Answered step by step

Verified Expert Solution

Question

1 Approved Answer

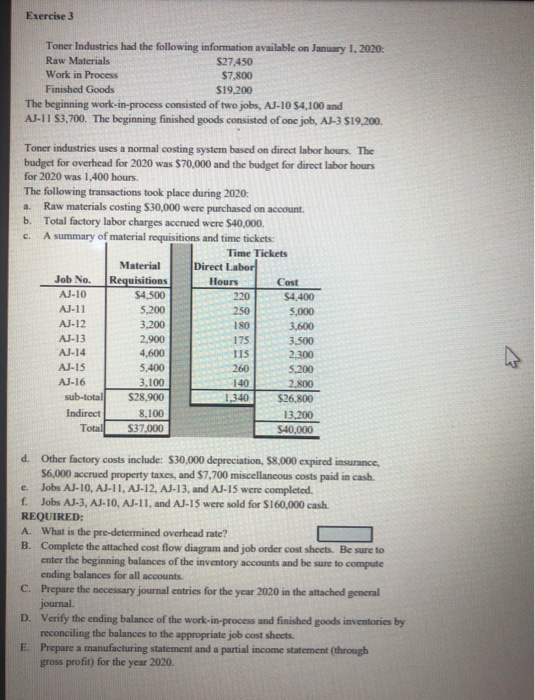

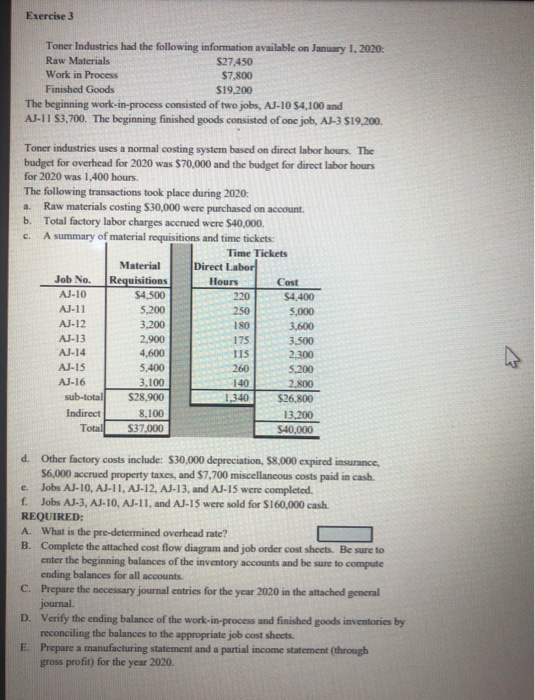

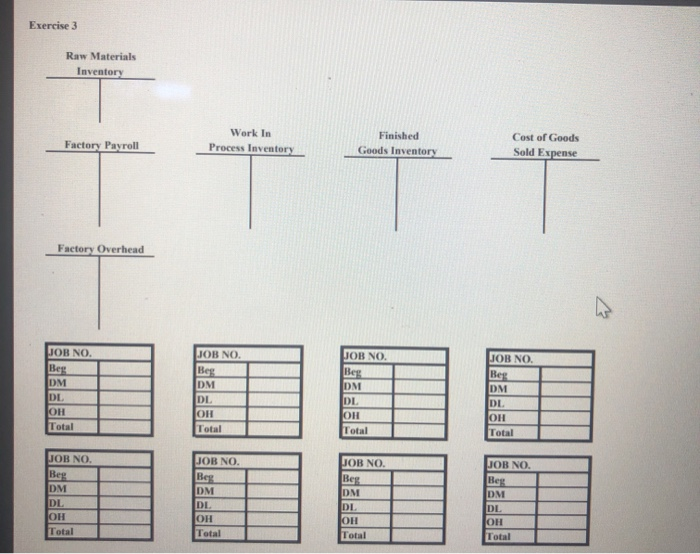

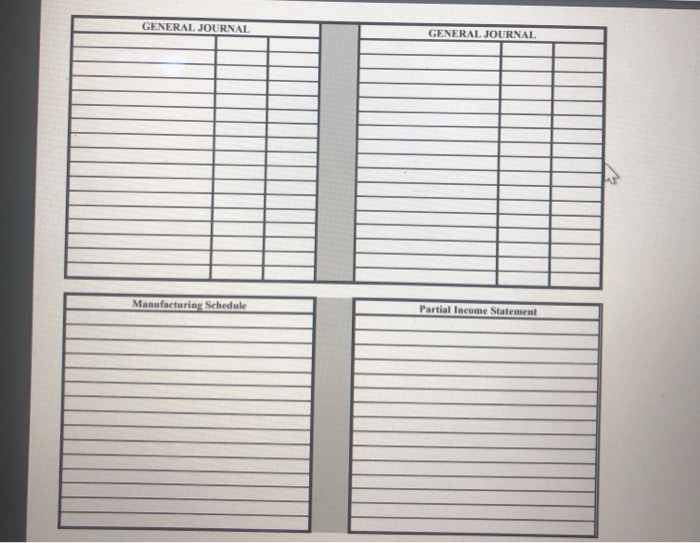

plz to the whole thing Exercise 3 a. Toner Industries had the following information available on January 1, 2020: Raw Materials $27,450 Work in Process

