Plz plz help

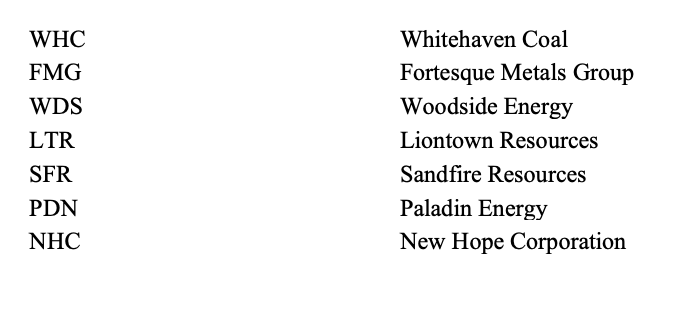

It was encouraging to see a generally high quality of work across the submitted assignments; the mean and median mark was 72%. The assignment more closely resembles the kind of open-ended projects you will asked to complete in industry than the typical university assignment but it is more challenging. We split it in two components to allow you to get feedback you can incorporate in the second part. The key to addressing what seems to be an unstructured assignment is to identify or define the major theme(s) and then explain the detail. Identifying the theme in the assignment was relatively easy. The notion that BHP and Woodside face rising stranded asset risk is straightforward and there are any number of media reports that tell this story. Assignments that presented a more detailed account of the risk(s) backed by reference to reliable sources received higher marks. For example, the following extract from an assignment reveals the ways in which BHP and Woodside differ in their exposure to stranded asset risk: "In BHP's most recent financial statements (H1FY23), operating assets by segment consisted of 50% copper, 31% iron ore, 13% coal, and 6% other (BHP Group, 2023a). In Woodside's most recent financial statements (FY22), all assets were allocated across oil and gas encompassing LNG, pipeline gas, and crude oil with 75% of equity production represented by natural gas (Woodside Energy Group, 2023)." The same assignment identified and explained less obvious source of stranded asset risk. "The emergence of green hydrogen as a cheaper alternative to green steel presents a significant technological challenge for BHP's numerous iron ore assets, particularly as a producer of lower-grade iron ore, which is unsuitable for steel production using hydrogen (Mazengarb, 2021). As a result, in the next ten years, BHP faces a serious stranded asset risk to its iron ore operations due to the threat of insufficient resource quality." Assignments attracted higher marks when their discussion provided an indication of the economic magnitude of exposure to stranded asset risk. Two examples: "As of 3rd April, the share price for BHP was AU\$46.97. Given the fact that fossil fuels was only 12% of the NOA, the sale of those related assets would not be a significant hit to BHP's operations. The EBIT it brings in for BHP is also much smaller compared to that of Copper and Iron Ore. However, BHP stands to gain much more than that in public perception, as they are now seen as trying to do better for the environment which is currently popular with many environmentally conscious investors" "Figure one [not shown here] highlights the cumulative demand for Woodside and BHP's commodities under different climate change scenarios. Woodside's portfolio consists of oil and gas assets which are most at risk of lower market demand over the next 30 years from a 1.5C scenario. However, BHP's assets stand to benefit from a 1.5C scenario as their iron, copper and potash reserves will see elevated demand over the next 30 years." Most assignments acknowledged that the impact of stranded asset risk was likely to grow over longer time horizons so that the exposure over next 5 years would likely be less than over the next 10 years and 20 years. This discussion earned more marks when the reasons for the lower risk exposure in the short term were explained. For instance, some assignments pointed out that countries' energy infrastructure was still heavily dependent on oil and gas which meant that in the short-term the demand for both was largely inelastic. It is rarely the case that all the evidence and relevant considerations point unambiguously in one direction. Things are more complicated. Assignments attracted higher marks when they acknowledged different points of view, as in the example below: "There are also contrary views on market conditions for oil and gas reserves which argue that fossil fuels will remain an important transition energy source. This argument suggests that the current stranded asset risk is overestimated in the short term and that fossil fuels will account for 6080% of the world's key energy sources by 2040 (Newell et al., 2019)." The timing of the impact of technological change and regulatory uncertainty is another issue. The two factors are complementary to a degree. The greater the costs imposed by regulations (and taxes) on companies that generate climate change emissions then the more investment will be put into technological development of alternative energy sources which will heighten stranded asset risk. Here is an example of an assignment that made a similar point and, importantly, discussed its implications for BHP and Woodside: "The impact of stranded asset risk over the next 10 years will depend on the uncertain timing of government policies to limit global warming to 1.5C as outlined in the Paris Agreement (van der Ploeg \& Rezai, 2020; Firdaus \& Mori, 2023). This will likely coincide