plz only answer the ones on red marked wrong

thank you

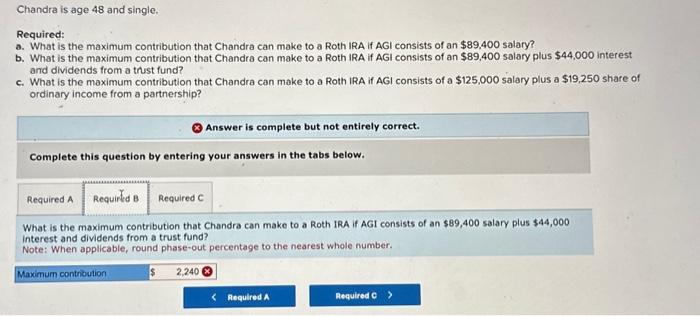

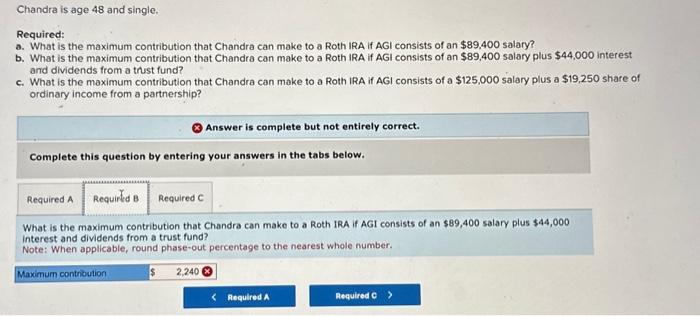

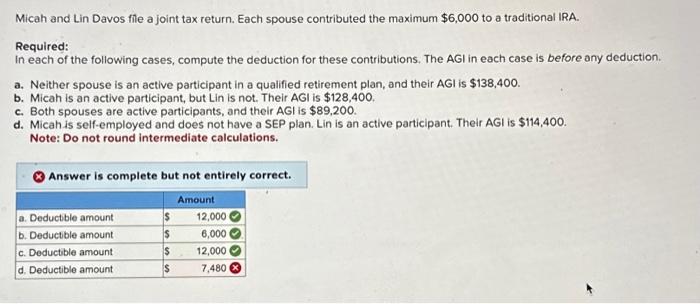

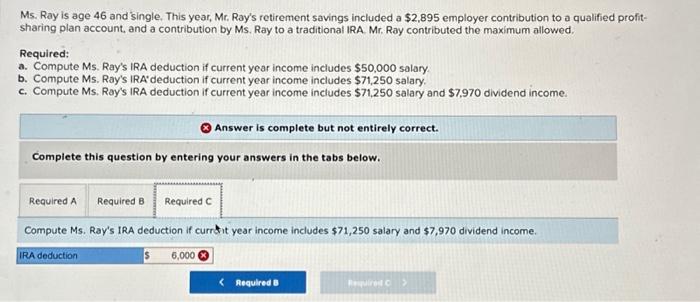

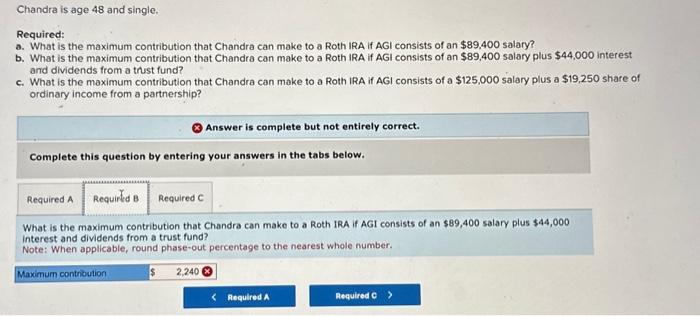

Chandra is age 48 and single. Required: a. What is the maximum contribution that Chandra can make to a Roth IRA If AGI consists of an $89,400 salary? b. What is the maximum contribution that Chandra can make to a Roth IRA if AGI consists of an $89,400 salary plus $44,000 interest and dividends from a trust fund? c. What is the maximum contribution that Chandra can make to a Roth IRA if AGI consists of a $125,000 salary plus a $19,250 share of ordinary income from a partnership? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the maximum contribution that Chandra can make to a Roth IRA if AGI consists of an $89,400 salary plus $44,000 interest and dividends from a trust fund? Note: When applicable, round phase-out percentage to the nearest whole number. Micah and Lin Davos file a joint tax return. Each spouse contributed the maximum $6,000 to a traditional IRA. Required: In each of the following cases, compute the deduction for these contributions. The AGI in each case is before any deduction. a. Neither spouse is an active participant in a qualified retirement plan, and their AGI is $138,400. b. Micah is an active participant, but Lin is not. Their AGI is $128,400. c. Both spouses are active participants, and their AGI is $89,200. d. Micah is self-employed and does not have a SEP plan. Lin is an active participant. Their AGI is $114,400. Note: Do not round intermediate calculations. Answer is complete but not entirely correct. Ms. Ray is age 46 and 'single. This year, Mr. Ray's retirement savings included a $2,895 employer contribution to a qualified profitsharing plan account, and a contribution by Ms. Ray to a traditional IRA. Mr. Ray contributed the maximum allowed. Required: a. Compute Ms. Ray's IRA deduction if current year income includes $50,000 salary. b. Compute Ms. Ray's IRA' deduction if current year income includes $71,250 salary. c. Compute Ms. Ray's IRA deduction if current year income includes $71,250 salary and $7,970 dividend income. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute Ms. Ray's IRA deduction if currsit year income includes $71,250 salary and $7,970 dividend income