Answered step by step

Verified Expert Solution

Question

1 Approved Answer

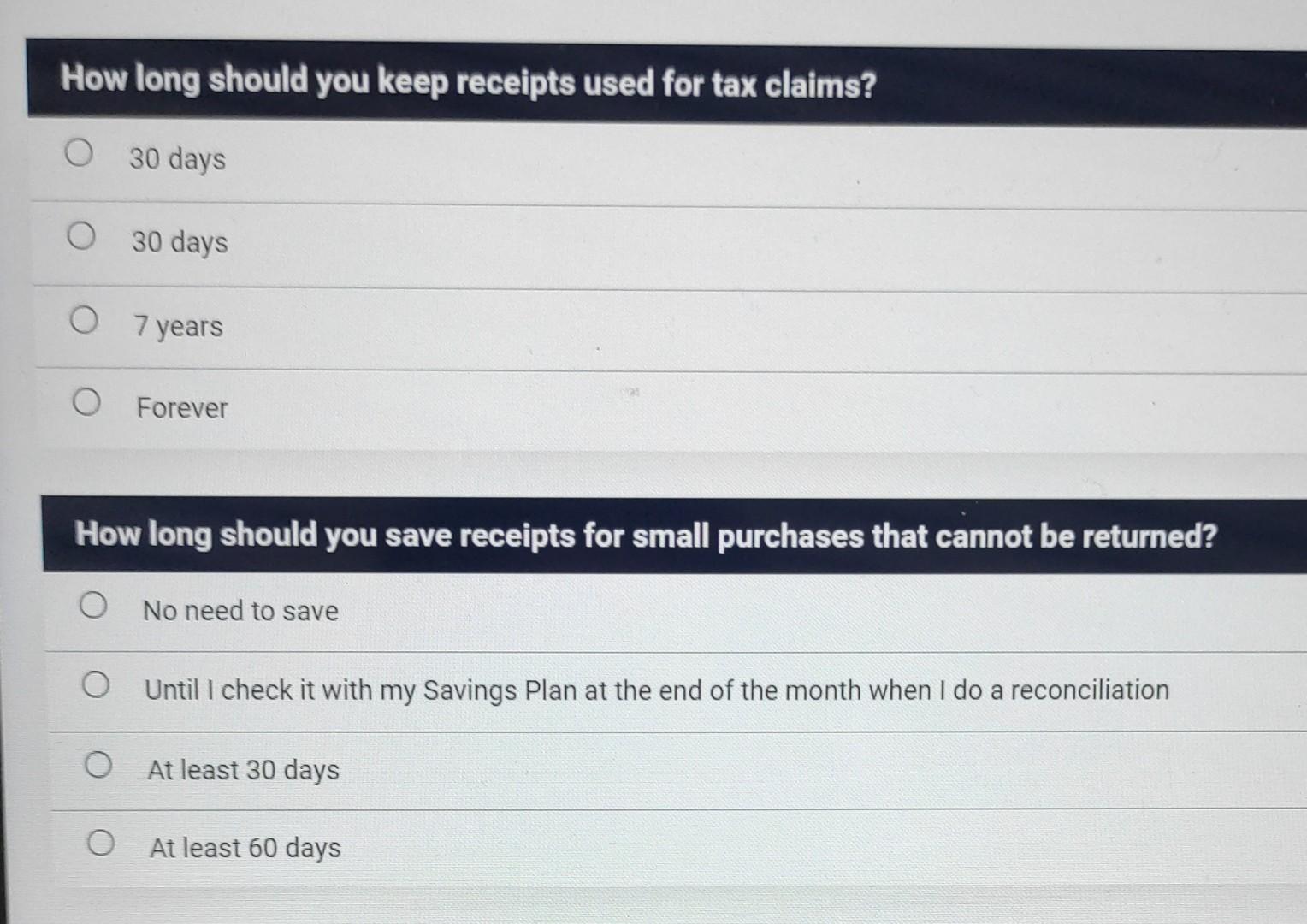

plz plz answer all di questions How long should you keep receipts used for tax claims? O 30 days O 30 days 0 7 years

