Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz i need help PART A: Transfer Pricing and Variances Gamma Company produces cars. Two of the profit centers, Tires center and Assembly center, were

plz i need help

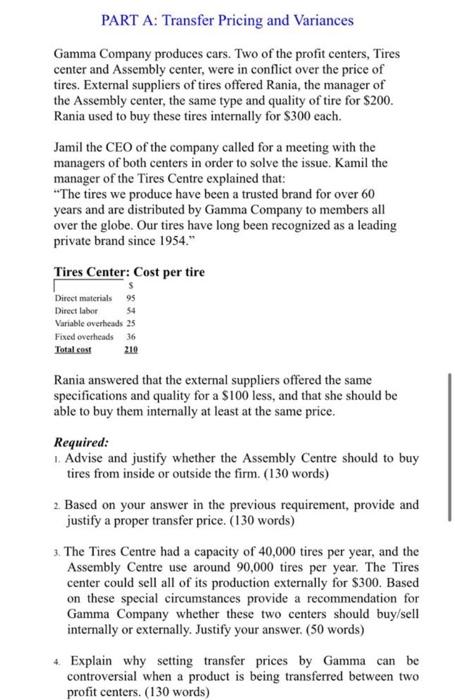

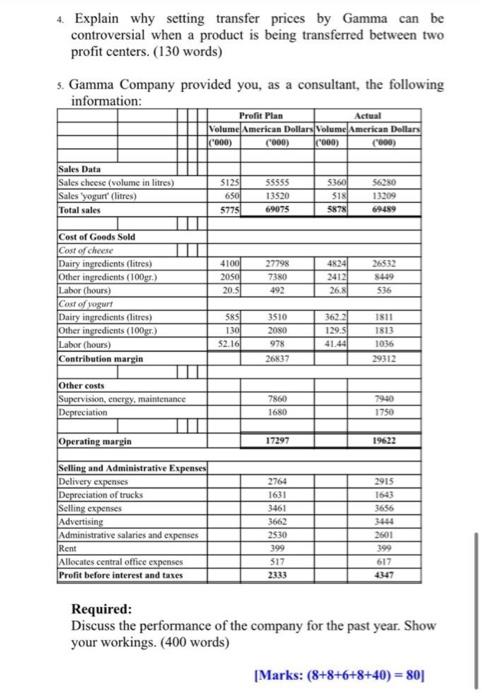

PART A: Transfer Pricing and Variances Gamma Company produces cars. Two of the profit centers, Tires center and Assembly center, were in conflict over the price of tires. External suppliers of tires offered Rania, the manager of the Assembly center, the same type and quality of tire for $200. Rania used to buy these tires internally for $300 each. Jamil the CEO of the company called for a meeting with the managers of both centers in order to solve the issue. Kamil the manager of the Tires Centre explained that: "The tires we produce have been a trusted brand for over 60 years and are distributed by Gamma Company to members all over the globe. Our tires have long been recognized as a leading private brand since 1954.** Tires Center: Cost per tire Direct materials 95 Direct labor 54 Variable overheads 25 Fixed overheads 36 Total cost 210 Rania answered that the external suppliers offered the same specifications and quality for a $100 less, and that she should be able to buy them internally at least at the same price. Required: Advise and justify whether the Assembly Centre should to buy tires from inside or outside the firm. (130 words) 2. Based on your answer in the previous requirement, provide and justify a proper transfer price. (130 words) 3. The Tires Centre had a capacity of 40,000 tires per year, and the Assembly Centre use around 90,000 tires per year. The Tires center could sell all of its production externally for $300. Based on these special circumstances provide a recommendation for Gamma Company whether these two centers should buy/sell internally or externally. Justify your answer. (50 words) 4 Explain why setting transfer prices by Gamma can be controversial when a product is being transferred between two profit centers. (130 words) 4. Explain why setting transfer prices by Gamma can be controversial when a product is being transferred between two profit centers. (130 words) 5. Gamma Company provided you, as a consultant, the following information: Profit Plan Actual Volume American Dollars Volume American Dollars ('000) (000) C000) (100) $125 5360 Sales Data Sales cheese (volume in litres) Sales yogurt (litres) Total sales 650 55555 13520 69075 $18 56250 13209 69489 5775 5878 4100 2050 20.5 27798 7380 192 48241 2412 26 26512 8449 536 Cost of Goods Sold Cost of cheese Dairy ingredients (litres) Other ingredients (100gr.) Labor (hours) Cost of yogurt Dairy ingredients (litres) Other ingredients (100 gr.) Labor (hours) Contribution margin SRS 130 $2.16 3510 2080 978 26837 362.2 129.5 41.44 1811 1813 1036 29312 Other costs Supervision, enersy, maintenance Depreciation 7860 1680 1750 Operating margin 17297 19622 Selling and Administrative Expenses Delivery expenses Depreciation of trucks Selling expenses Advertising Administrative salaries and expenses Rent Allocates central office expenses Profit before interest and taxes 2764 1631 3461 3662 2530 2915 1643 3656 3444 2601 399 617 4347 399 317 2133 Required: Discuss the performance of the company for the past year. Show your workings. (400 words) Marks: (8+8+6+8+40) = 801

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started