Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz hurry Question 3) 5 Marks On 21 July 2020, the Government announced the extension of the JobKeeper Payment for a further six months until

plz hurry

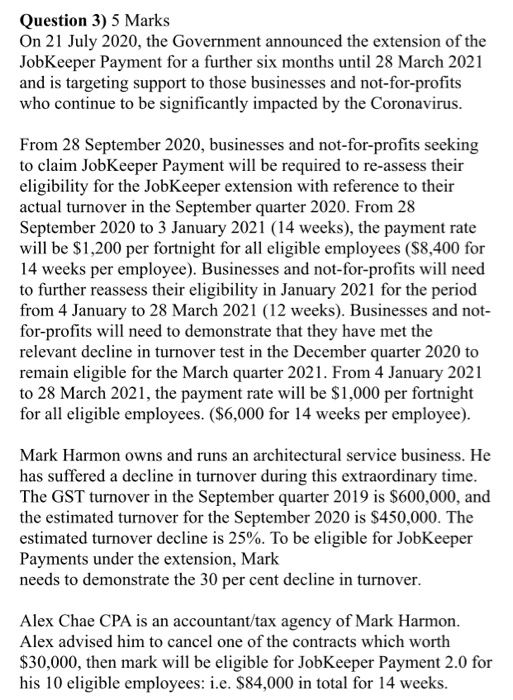

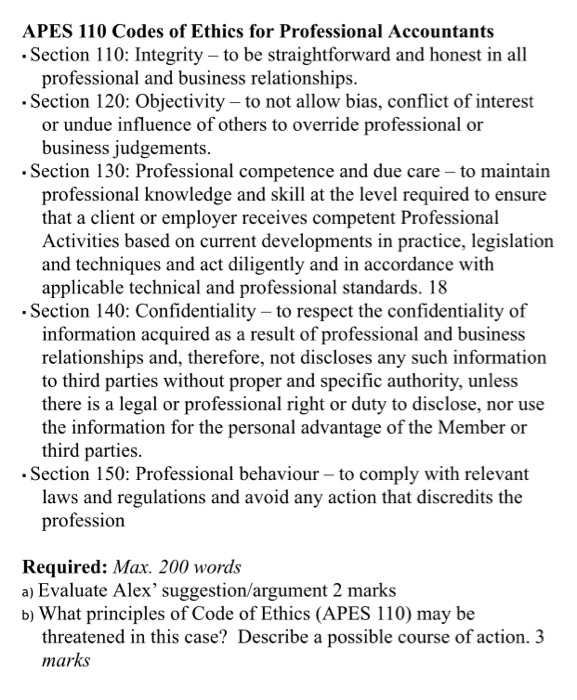

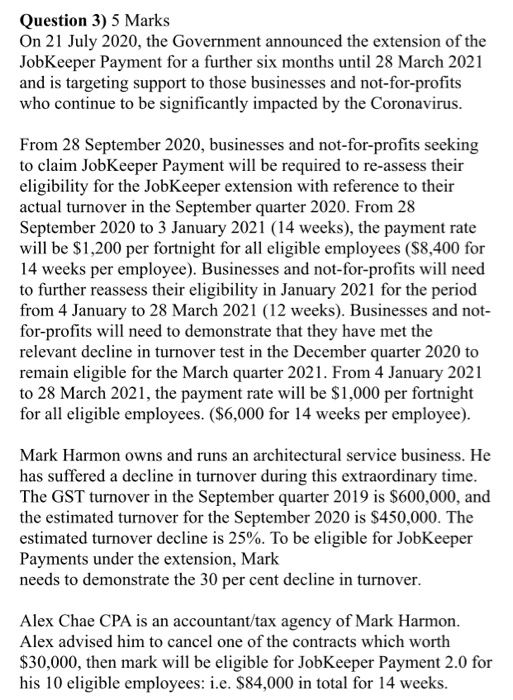

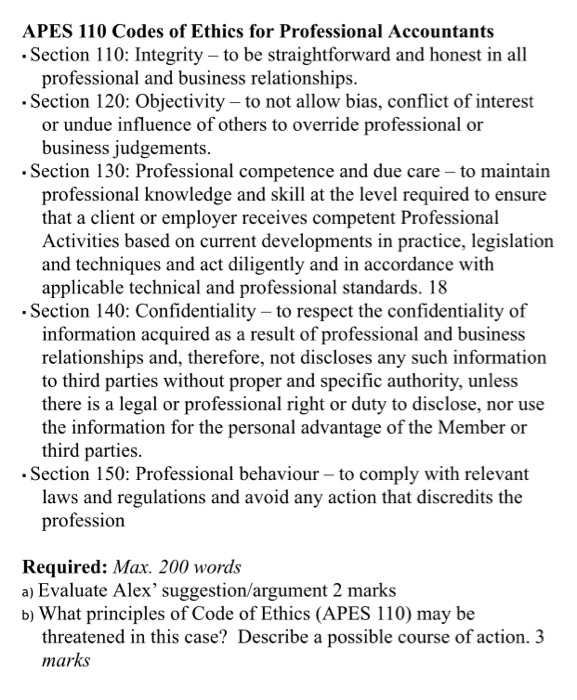

Question 3) 5 Marks On 21 July 2020, the Government announced the extension of the JobKeeper Payment for a further six months until 28 March 2021 and is targeting support to those businesses and not-for-profits who continue to be significantly impacted by the Coronavirus. From 28 September 2020, businesses and not-for-profits seeking to claim JobKeeper Payment will be required to re-assess their eligibility for the JobKeeper extension with reference to their actual turnover in the September quarter 2020. From 28 September 2020 to 3 January 2021 (14 weeks), the payment rate will be $1,200 per fortnight for all eligible employees ($8,400 for 14 weeks per employee). Businesses and not-for-profits will need to further reassess their eligibility in January 2021 for the period from 4 January to 28 March 2021 (12 weeks). Businesses and not- for-profits will need to demonstrate that they have met the relevant decline in turnover test in the December quarter 2020 to remain eligible for the March quarter 2021. From 4 January 2021 to 28 March 2021, the payment rate will be $1,000 per fortnight for all eligible employees. ($6,000 for 14 weeks per employee). Mark Harmon owns and runs an architectural service business. He has suffered a decline in turnover during this extraordinary time. The GST turnover in the September quarter 2019 is $600,000, and the estimated turnover for the September 2020 is $450,000. The estimated turnover decline