plz plz answer all di questions

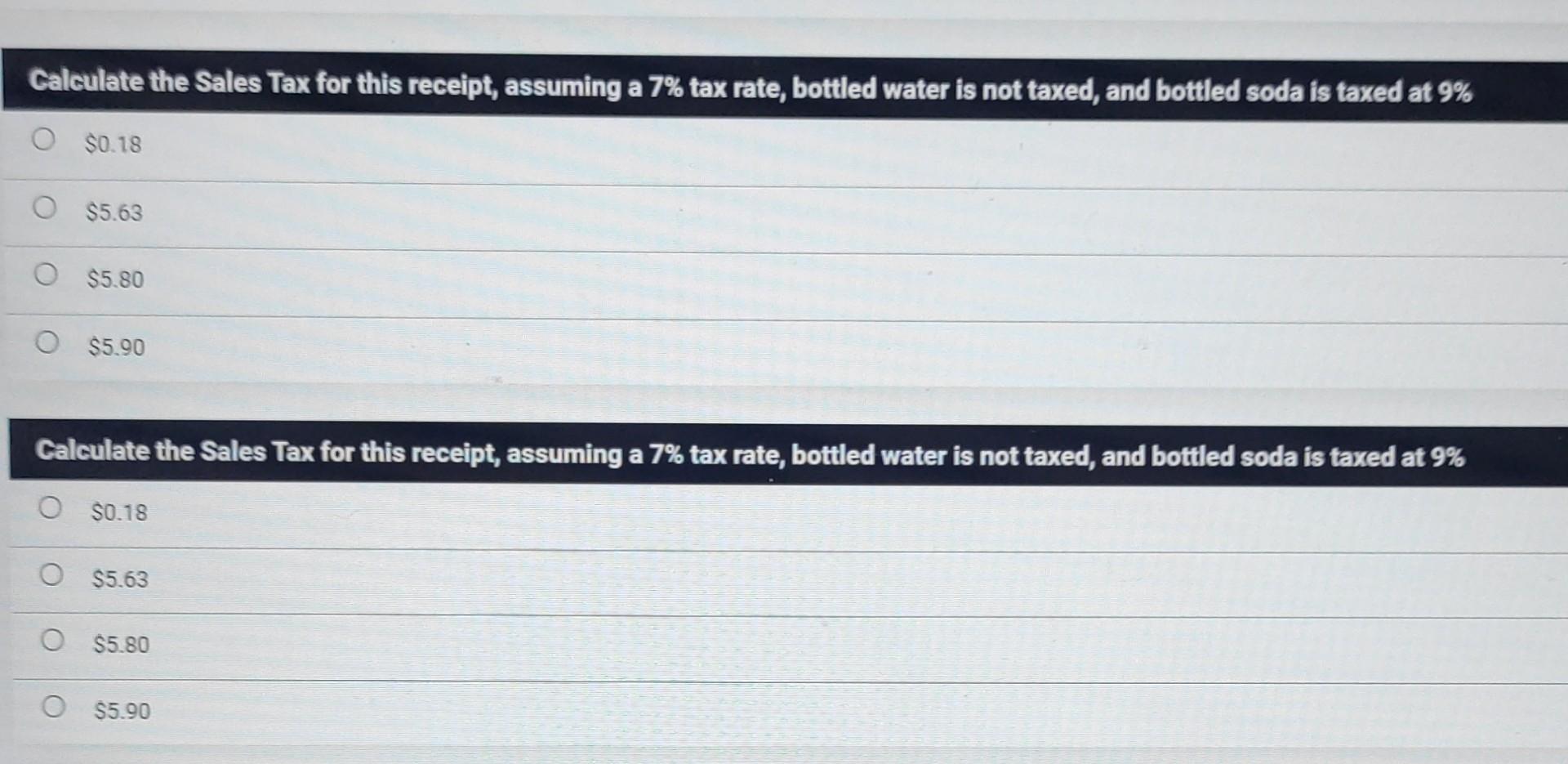

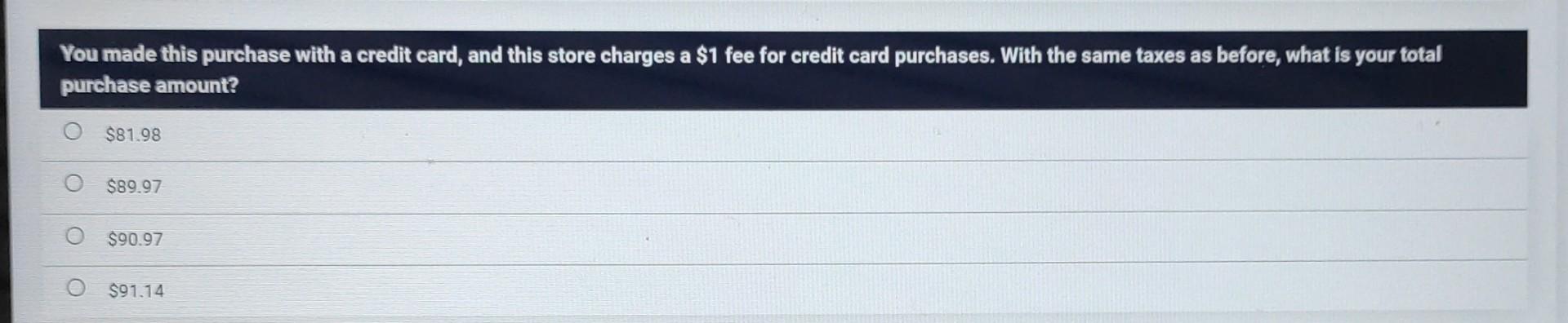

How long should you keep receipts used for tax claims? O 30 days O 30 days 0 7 years O Forever How long should you save receipts for small purchases that cannot be returned? O No need to save o Until I check it with my Savings Plan at the end of the month when I do a reconciliation a O At least 30 days At least 60 days Calculate the Sales Tax for this receipt, assuming a 7% tax rate, bottled water is not taxed, and bottled soda is taxed at 9% O $0.18 $5.63 o $5.80 $5.90 Calculate the Sales Tax for this receipt, assuming a 7% tax rate, bottled water is not taxed, and bottled soda is taxed at 9% $0.18 O $5.63 O $5.80 O $5.90 You made this purchase with a credit card, and this store charges a $1 fee for credit card purchases. With the same taxes as before, what is your total purchase amount? $81.98 $89.97 $90.97 $91.14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started