Question

Plz show steps and formulas! Thx! Pointless Luxuries Inc. (PLI) produces unusual gifts targeted at wealthy consumers. The company is analyzing the introduction of a

Plz show steps and formulas! Thx!

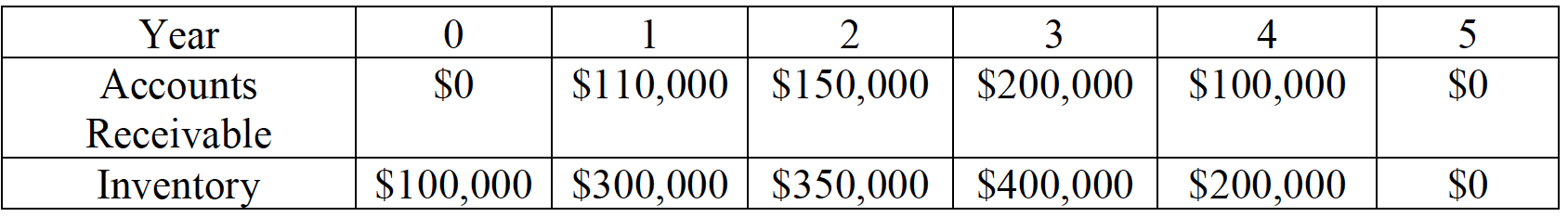

Pointless Luxuries Inc. (PLI) produces unusual gifts targeted at wealthy consumers. The company is analyzing the introduction of a new device designed to attach to the collar of a cat or dog. The product contains a GPS, an audible that can be triggered remotely, and an automatic emergency K-911 number that is called if the animal is injured. PLI estimates that developing this product will require up-front capital expenditures of $9 million, costs that will be depreciated on a straight-line basis to zero over five years. However, PLI estimates they could sell the equipment at the end of five years for $3,000,000. The project would use an existing warehouse that you own that is currently rented out to a neighboring firm. Next years rental charge on the warehouse is $200,000 and the rent is expected to grow at 4% a year. PLI believes that it can sell the product initially for $160. The selling price will increase to $190 in years 2 and 3 before falling to $170 and $150 in years 4 and 5, respectively. After five years the company will withdraw the product from the market and replace it with something else. Variable costs are $75 in year 1 and increase at an annual rate of 10%. PLI forecasts volume of 25,000 units the first year with subsequent increases of 25% (year 2), 20% (year 3), 20% (year 4), and 15% (year 5). Offering this product will force PLI to make additional investments in receivables and inventory. Projected end-of-year balances appear in the following table.

The firm faces a tax rate of 20%.

a. Calculate the projects cash flows each year.

b. Calculate the NPV assuming a 10% opportunity cost of capital. What if the cost of capital is 20%?

c. What is the IRR of the investment?

\begin{tabular}{|c|c|c|c|c|c|c|} \hline Year & 0 & 1 & 2 & 3 & 4 & 5 \\ \hline AccountsReceivable & $0 & $110,000 & $150,000 & $200,000 & $100,000 & $0 \\ \hline Inventory & $100,000 & $300,000 & $350,000 & $400,000 & $200,000 & $0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Year & 0 & 1 & 2 & 3 & 4 & 5 \\ \hline AccountsReceivable & $0 & $110,000 & $150,000 & $200,000 & $100,000 & $0 \\ \hline Inventory & $100,000 & $300,000 & $350,000 & $400,000 & $200,000 & $0 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started