Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz provide the calculations also o Google L. POD-application to. S full book BUSA - Google Drive Makkar ielts IELTS Speaking Cue Le IELTS Speaking

plz provide the calculations also

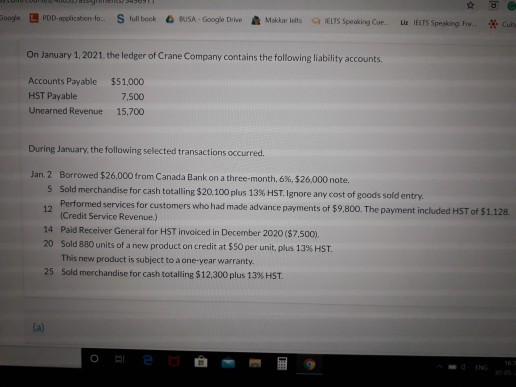

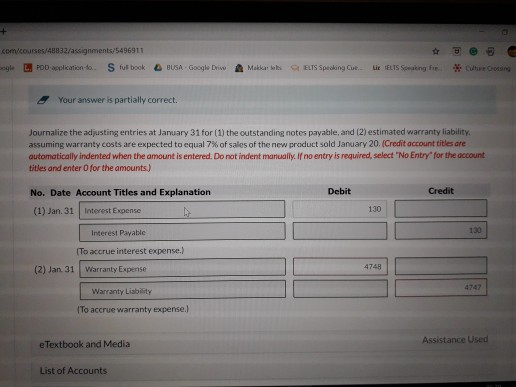

o Google L. POD-application to. S full book BUSA - Google Drive Makkar ielts IELTS Speaking Cue Le IELTS Speaking Fre On January 1, 2021.the ledger of Crane Company contains the following liability accounts. Accounts Payable HST Payable Unearned Revenue $51.000 7.500 15,700 During January, the following selected transactions occurred. Jan. 2 Borrowed $26,000 from Canada Bank on a three-month, 6%, $26,000 note. 5 Sold merchandise for cash totalling $20,100 plus 13% HST. Ignore any cost of goods sold entry. 12 Performed services for customers who had made advance payments of $9,800. The payment included HST of $1.128. Credit Service Revenue.) 14 Paid Receiver General for HST invoiced in December 2020 ($7.500) 20 Sold 880 units of a new product on credit at $50 per unit, plus 13% HST. This new product is subject to a one-year warranty. 25 Sold merchandise for cash totalling $12,300 plus 13% HST. + com/courses/48832/assignments/5496911 L. POD aplication to Sful book BUSA - Google Drive Makkar i LS Speaking Cul.. Lit IELTS Sating Your answer is partially correct. Journalize the adjusting entries at January 31 for (1) the outstanding notes payable, and (2) estimated warranty liability. assuming warranty costs are expected to equal 7% of sales of the new product sold January 20. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit No. Date Account Titles and Explanation (1) Jan. 31 Interest Expense 130 Interest Payable 130 (To accrue interest expense.) (2) Jan 31 Warranty Expense 4748 Warranty Liability To accrue warranty expense.) e Textbook and Media Assistance Used List of Accounts o Google L. POD-application to. S full book BUSA - Google Drive Makkar ielts IELTS Speaking Cue Le IELTS Speaking Fre On January 1, 2021.the ledger of Crane Company contains the following liability accounts. Accounts Payable HST Payable Unearned Revenue $51.000 7.500 15,700 During January, the following selected transactions occurred. Jan. 2 Borrowed $26,000 from Canada Bank on a three-month, 6%, $26,000 note. 5 Sold merchandise for cash totalling $20,100 plus 13% HST. Ignore any cost of goods sold entry. 12 Performed services for customers who had made advance payments of $9,800. The payment included HST of $1.128. Credit Service Revenue.) 14 Paid Receiver General for HST invoiced in December 2020 ($7.500) 20 Sold 880 units of a new product on credit at $50 per unit, plus 13% HST. This new product is subject to a one-year warranty. 25 Sold merchandise for cash totalling $12,300 plus 13% HST. + com/courses/48832/assignments/5496911 L. POD aplication to Sful book BUSA - Google Drive Makkar i LS Speaking Cul.. Lit IELTS Sating Your answer is partially correct. Journalize the adjusting entries at January 31 for (1) the outstanding notes payable, and (2) estimated warranty liability. assuming warranty costs are expected to equal 7% of sales of the new product sold January 20. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit No. Date Account Titles and Explanation (1) Jan. 31 Interest Expense 130 Interest Payable 130 (To accrue interest expense.) (2) Jan 31 Warranty Expense 4748 Warranty Liability To accrue warranty expense.) e Textbook and Media Assistance Used List of AccountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started