Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help with all parts i will upvote. Problem 7A-4 Activity-Based Costing as an Alternative to Traditional Product Costing [LO6] For many years. Sinclair Graphic

plz help with all parts i will upvote.

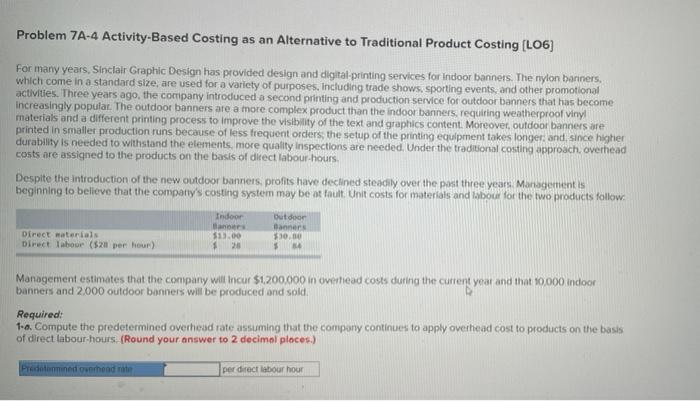

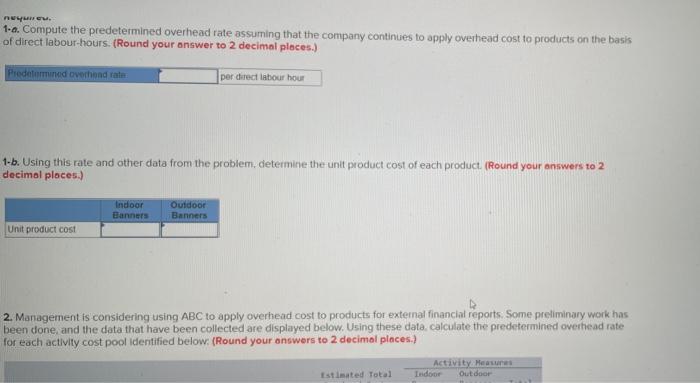

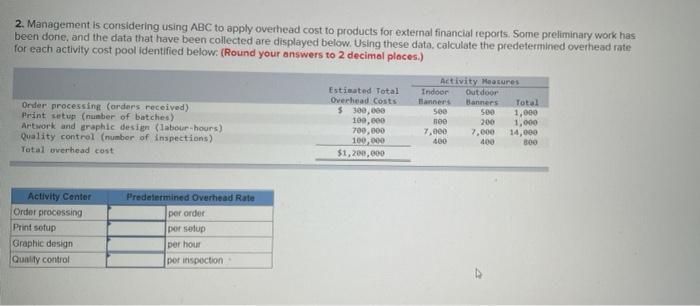

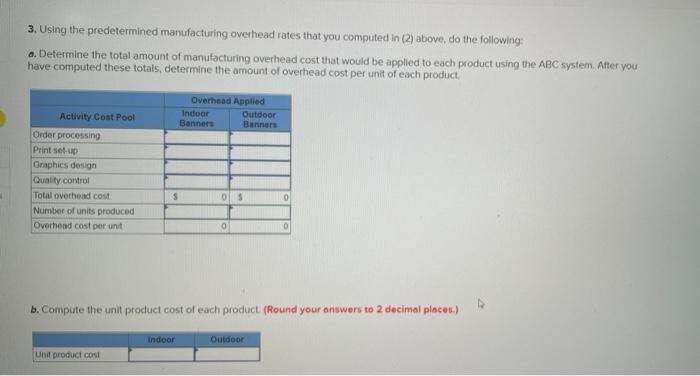

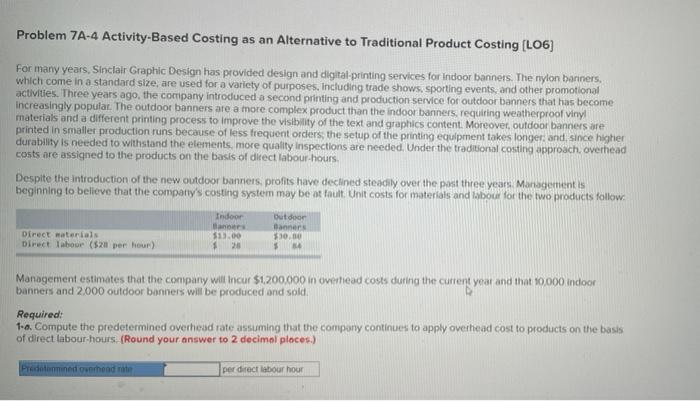

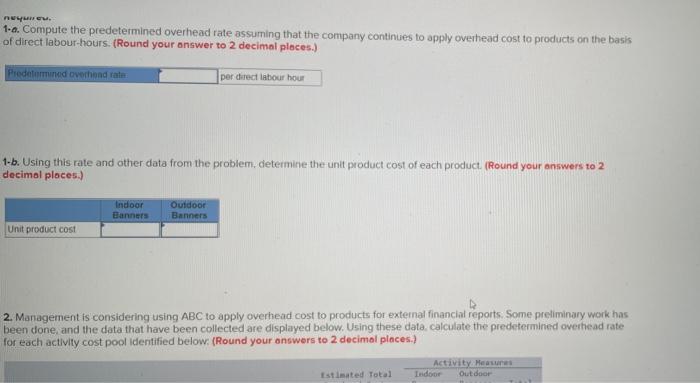

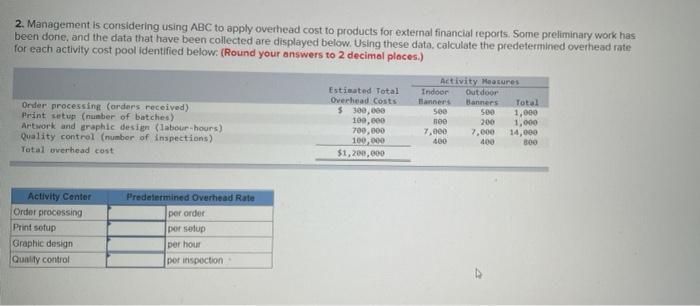

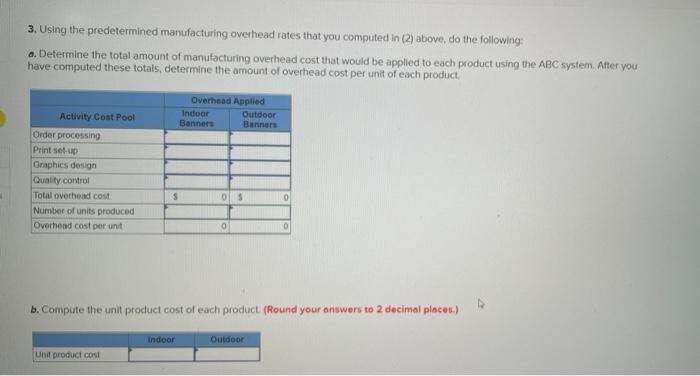

Problem 7A-4 Activity-Based Costing as an Alternative to Traditional Product Costing [LO6] For many years. Sinclair Graphic Design has provided design and digital-printing services for Indoor banners. The nylon banners, which come in a standard size, are used for a variety of purposes. Including trade shows, sporting events, and other promotional activities. Three years ago, the company introduced a second printing and production service for outdoor banners that has become increasingly popular. The outdoor banners are a more complex product than the indoor banners, requiring weatherproof vinyl materials and a different printing process to improve the visibility of the text and graphics content. Moreover, outdoor banners are printed in smaller production runs because of less frequent orders; the setup of the printing equipment takes longer; and, since higher durability is needed to withstand the elements, more quality inspections are needed. Under the traditional costing approach, overhead costs are assigned to the products on the basis of direct labour-hours. Despite the introduction of the new outdoor banners, profits have declined steadily over the past three years. Management is beginning to believe that the company's costing system may be at fault. Unit costs for materials and labour for the two products follow: Indoor Outdoor Banners Banners Direct materials $13.00 $30.00 Direct labour ($28 per hour) $ 28 $14 Management estimates that the company will Incur $1,200,000 in overhead costs during the current year and that 10,000 indoor banners and 2.000 outdoor banners will be produced and sold. Required: 1-a. Compute the predetermined overhead rate assuming that the company continues to apply overhead cost to products on the basis of direct labour-hours. (Round your answer to 2 decimal places.) Predatanmined overhead rate per direct labour hour Required. 