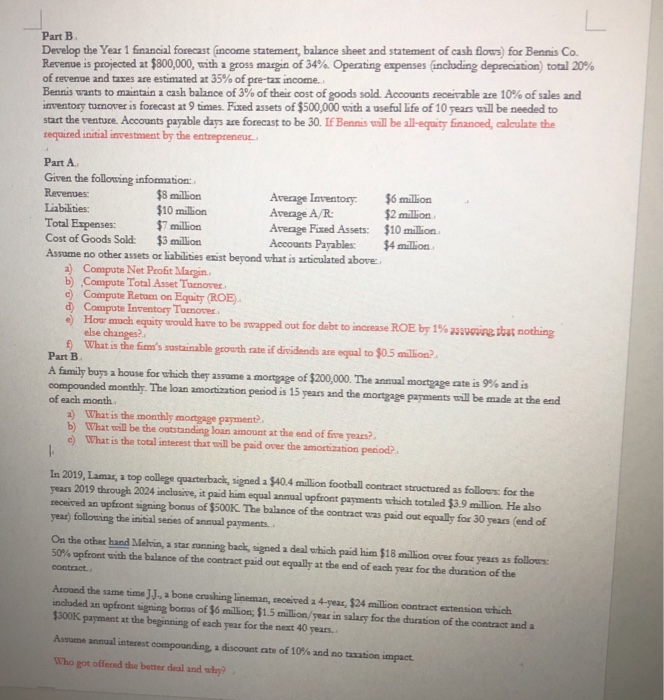

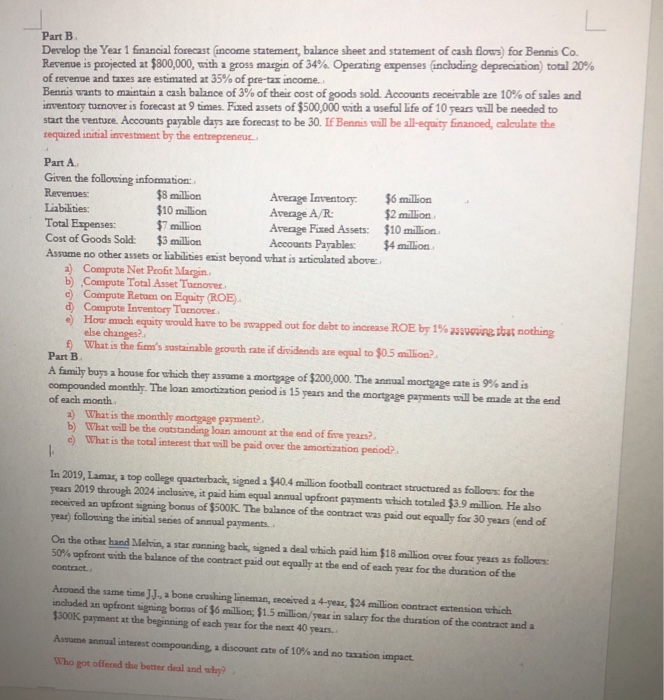

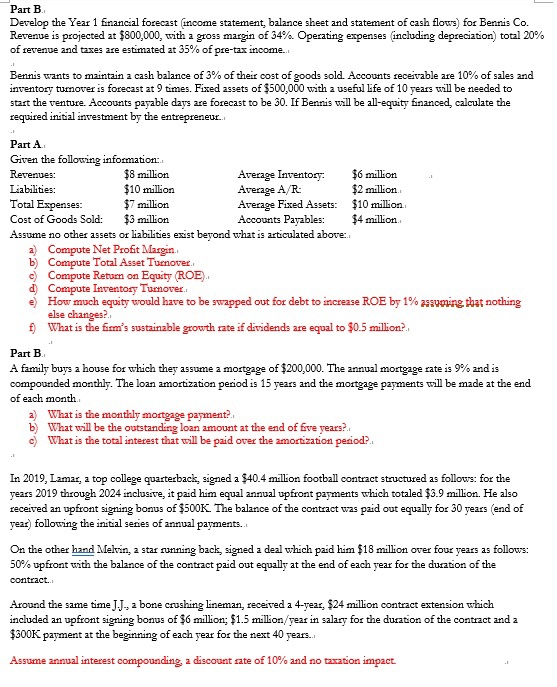

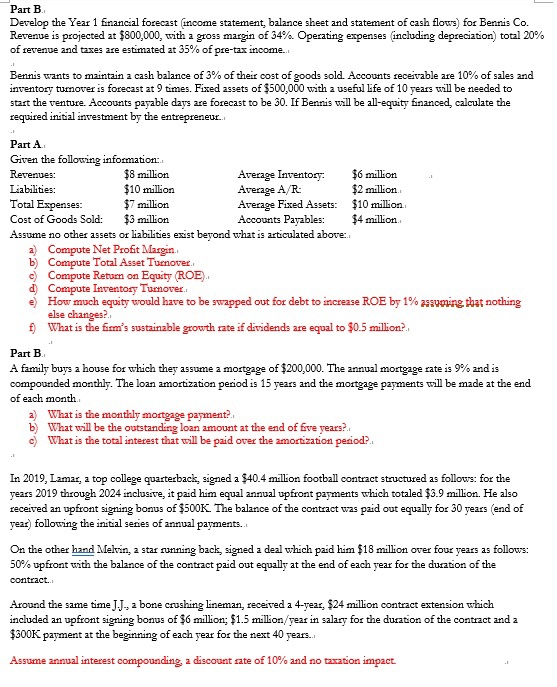

Part Develop the Year 1 financial forecast income statement, balance sheet and statement of cash flows for Bennis Co. Revenue is projected at $800,000, with a gross margin of 34% Operating expenses (including depreciation total 20% of revenge and taxes are estimated at 35% of pre-tax income Bennis wants to maintain a cash balance of 3% of their cost of goods sold Accounts receivable are 10% of sales and inventory turnover is forecast at 9 times. Fixed assets of $500,000 with a useful life of 10 years will be needed to start the venture. Accounts payable days are forecast to be 30. If Bennis will be all-equity financed, calculate the required initial investment by the entrepreneur Part A Given the following information Revenues: $8 million Average Inventory: $6 million Liabilities: $10 million Avecage AR $2 million Total Expenses: Avenge Fund Assets: $10 million Cost of Goods Sold: $3 million Accounts Payables: $4 million Assume no other assets or liabilities exist beyond what is articulated above 2) Compute Net Profit Margin b) Compute Total Asset Turnover c) Compute Return on Equity ROE d) Compute Inventory Toote e) How much equity would have to be swapped out for debt to increase ROE by 1% sering that nothing else changes f) What is the firm's sustainable growth rate if dividends are equal to $0.5 million Part B A family buys a house for which they assume a mortgage of $200,000. The annual mortgage rate is 9% and is compounded monthly. The loan amortization period is 15 years and the mortgage payments will be made at the end of each month a) What is the monthly mortgage payment b) What will be the outstanding loan amount at the end of five years? c) What is the total interest that will be paid over the amortization period In 2019, Lamar, a top college quarterback, signed a $40.4 million football contract structured as follows for the years 2019 through 2024 inclusive, it paid him equal annual upfront payments which totaled $3.9 million. He also received an upfront signing boms of $500K. The balance of the contract was paid out equally for 30 years (end of year) following the initial series of annual payments. On the other hand Melvin, a star ranning back, signed a deal which paid him $18 million over four years as follows: 50% upfront with the balance of the contract paid out equally at the end of each year for the duration of the contact Around the same time JJ, bone crushing lineman, received a 4-ear, $24 million contract extension which included an opfront signing bonos of $6 million $1.5 million/sear in salary for the duration of the contract anda $300K payment at the beginning of each year for the next 40 years. Asume annual interest compounding a discount rate of 10% and no taxation impact Who got offered the better deal and why? Part B. Develop the Year 1 financial forecast income statement, balance sheet and statement of cash flows) for Bennis Co. Revenue is projected at $800,000, with a gross margin of 34%. Operating expenses including depreciation) total 20% of revenue and taxes are estimated at 35% of pre-tax income... Bennis wants to maintain a cash balance of 3% of their cost of goods sold. Accounts receivable are 10% of sales and inventory tumover is forecast at 9 times. Fixed assets of $500,000 with a useful life of 10 years will be needed to start the venture. Accounts payable days are forecast to be 30. If Bennis will be all-equity financed, calculate the required initial investment by the entrepreneur... Part A Given the following information. Revenues: $8 million Average Inventory: $6 million Liabilities: $10 million Average A/R $2 million Total