Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz solve in 40 mins i will give you thumb up (d) (9 pts) Suppose a different company offers Ludo Corporation a Loss Control service

plz solve in 40 mins i will give you thumb up

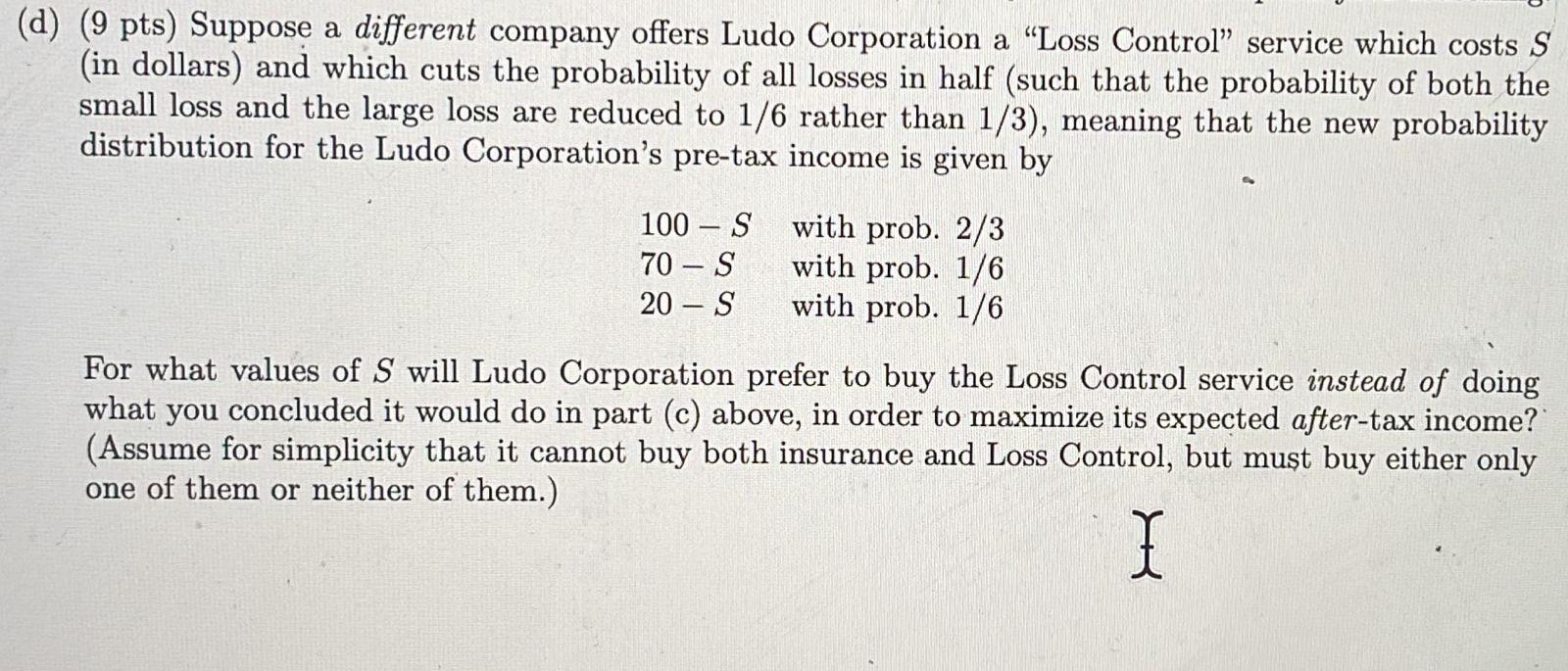

(d) (9 pts) Suppose a different company offers Ludo Corporation a Loss Control service which costs S (in dollars) and which cuts the probability of all losses in half (such that the probability of both the small loss and the large loss are reduced to 1/6 rather than 1/3), meaning that the new probability distribution for the Ludo Corporation's pre-tax income is given by 100 S with prob. 2/3 70 - S with prob. 1/6 20 S with prob. 1/6 For what values of S will Ludo Corporation prefer to buy the Loss Control service instead of doing what you concluded it would do in part (c) above, in order to maximize its expected after-tax income? (Assume for simplicity that it cannot buy both insurance and Loss Control, but mut buy either only one of them or neither of them.) I (d) (9 pts) Suppose a different company offers Ludo Corporation a Loss Control service which costs S (in dollars) and which cuts the probability of all losses in half (such that the probability of both the small loss and the large loss are reduced to 1/6 rather than 1/3), meaning that the new probability distribution for the Ludo Corporation's pre-tax income is given by 100 S with prob. 2/3 70 - S with prob. 1/6 20 S with prob. 1/6 For what values of S will Ludo Corporation prefer to buy the Loss Control service instead of doing what you concluded it would do in part (c) above, in order to maximize its expected after-tax income? (Assume for simplicity that it cannot buy both insurance and Loss Control, but mut buy either only one of them or neither of them.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started