Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz solve in 45 mins i will thumb up 3. (36 pts) For each of the following statements, say whether the statement is true, false,

plz solve in 45 mins i will thumb up

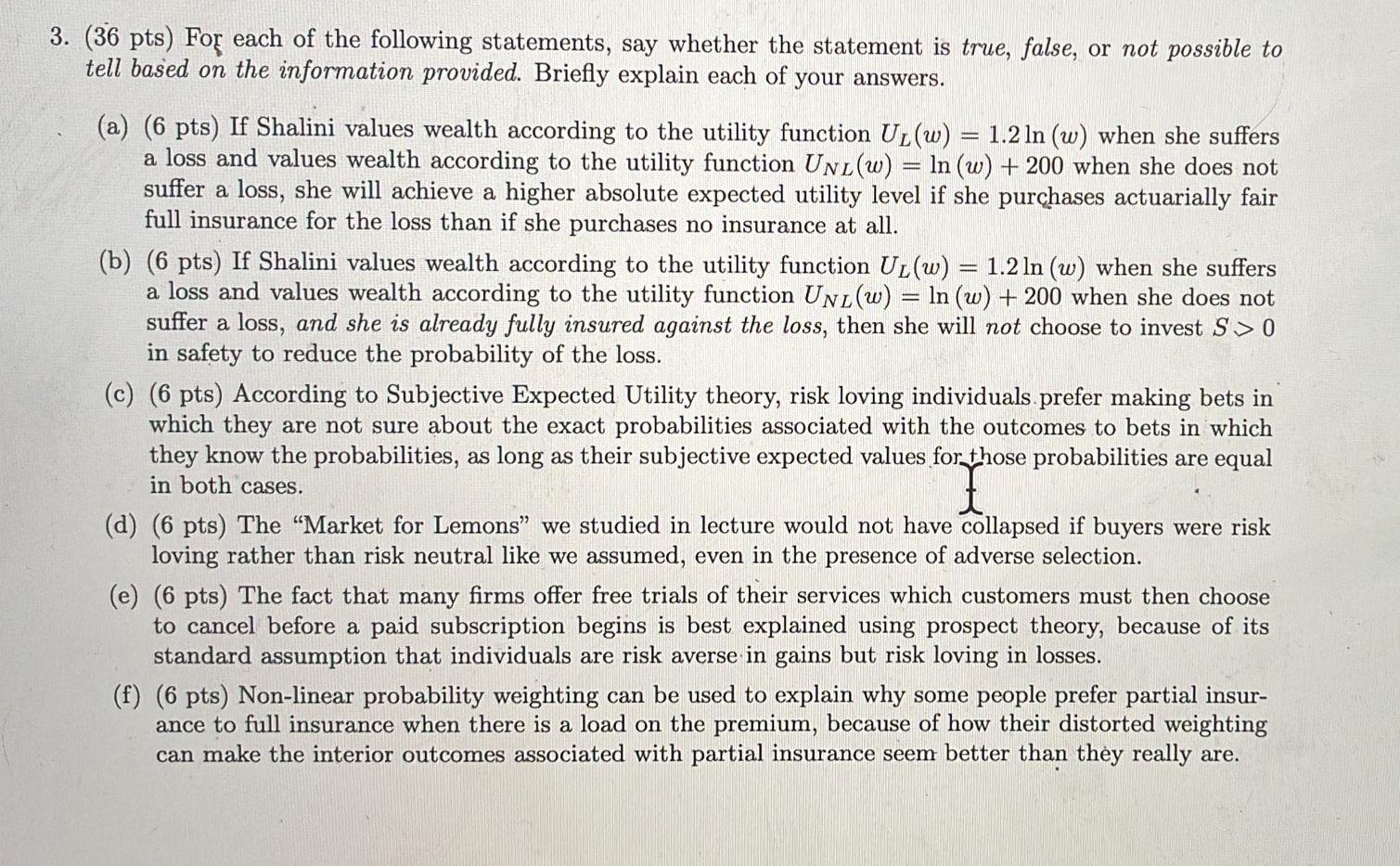

3. (36 pts) For each of the following statements, say whether the statement is true, false, or not possible to tell based on the information provided. Briefly explain each of your answers. a = (a) (6 pts) If Shalini values wealth according to the utility function UL(w) = 1.2 In (w) when she suffers a loss and values wealth according to the utility function Uni(w) = ln (w) + 200 when she does not suffer a loss, she will achieve a higher absolute expected utility level if she purchases actuarially fair full insurance for the loss than if she purchases no insurance at all. (b) (6 pts) If Shalini values wealth according to the utility function Ul(w) = 1.2 ln (w) when she suffers a loss and values wealth according to the utility function Unl(w) = ln (w) + 200 when she does not suffer a loss, and she is already fully insured against the loss, then she will not choose to invest S> 0 in safety to reduce the probability of the loss. (c) (6 pts) According to Subjective Expected Utility theory, risk loving individuals prefer making bets in which they are not sure about the exact probabilities associated with the outcomes to bets in which they know the probabilities, as long as their subjective expected values for those probabilities are equal in both cases. (d) (6 pts) The Market for Lemons we studied in lecture would not have collapsed if buyers were risk loving rather than risk neutral like we assumed, even in the presence of adverse selection. (e) (6 pts) The fact that many firms offer free trials of their services which customers must then choose to cancel before a paid subscription begins is best explained using prospect theory, because of its standard assumption that individuals are risk averse in gains but risk loving in losses. (f) (6 pts) Non-linear probability weighting can be used to explain why some people prefer partial insur- ance to full insurance when there is a load on the premium, because of how their distorted weighting can make the interior outcomes associated with partial insurance seem better than they really are. 3. (36 pts) For each of the following statements, say whether the statement is true, false, or not possible to tell based on the information provided. Briefly explain each of your answers. a = (a) (6 pts) If Shalini values wealth according to the utility function UL(w) = 1.2 In (w) when she suffers a loss and values wealth according to the utility function Uni(w) = ln (w) + 200 when she does not suffer a loss, she will achieve a higher absolute expected utility level if she purchases actuarially fair full insurance for the loss than if she purchases no insurance at all. (b) (6 pts) If Shalini values wealth according to the utility function Ul(w) = 1.2 ln (w) when she suffers a loss and values wealth according to the utility function Unl(w) = ln (w) + 200 when she does not suffer a loss, and she is already fully insured against the loss, then she will not choose to invest S> 0 in safety to reduce the probability of the loss. (c) (6 pts) According to Subjective Expected Utility theory, risk loving individuals prefer making bets in which they are not sure about the exact probabilities associated with the outcomes to bets in which they know the probabilities, as long as their subjective expected values for those probabilities are equal in both cases. (d) (6 pts) The Market for Lemons we studied in lecture would not have collapsed if buyers were risk loving rather than risk neutral like we assumed, even in the presence of adverse selection. (e) (6 pts) The fact that many firms offer free trials of their services which customers must then choose to cancel before a paid subscription begins is best explained using prospect theory, because of its standard assumption that individuals are risk averse in gains but risk loving in losses. (f) (6 pts) Non-linear probability weighting can be used to explain why some people prefer partial insur- ance to full insurance when there is a load on the premium, because of how their distorted weighting can make the interior outcomes associated with partial insurance seem better than they really areStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started