Expenses: $7 million Average Fixed Assets: $10 million Cost of Goods Sold: $3 million Accounts Payables: $4 million Assume no other assets or liabilities exist beyond what is articulated above. a) Compute Net Profit Margin. b) Compute Total Asset Tumover. c) Compute Return on Equity (ROE). d) Compute Inventory Tumover. e) How much equity would have to be swapped out for debt to increase ROE by 1% assering that nothing else changes? f) What is the firm's sustainable growth rate if dividends are equal to $0.5 million? Part B. A family buys a house for which they assume a mortgage of $200,000. The annual mortgage rate is 9% and is compounded monthly. The loan amortization period is 15 years and the mortgage payments will be made at the end of each month. a) What is the monthly mortgage payment b) What will be the outstanding loan amount at the end of five years? c) What is the total interest that will be paid over the amortization period? In 2019, Lamar, a top college quarterback, signed a $40.4 millon football contract structured as follows: for the years 2019 through 2024 inclusive, it paid him equal annual upfront payments which totaled $3.9 million. He also received an upfront signing bonus of $500K. The balance of the contract was paid out equally for 30 years end of year) following the initial series of annual payments... On the other hand Melvin, a star running back, signed a deal which paid him $18 million over four years as follows: 50% upfront with the balance of the contract paid out equally at the end of each year for the duration of the contract.. Around the same time JJ., a bone crushing Lineman, received a 4-year, $24 million contract extension which included an upfront signing bonus of $6 million; $1.5 million/year in salary for the duration of the contract and a $300K payment at the beginning of each year for the next 40 years. Assume annual interest compounding, a discount sate of 10% and no taxation impact. Part Develop the Year 1 financial forecast income statement, balance sheet and statement of cash flows for Bennis Co. Revenue is projected at $800,000, with a gross margin of 34% Operating expenses (including depreciation total 20% of revenge and taxes are estimated at 35% of pre-tax income Bennis wants to maintain a cash balance of 3% of their cost of goods sold Accounts receivable are 10% of sales and inventory turnover is forecast at 9 times. Fixed assets of $500,000 with a useful life of 10 years will be needed to start the venture. Accounts payable days are forecast to be 30. If Bennis will be all-equity financed, calculate the required initial investment by the entrepreneur Part A Given the following information Revenues: $8 million Average Inventory: $6 million Liabilities: $10 million Avecage AR $2 million Total Expenses: Avenge Fund Assets: $10 million Cost of Goods Sold: $3 million Accounts Payables: $4 million Assume no other assets or liabilities exist beyond what is articulated above 2) Compute Net Profit Margin b) Compute Total Asset Turnover c) Compute Return on Equity ROE d) Compute Inventory Toote e) How much equity would have to be swapped out for debt to increase ROE by 1% sering that nothing else changes f) What is the firm's sustainable growth rate if dividends are equal to $0.5 million Part B A family buys a house for which they assume a mortgage of $200,000. The annual mortgage rate is 9% and is compounded monthly. The loan amortization period is 15 years and the mortgage payments will be made at the end of each month a) What is the monthly mortgage payment b) What will be the outstanding loan amount at the end of five years? c) What is the total interest that will be paid over the amortization period In 2019, Lamar, a top college quarterback, signed a $40.4 million football contract structured