Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz i want the answers plz i need the answer in 4 hours plz The lease terms are as follows: - The lease term will

plz i want the answers

plz i need the answer in 4 hours plz

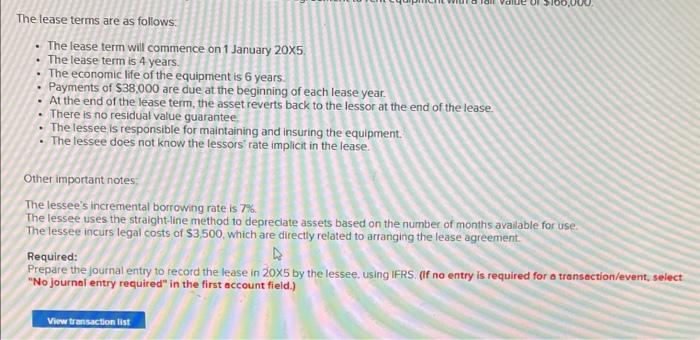

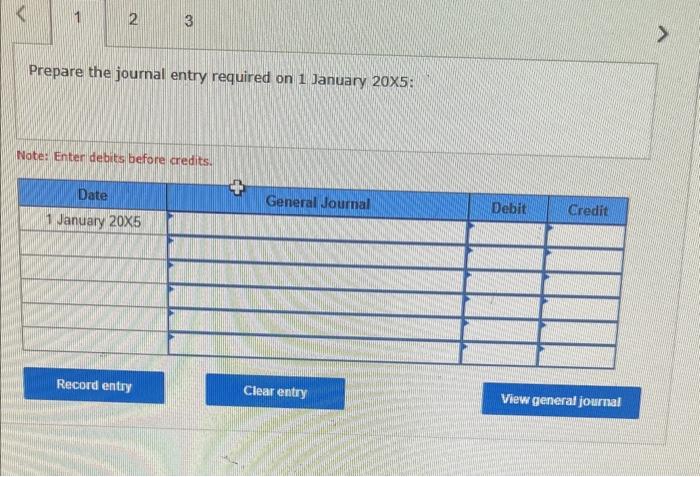

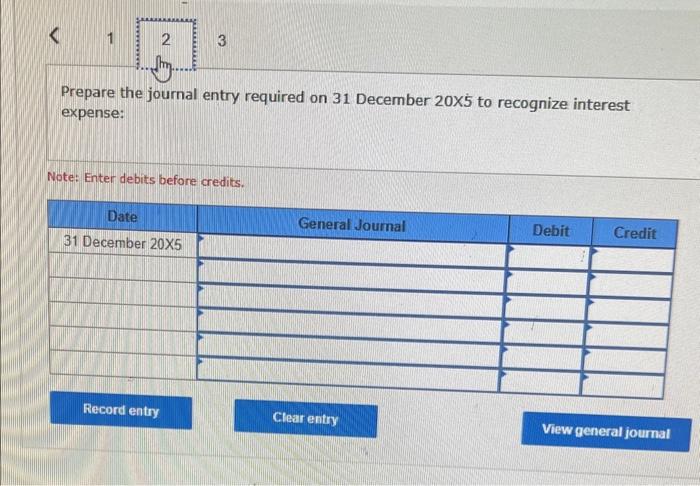

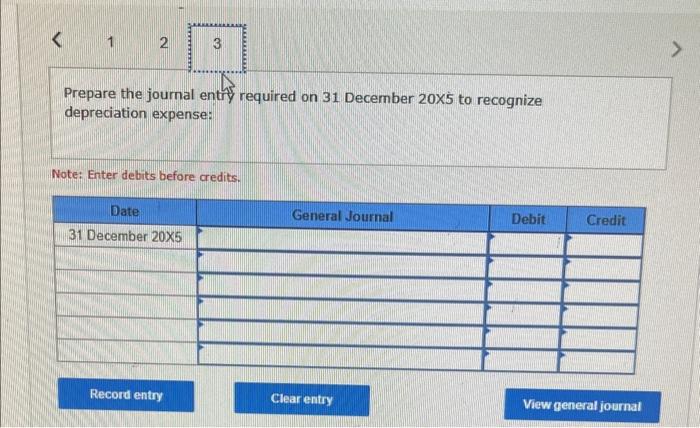

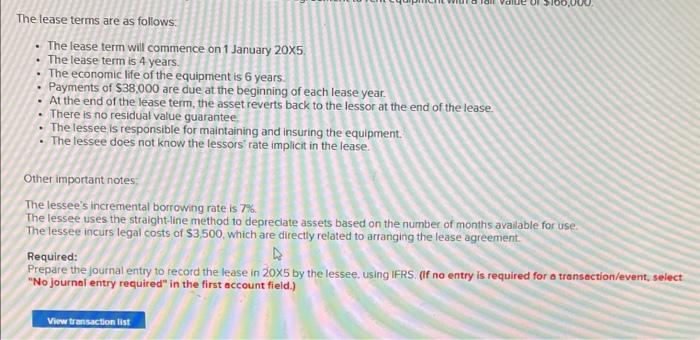

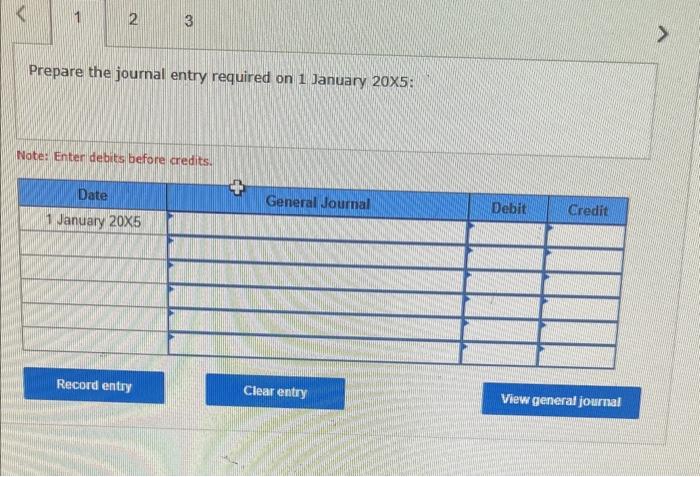

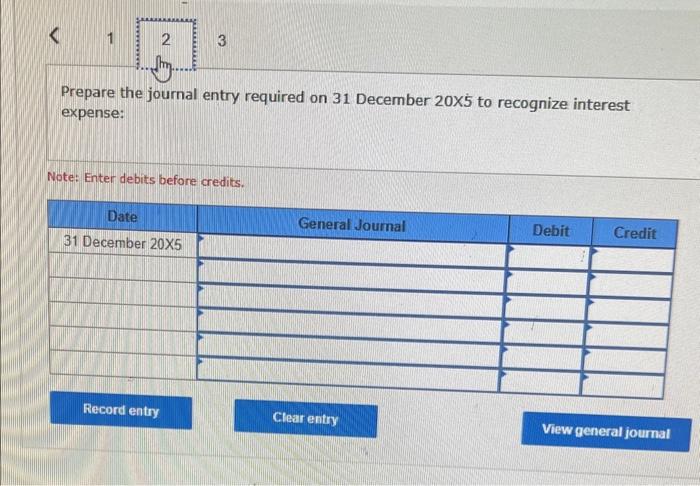

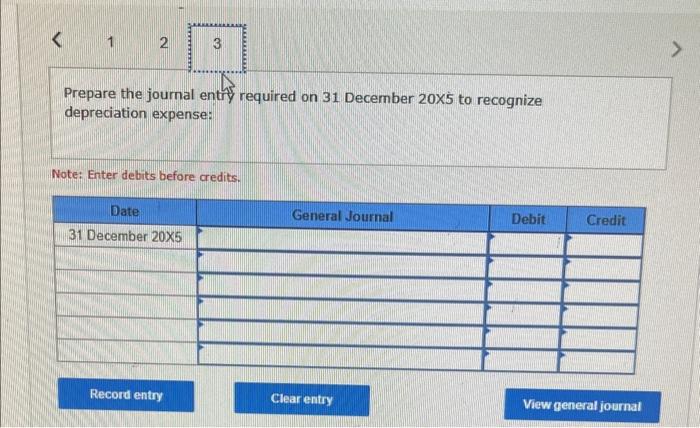

The lease terms are as follows: - The lease term will commence on 1 January 205. - The lease term is 4 years. - The economic life of the equipment is 6 years. - Payments of $38,000 are due at the beginning of each lease year. - At the end of the lease term, the asset reverts back to the lessor at the end of the lease. - There is no residual value guarantee. - The lessee is responsible for maintaining and insuring the equipment. - The lessee does not know the lessors' rate implicit in the lease. Other important notes: The lessee's incremental borrowing rate is 7%. The lessee uses the straight -line method to depreclate assets based on the number of months available for use. The lessee incurs legal costs of $3.500, which are directly related to arranging the lease agreement. Required: Prepare the journal entry to record the lease in 205 by the lessee, using IFRS. (If no entry is required for a transoction/event, sele. "No journal entry required" in the first account field.) Prepare the journal entry required on 1 January 205 : Note: Enter debits before credits. Prepare the journal entry required on 31 December 205 to recognize interest expense: Note: Enter debits before credits. Prepare the journal entry required on 31 December 20x5 to recognize depreciation expense: Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started