Answered step by step

Verified Expert Solution

Question

1 Approved Answer

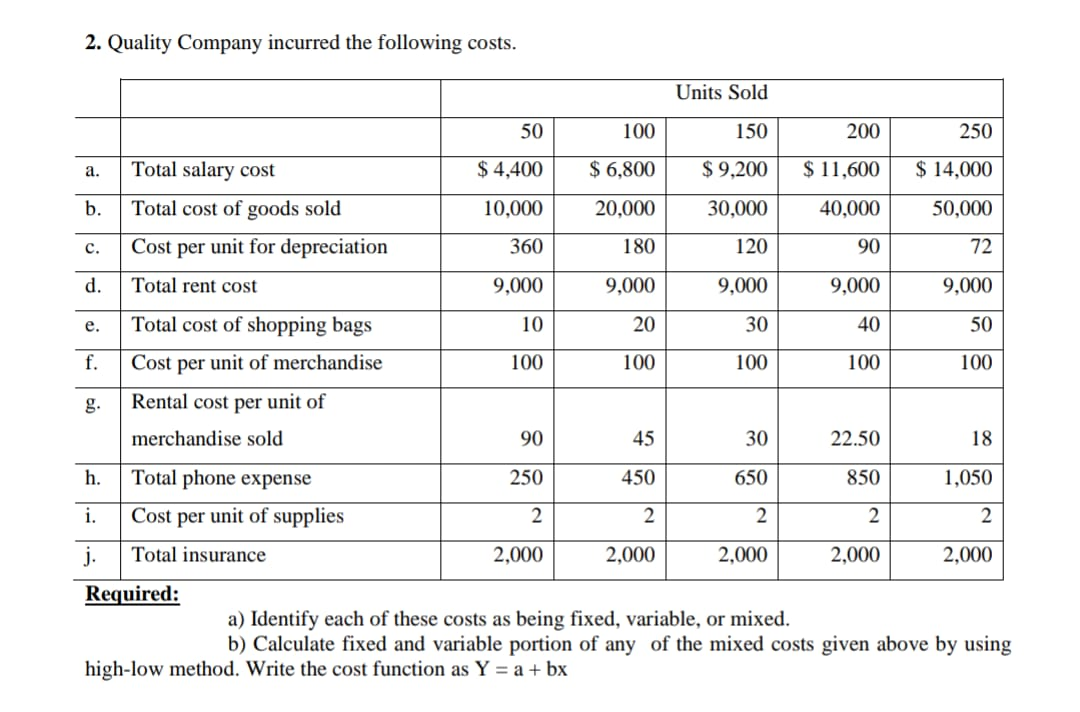

plz i want solution of these 2 questions 2. Quality Company incurred the following costs. Units Sold 50 100 150 200 250 a. Total salary

plz i want solution of these 2 questions

2. Quality Company incurred the following costs. Units Sold 50 100 150 200 250 a. Total salary cost $ 4,400 $ 6,800 $ 9,200 $ 11,600 $ 14,000 b. 10,000 20,000 30,000 40,000 50,000 Total cost of goods sold Cost per unit for depreciation c. 360 180 120 90 72 d. Total rent cost 9,000 9,000 9,000 9,000 9,000 e. Total cost of shopping bags 10 20 30 40 50 f. Cost per unit of merchandise 100 100 100 100 100 Rental cost per unit of merchandise sold 90 45 30 22.50 18 h. Total phone expense 250 450 650 850 1,050 i. Cost per unit of supplies 2 2 2 2 2 j. Total insurance 2.000 2,000 2.000 2.000 2.000 Required: a) Identify each of these costs as being fixed, variable, or mixed. b) Calculate fixed and variable portion of any of the mixed costs given above by using high-low method. Write the cost function as Y = a + bx

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started