Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz help with all q n parts... i will upvote if accurate. next q with all parts plz i will upvote! no excel plz Problem

plz help with all q n parts... i will upvote if accurate.

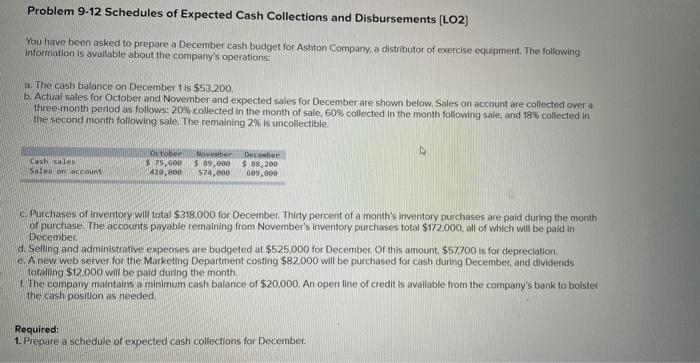

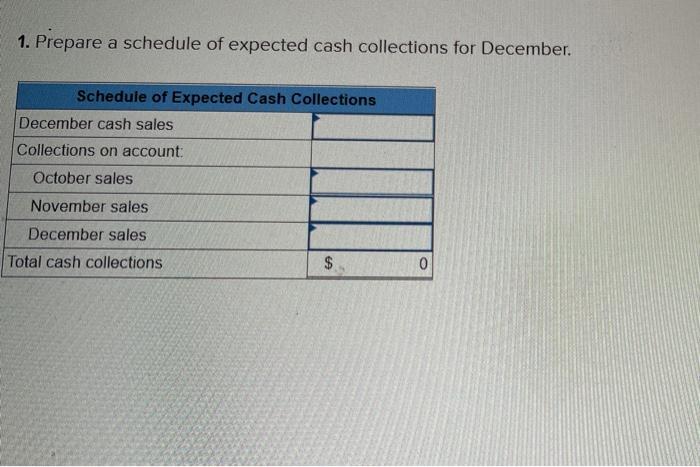

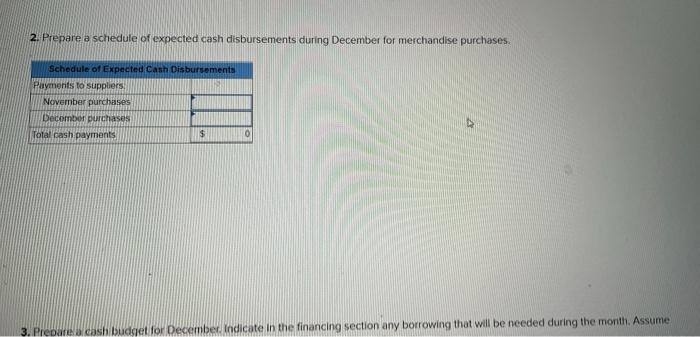

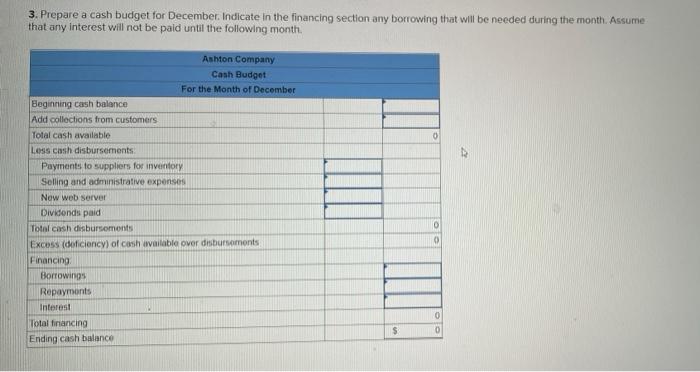

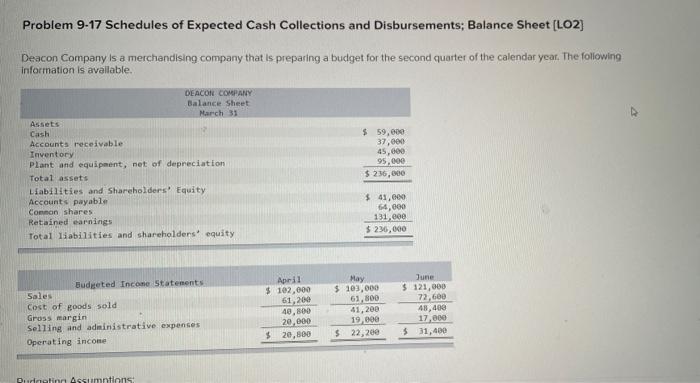

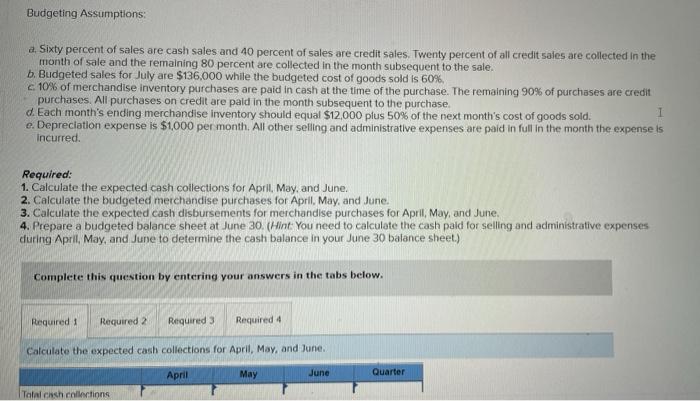

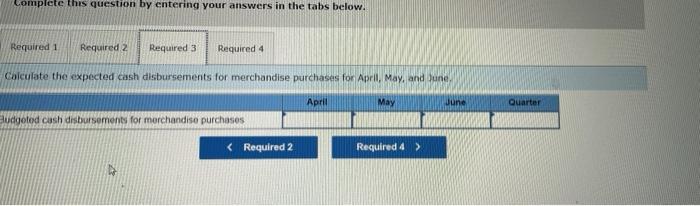

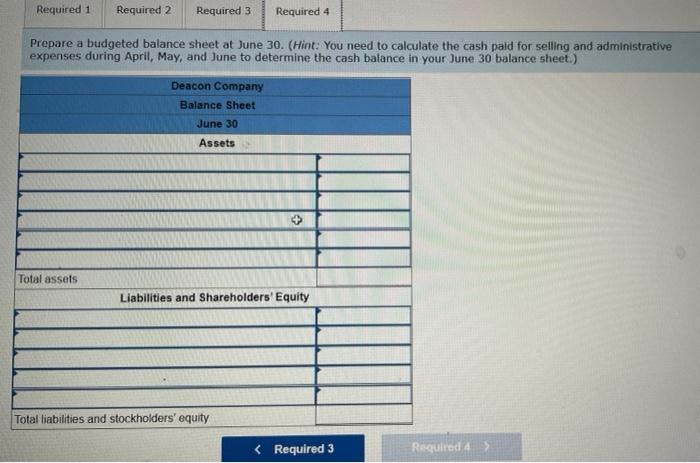

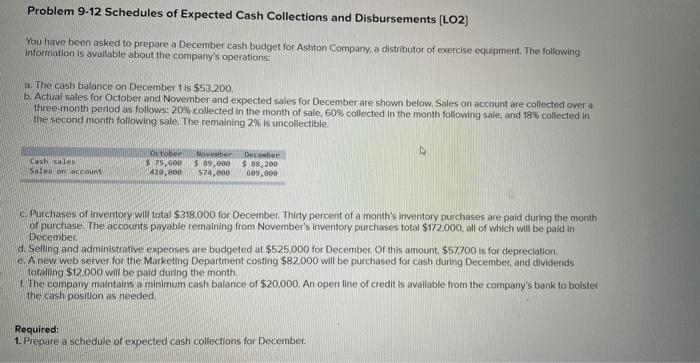

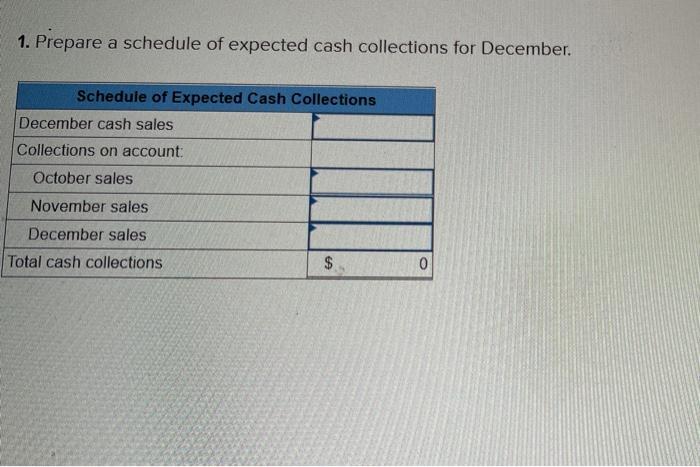

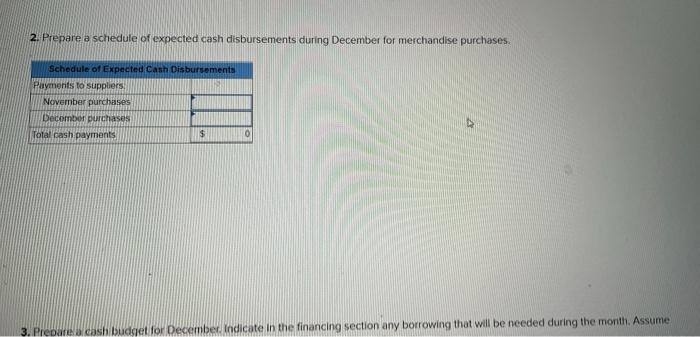

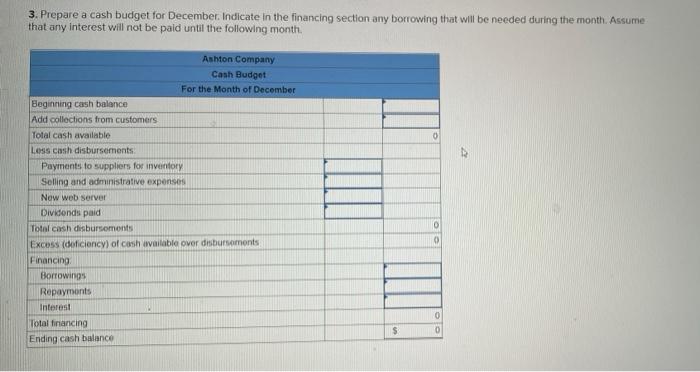

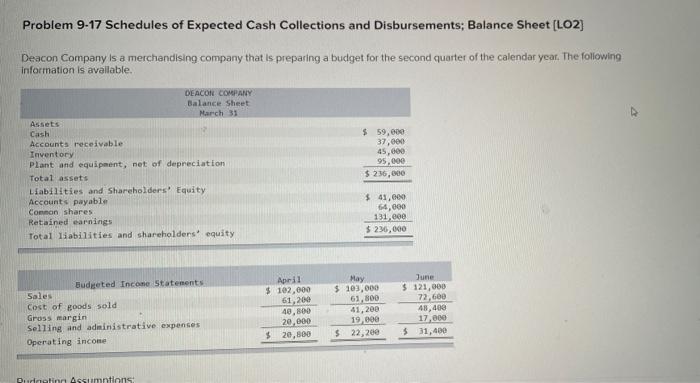

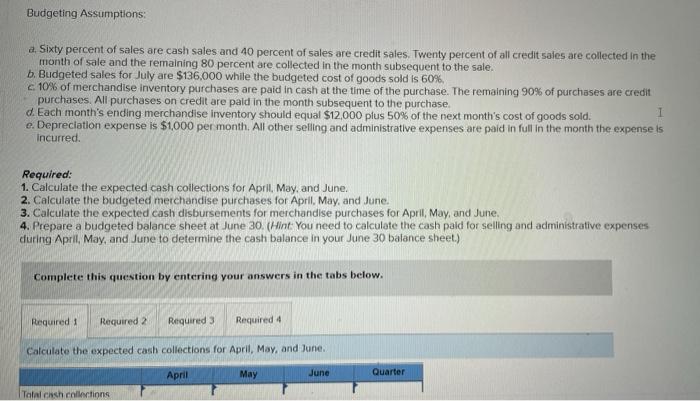

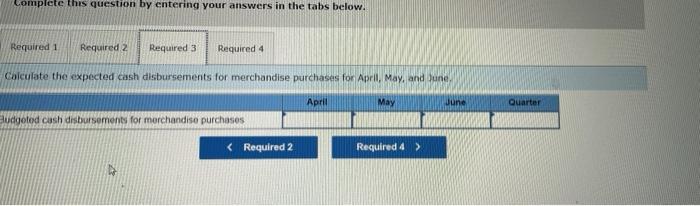

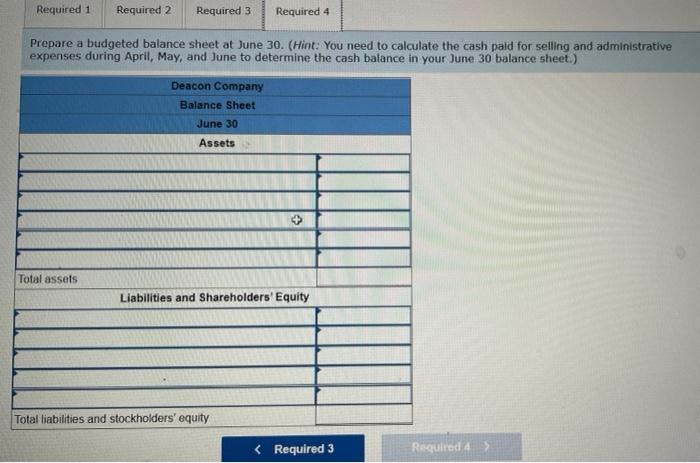

Problem 9.12 Schedules of Expected Cash Collections and Disbursements [LO2] You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following intormation is available about the company's operations: a. The cash balance on December 115$53.200. b. Actual sales for October and November and expected sales for December are shown below. Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following siale. The remaining 2% is uncollectible. 6u Purchases of inventory will total \$318,000 for December. Thity percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $172,000, all of which will be paid in December: 4. Selling and administrative expenses are budgeted at $525,000 for December. Of this amount, $57,700 is for depreciation. e. A now web server for the Marketing Department costing $82,000 will be purchased for cash during December, and dividends totaling $12.000 will be paid during the month. f. The company maintains a minimum cash balance of $20,000. An open line of credit is avallable from the company's bank to bolster the cash position as needed. Required: 1. Prepare a schiedule of expected cash collections for December. 1. Prepare a schedule of expected cash collections for December. 2. Prepare a schedule of expected cash disbursements during December for merchandise purchases. 3. Prebares.cashbudget for December. Indicate in the financing section any borrowing that will be needed during the morith. Assume 3. Prepare a cash budget for December. Indicate in the financing section any borrowing that will be needed during the month. Assume that any interest will not be paid until the following month. Problem 9-17 Schedules of Expected Cash Collections and Disbursements; Balance Sheet [LO2] Deacon Company is a merchandising company that is preparing a budget for the second quarter of the calendar year. The following information is avallable. Budgeting Assumptions: a. Sixty percent of sales are cash sales and 40 percent of sales are credit sales. Twenty percent of all credit sales are collected in the month of sale and the remaining 80 percent are collected in the month subsequent to the sale. b. Budgeted sales for July are $136,000 while the budgeted cost of goods sold is 60%. c. 10% of merchandise inventory purchases are paid in cash at the time of the purchase. The remaining 90% of purchases are credit purchases. All purchases on credit are paid in the month subsequent to the purchase. d. Each month's ending merchandise imventory should equal $12,000 plus 50% of the next month's cost of goods sold. e. Depreciation expense is $1,000 per month. All other seling and administrative expenses are paid in full in the month the expense is incurred. Required: 1. Calculate the expected cash collections for Aprill, May, and June. 2. Calculate the budgeted merchandise purchases for April, May, and June. 3. Calculate the expected cash disbursements for merchandise purchases for April, May; and June. 4. Prepare a budgeted balance sheet at June 30. (Hint: You need to calculate the cash pald for selling and administrative expenses during April, May, and June to determine the cash balance in your June 30 balance sheet.) Complete this question by entering your answers in the tabs below. Calculate the expected cash coliections for April., May, and June. Complete this guestion by entering your answers in the tabs below. alculate the expected cash disbursements for merchandise purchases for Aprli, May, and lune. Prepare a budgeted balance sheet at June 30. (Hint: You need to calculate the cash paid for selling and administrative expenses during April, May, and June to determine the cash balance in your June 30 balance sheet.)

next q with all parts plz i will upvote! no excel plz

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started