as follows for the years 2019 through 2024 inclusive, it paid him equal annual upfront payments which totaled $3.9 million. He also received an upfront signing boms of $500K. The balance of the contract was paid out equally for 30 years (end of year) following the initial series of annual payments. On the other hand Melvin, a star ranning back, signed a deal which paid him $18 million over four years as follows: 50% upfront with the balance of the contract paid out equally at the end of each year for the duration of the contact Around the same time JJ, bone crushing lineman, received a 4-ear, $24 million contract extension which included an opfront signing bonos of $6 million $1.5 million/sear in salary for the duration of the contract anda $300K payment at the beginning of each year for the next 40 years. Asume annual interest compounding a discount rate of 10% and no taxation impact Who got offered the better deal and why? Part B. Develop the Year 1 financial forecast income statement, balance sheet and statement of cash flows) for Bennis Co. Revenue is projected at $800,000, with a gross margin of 34%. Operating expenses including depreciation) total 20% of revenue and taxes are estimated at 35% of pre-tax income... Bennis wants to maintain a cash balance of 3% of their cost of goods sold. Accounts receivable are 10% of sales and inventory tumover is forecast at 9 times. Fixed assets of $500,000 with a useful life of 10 years will be needed to start the venture. Accounts payable days are forecast to be 30. If Bennis will be all-equity financed, calculate the required initial investment by the entrepreneur... Part A Given the following information. Revenues: $8 million Average Inventory: $6 million Liabilities: $10 million Average A/R $2 million Total Expenses: $7 million Average Fixed Assets: $10 million Cost of Goods Sold: $3 million Accounts Payables: $4 million Assume no other assets or liabilities exist beyond what is articulated above. a) Compute Net Profit Margin. b) Compute Total Asset Tumover. c) Compute Return on Equity (ROE). d) Compute Inventory Tumover. e) How much equity would have to be swapped out for debt to increase ROE by 1% assering that nothing else changes? f) What is the firm's sustainable growth rate if dividends are equal to $0.5 million? Part B. A family buys a house for which they assume a mortgage of $200,000. The annual mortgage rate is 9% and is compounded monthly. The loan amortization period is 15 years and the mortgage payments will be made at the end of each month. a) What is the monthly mortgage payment b) What will be the outstanding loan amount at the end of five years? c) What is the total interest that will be paid over the amortization period? In 2019, Lamar, a top college quarterback, signed a $40.4 millon football contract structured as follows: for the years 2019 through 2024 inclusive, it paid him equal annual upfront payments which totaled $3.9 million. He also received an upfront signing bonus of $500K. The balance of the contract was paid out equally for 30 years end of year) following the initial series of annual payments... On the other hand Melvin, a star running back, signed a deal which paid him $18 million over four years as follows: 50% upfront with the balance of the contract paid out equally at the end of each year for the duration of the contract.. Around the same time JJ., a bone crushing Lineman, received a 4-year, $24 million contract extension which included an upfront signing bonus of $6 million; $1.5 million/year in salary for the duration of the contract and a $300K payment at the beginning of each year for the next 40 years. Assume annual interest compounding, a discount sate of 10% and no taxation impact

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started