is 25%. To be eligible for JobKeeper Payments under the extension, Mark needs to demonstrate the 30 per cent decline in turnover. Alex Chae CPA is an accountant/tax agency of Mark Harmon. Alex advised him to cancel one of the contracts which worth $30,000, then mark will be eligible for JobKeeper Payment 2.0 for his 10 eligible employees: i.e. $84,000 in total for 14 weeks. APES 110 Codes of Ethics for Professional Accountants Section 110: Integrity - to be straightforward and honest in all professional and business relationships. Section 120: Objectivity to not allow bias, conflict of interest or undue influence of others to override professional or business judgements. Section 130: Professional competence and due care to maintain professional knowledge and skill at the level required to ensure that a client or employer receives competent Professional Activities based on current developments in practice, legislation and techniques and act diligently and in accordance with applicable technical and professional standards. 18 Section 140: Confidentiality to respect the confidentiality of information acquired as a result of professional and business relationships and, therefore, not discloses any such information to third parties without proper and specific authority, unless there is a legal or professional right or duty to disclose, nor use the information for the personal advantage of the Member or third parties. Section 150: Professional behaviour to comply with relevant laws and regulations and avoid any action that discredits the profession Required: Max. 200 words a) Evaluate Alex' suggestion/argument 2 marks b) What principles of Code of Ethics (APES 110) may be threatened in this case? Describe a possible course of action. 3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started