1-4. Compute the predetermined overhead rate assuming that the company continues to apply overhead cost to products on the basis of direct labour-hours. (Round your answer to 2 decimal places.) Predetermined overhead rate per direct labour hour 1-b. Using this rate and other data from the problem, determine the unit product cost of each product. (Round your answers to 2 decimal places.) Indoor Banners Outdoor Banners Unit product cost 2. Management is considering using ABC to apply overhead cost to products for external financial reports. Some preliminary work has been done, and the data that have been collected are displayed below. Using these data, calculate the predetermined overhead rate for each activity cost pool identified below: (Round your answers to 2 decimal places.) Activity Measures Outdoor Estimated Total Indoor 2. Management is considering using ABC to apply overhead cost to products for external financial reports. Some preliminary work has been done, and the data that have been collected are displayed below. Using these data, calculate the predetermined overhead rate for each activity cost pool identified below: (Round your answers to 2 decimal places.) Estimated Total Overhead Costs $ 300,000 100,000 Activity Measures Indoor Outdoor Banners Banners Order processing (orders received) Print setup (number of batches) 500 500 B00 200 700,000 7,000 7,000 Artwork and graphic design (labour-hours) Quality control (number of inspections) Total overhead cost 100,000 400 400 $1,200,000 Activity Center Order processing Print setup Graphic design Quality control - Predetermined Overhead Rate per order per setup per hour por inspection Total 1,000 1,000 14,000 800 M 3. Using the predetermined manufacturing overhead rates that you computed in (2) above, do the following: a. Determine the total amount of manufacturing overhead cost that would be applied to each product using the ABC system. After you have computed these totals, determine the amount of overhead cost per unit of each product. Overhead Applied Activity Cost Pool Order processing Print set-up Graphics design Quality control Total overhead cost S 0 $ Number of units produced Overhead cost per unit 0 0 b. Compute the unit product cost of each product. (Round your answers to 2 decimal places.) Indoor Outdoor Unit product cost Indoor Banners Outdoor Banners 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started