with growth in renewable technologies which will contribute to worsening market conditions from lower demand. As government regulation is implemented in relation to climate change, this will drive greater stranded asset risk for Woodside over the next 10 years. Contrary to Woodside, BHP's stranded asset risk is limited given there are long term demand tailwinds for their commodities as outlined in figure 1 [not shown in this extract]." Some assignments made the relevant point that companies like BHP and Woodside can and probably will take steps to minimise their exposure to stranded asset risk by, amongst other things, using technology that minimises their emissions. Of course, whether such efforts will be sufficient to make a difference remains to be seen. Assignments attracted higher marks when they made the point and illustrated it with some numbers that the impact of stranded asset risk in the 20 -year horizon was low in part because reasonable discount rates substantially reduced the present value of the cash flows expected in 20 years. Incidentally, my own view is that the development of new energy sources and regulatory pressures are more important contributors to stranded asset risk than divestment. My view is based on the negligible impact of divestment campaigns on the profitability of tobacco companies. Tobacco companies remain highly profitable despite extensive and sustained divestment campaigns against them. In relation to second question of Part A, whether BHP timed its sale of its oil and gas assets to Woodside well, there seemed to be a difference of opinion. Most students agreed but a substantial minority said it was a mistake, BHP would have been better off if they had delayed the sale given the record profits earned by oil and gas companies due to the world-wide disruption in supply as a result of the Russian invasion of Ukraine. It's true that, as things turned out, BHP would have earned higher profits in the short term if it had not sold its oil and gas assets. However, at the time of the sale, the turn of events wasn't known. In general, if you are facing a risk of some sort, you can't wait until the outcome is known before making a decision. The way to make these decisions is to identify which company is best positioned to bear the stranded asset risk. As discussed earlier, BHP is much less exposed to stranded asset risk than Woodside. It may appear that BHP is better placed to bear the risk of its oil and gas assets. However, by getting rid of its assets that are most exposed to stranded asset risk, BHP probably gains much by not being a target of climate change activists. Woodside is already heavily exposed to stranded asset risk and is already a target of climate change activists and so taking more oil and gas assets won't make much difference, if at all. Looking at the problem in this way,suggests that it was a sensible move by BHP to divest its oil and gas assets to Woodside. Guidance on Part 2 of the Assignment 1. Provide a brief summary of your expectations regarding stranded asset risk from Part A in your assignment. This should include information that is related to your expectations for stranded asset risk in the next 5-, 10-, and 20 -years. (20\%) What we're looking for here is your opinion, supported by evidence, whether you expect stranded asset risk to be a concern for natural resources companies over the next 5-, 10-, and 20 years. You can draw on your work from Part A but you are free to modify your Part A opinion, based on feedback and any further reading. This part of the assignment sets the foundation for the second question of part 2, which is to assess the likely impact of stranded asset risk on 8 specific natural resource companies. 2. List the following 8 ASX listed companies in order of the stranded asset risk to which you expect they are exposed (40\%). Which combination of companies would you go long and which would you short in order to maximise excess risk adjusted return over the next 5 years? (40%) The exposure of natural resource companies to stranded asset risk depends on the mix of assets they have (as discussed with respect to Woodside and BHP). This is why you are asked to identify the major commodities mined by each company and the proportion of revenue from each. Note that the proportion of revenue will change with the price of each commodity so you need to form some expectation of future demand and supply. It would be useful to review reports discussing future demand for each commodity. In general we can expect producers to more biased in forecasts than independent industry experts so think about when deciding which reports to rely on and read more than one report. It may be useful to classify the natural resources in terms of their exposure to stranded asset risk (e.g., fossil fuels would probably rate high and rare earth minerals would probably rate low). Note that there is some uncertainty as to which technologies will prevail as economies decarbonise so a natural