Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz i need the anwer on urgent basis plz do it with in 1 hour Q1: (15) You are a professional accountant working for Nadeem

Plz i need the anwer on urgent basis plz do it with in 1 hour

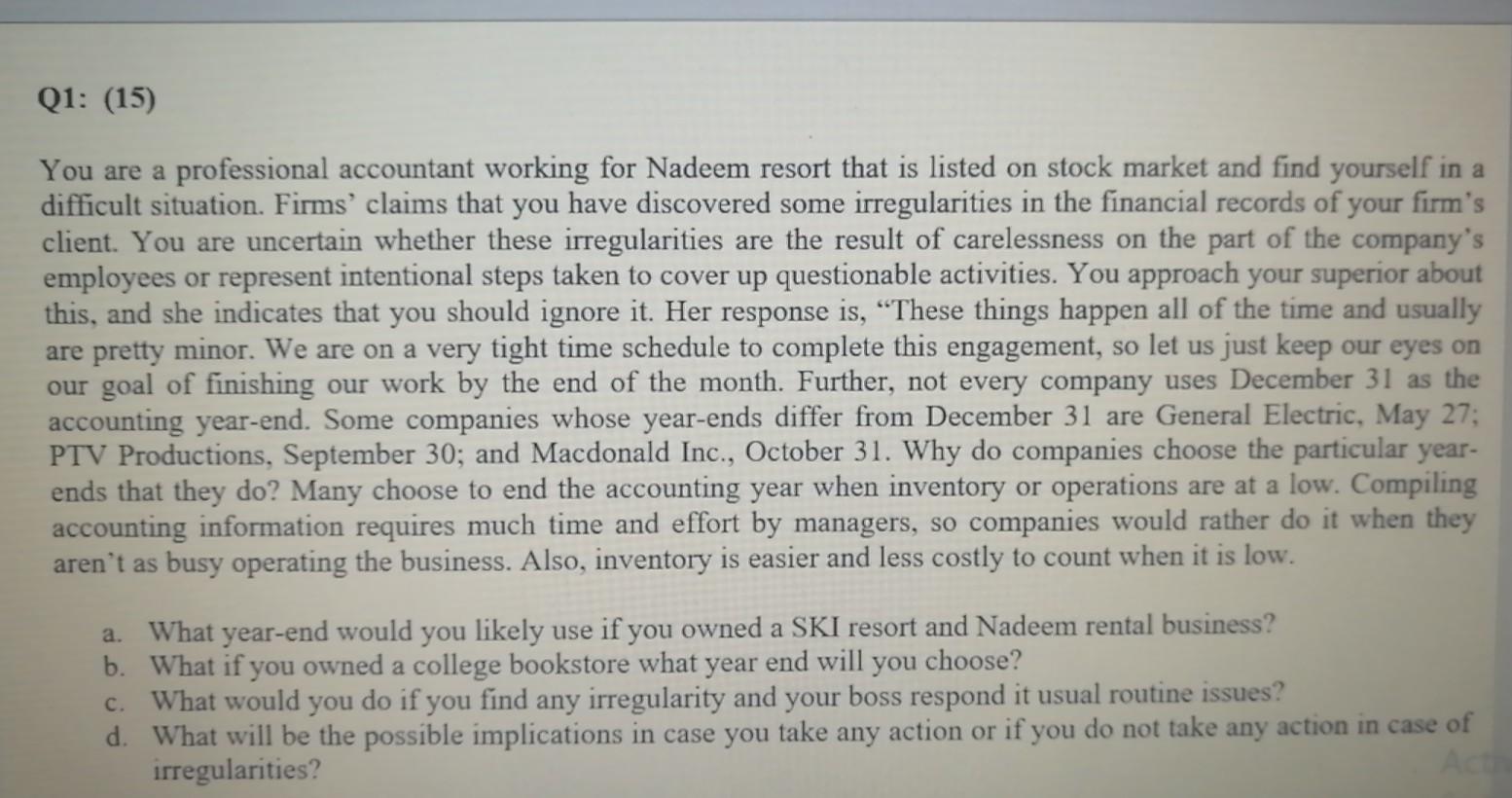

Q1: (15) You are a professional accountant working for Nadeem resort that is listed on stock market and find yourself in a difficult situation. Firms' claims that you have discovered some irregularities in the financial records of your firm's client. You are uncertain whether these irregularities are the result of carelessness on the part of the company's employees or represent intentional steps taken to cover up questionable activities. You approach your superior about this, and she indicates that you should ignore it. Her response is, These things happen all of the time and usually are pretty minor. We are on a very tight time schedule to complete this engagement, so let us just keep our eyes on our goal of finishing our work by the end of the month. Further, not every company uses December 31 as the accounting year-end. Some companies whose year-ends differ from December 31 are General Electric, May 27; PTV Productions, September 30; and Macdonald Inc., October 31. Why do companies choose the particular year- ends that they do? Many choose to end the accounting year when inventory or operations are at a low. Compiling accounting information requires much time and effort by managers, so companies would rather do it when they aren't as busy operating the business. Also, inventory is easier and less costly to count when it is low. a. What year-end would you likely use if you owned a SKI resort and Nadeem rental business? b. What if you owned a college bookstore what year end will you choose? c. What would you do if you find any irregularity and your boss respond it usual routine issues? d. What will be the possible implications in case you take any action or if you do not take any action in case of irregularities? ACStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started