Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plz just answer what I doing wrong! I will give good rate! LearnCo manufactures and sells one product, an abacus for classroom use, with two

Plz just answer what I doing wrong! I will give good rate!

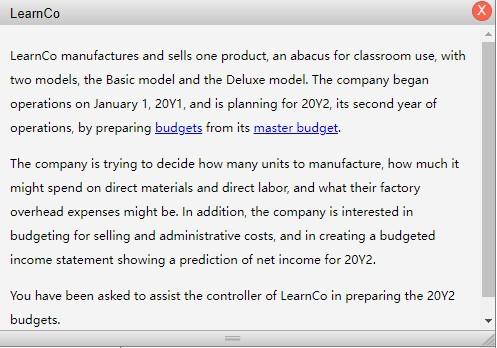

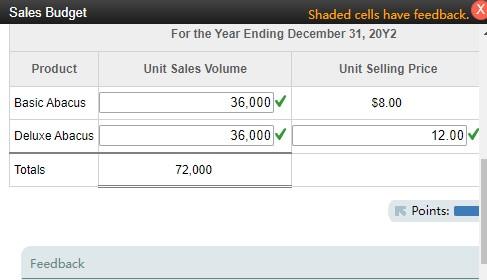

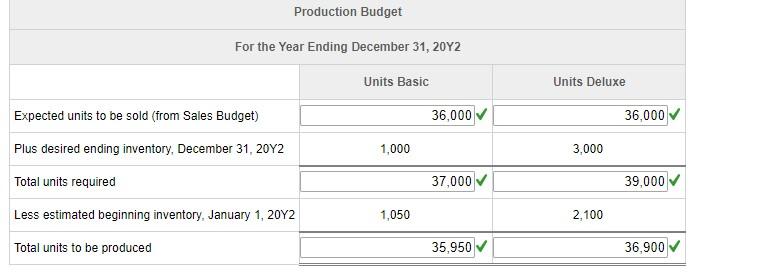

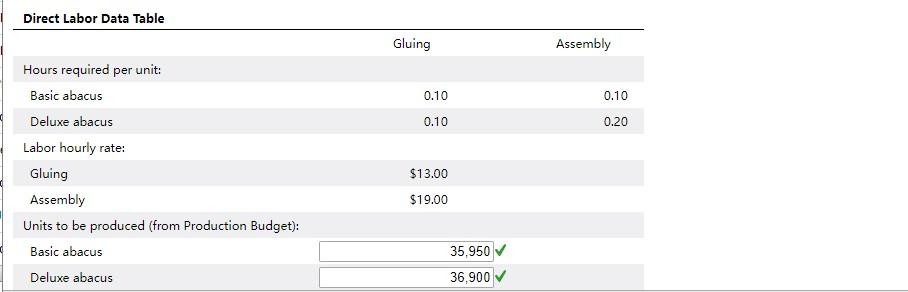

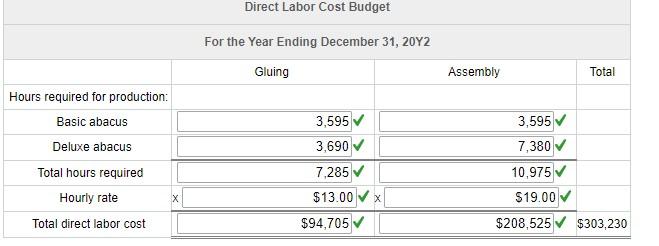

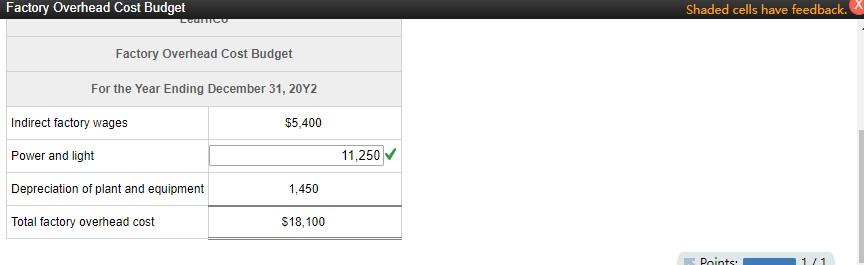

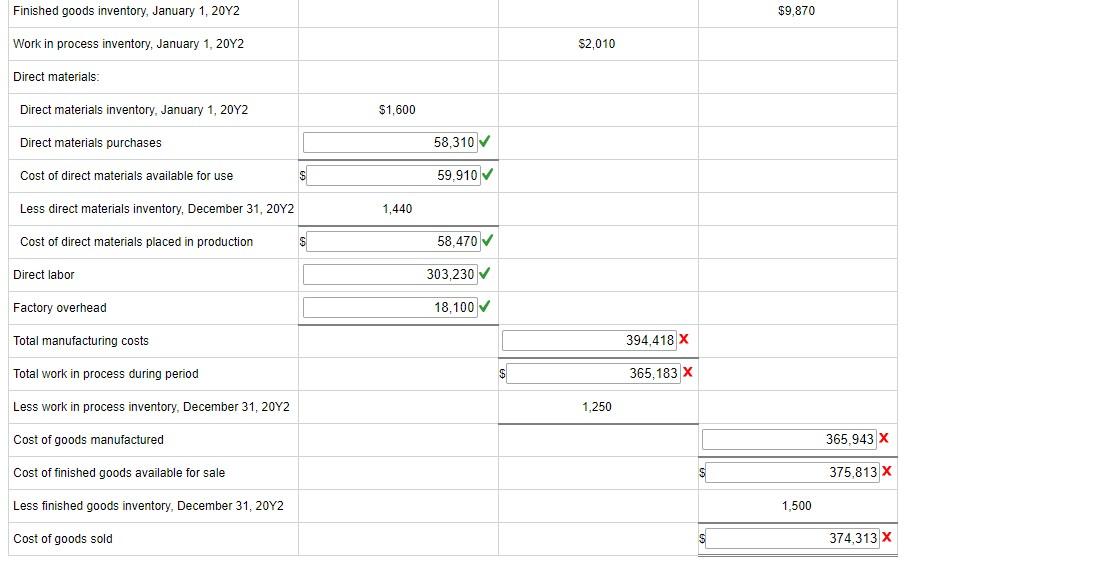

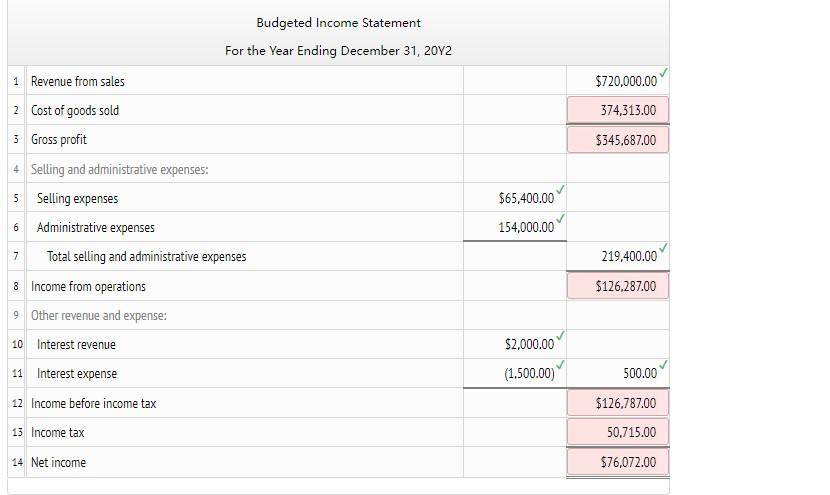

LearnCo manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20 Y2 budgets. Sales Budget Shaded cells have feedback. For the Year Ending December 31, 20Y2 Points: Feedback Production Budget For the Year Ending December 31, 20 Y2 Packages required for production: Direct Labor Data Table Gluing Assembly Hours required per unit: Basic abacus Deluxe abacus Labor hourly rate: Gluing $13.00 Assembly $19.00 Units to be produced (from Production Budget): Basic abacus Deluxe abacus \begin{tabular}{|r|} \hline 35,950 \\ \hline 36,900 \\ \hline \end{tabular} Direct Labor Cost Budget For the Year Ending December 31,20 Y2 Factory Overhead Cost Budget Shaded cells have feedback. Factory Overhead Cost Budget For the Year Ending December 31, 20Y2 Indirect factory wages $5,400 Power and light Depreciation of plant and equipment 1,450 Total factory overhead cost $18,100 Finished goods inventory, January 1,20Y2 $9,870 Work in process inventory, January 1,20Y2 $2,010 Direct materials: Budgeted Income Statement For the Year Ending December 31, 20Y2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started