resource such as lithium that is essential in some renewable technologies may not be certain to dominate in the future. You should assess this risk. Having come to a view on the exposure of each company's stranded asset risk, the next step is to see if this risk is reflected in share prices. You don't want to go short on a company with a high stranded asset risk if the share price already reflects that risk. No one can know how efficiently share prices reflect stranded asset risk but price/earnings ratio and book to market ratios can be indicative. Companies that you think have exposure to stranded asset risk and that have high price/earning ratios relative to other companies and low book to market ratio relative to other companies are more likely to be over-valued. Think about which set of companies are the appropriate benchmark. Incidentally, you can be 100% long in all the companies, 100% short on all the companies or any combination in-between. Finally, my advice is to spend 50% of the time researching and 50% of the time writing. It is challenging to write a concise and clear account of anything. A deservedly famous saying amongst people who write for a living is one attributed to the French mathematician and philosopher Blaise Pascal. He reportedly once wrote to a friend saying, "I am sorry to have written a long letter, if I had more time it would have been shorter". The full question (Part 2) is copied below: What companies in Australia have the highest stranded asset risk? ChatGPT: Identifying companies with the highest stranded asset risk is a complex process that requires detailed analysis of each company's specific situation. It involves assessing factors such as the type of minerals mined, the location of the mine, the company's level of debt, and the extent to which it is exposed to technological, regulatory, and market risks. That being said, there are several factors that could increase the stranded asset risk for mining companies operating in Australia. Some of these factors include: 1. Coal mining: As the world moves towards renewable energy, the demand for coal is expected to decline. This could result in coal mines becoming uneconomic and stranded assets. Therefore, companies with significant coal mining operations, such as BHP Group, Rio Tinto, and Anglo American, could be at risk. 2. Iron ore mining: Iron ore is Australia's biggest export, but there is a risk that demand for it could decline if steel production becomes more sustainable. This could result in iron ore mines becoming stranded assets. Therefore, companies with significant iron ore mining operations, such as BHP Group, Rio Tinto, and Fortescue Metals Group, could be at risk. 3. Regulatory changes: Regulatory changes that limit the amount of carbon emissions or water use from mining operations could increase the stranded asset risk for mining companies. Companies that operate in regions that are prone to drought or face stringent environmental regulations, such as New South Wales and Western Australia, could be at higher risk. It's important to note that each mining company has unique circumstances that impact their risk of stranded assets, and the situation is constantly evolving. Therefore, it's recommended that investors and analysts conduct their own research and analysis to identify companies with high stranded asset risk. ChatGPT tells us that identifying companies with the highest stranded risk is a "complex process". Your lecturer is also aware that this task is not a simple one. You will notice that ChatGPT's answer provides a non-detailed response, one that is not useful to your employer to assist their decision making. Required: 2. Provide a brief summary of your expectations regarding stranded asset risk from Part A in your assignment. This should include information that is related to your expectations for stranded asset risk in the next 5-, 10-, and 20-years. 3. List the following 8ASX listed companies in order of the stranded asset risk you expect they are exposed to. Which combination of companies would you go long and which would you short in order to maximise excess risk adjusted return over the next 5 years? To support your answer you are required to provide the following information for each company: - Major commodities mined by the company. - The proportion of revenue that comes from the major commodities in the company's portfolio. - Price-to-earnings ratio - Market-to-book ratio Please note that is is not enough to simply list this information. It needs to relate to additional research you have undertaken to formulate your expectations on stranded asset risk, and your decision on the combination of assets you decide to go long or short to maximise excess risk adjusted return over the next 5 years. A good source of information is the companies' annual reports. Table 1: List of ASX mining companies WHCFMGWDSLTRSFRPDNNHCWhitehavenCoalFortesqueMetalsGroupWoodsideEnergyLiontownResourcesSandfireResourcesPaladinEnergyNewHopeCorporation