plz to the whole thing

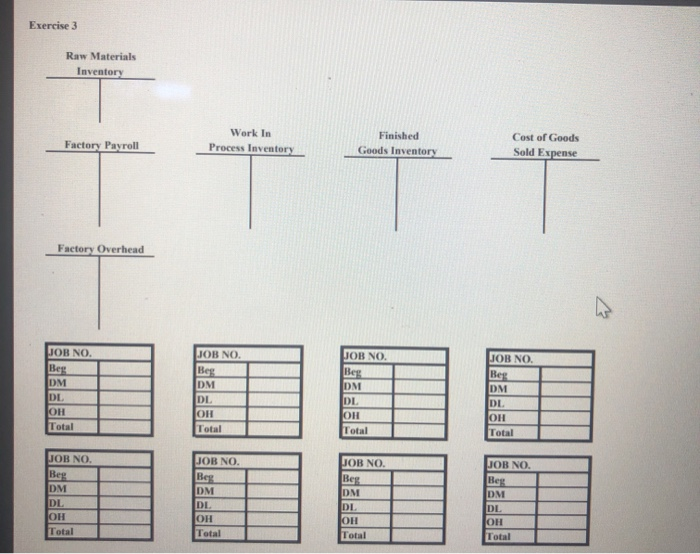

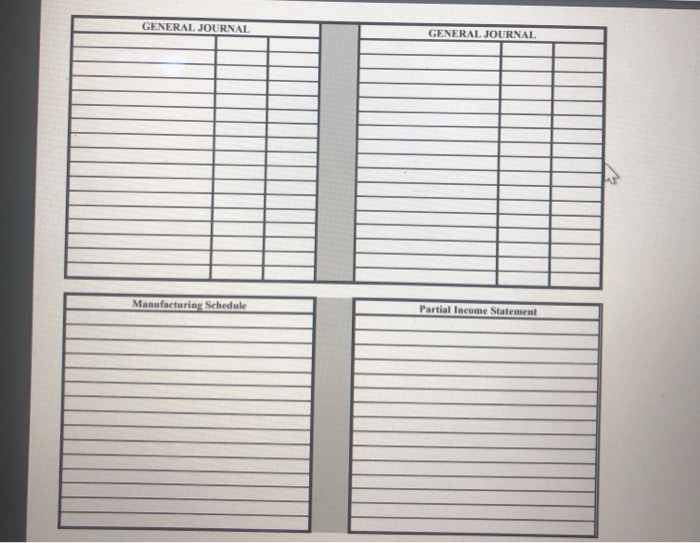

Exercise 3 a. Toner Industries had the following information available on January 1, 2020: Raw Materials $27,450 Work in Process $7,800 Finished Goods $19,200 The beginning work-in-process consisted of two jobs, AJ-10 54,100 and AJ-11 53,700. The beginning finished goods consisted of one job, AJ-3 519,200. Toner industries uses a normal costing system based on direct labor hours. The budget for overhead for 2020 was $70,000 and the budget for direct labor hours for 2020 was 1,400 hours. The following transactions took place during 2020: Raw materials costing $30,000 were purchased on account. b. Total factory labor charges accrued were $40,000 A summary of material requisitions and time tickets: Time Tickets Material Direct Labor Job No. Requisitions Hours Cost AJ-10 $4,500 220 $4,400 AJ-11 5,200 250 5.000 AJ-12 3,200 180 3,600 AJ-13 2,900 175 3,500 AJ-14 4,600 115 2,300 AJ-15 5,400 260 5.200 AJ-16 3.100 140 2.800 sub-total $28,900 1,340 $26.800 Indirect 8,100 13,200 Total $37,000 $40.000 C. a d. Other factory costs include: $30,000 depreciation, 8,000 expired insurance, 56,000 accrued property taxes, and $7,700 miscellaneous costs paid in cash. e. Jobs AJ-10, AJ-11, AJ-12, AJ-13, and AJ-15 were completed. f. Jobs AJ-3, AJ-IO, AJ-11, and AJ-15 were sold for $160,000 cash. REQUIRED: A. What is the pre-determined overhead rate? B. Complete the attached cost flow diagram and job order cost sheets. Be sure to enter the beginning balances of the inventory accounts and be sure to compute ending balances for all accounts C. Prepare the necessary journal entries for the year 2020 in the attached general journal. D. Verify the ending balance of the work-in-process and finished goods inventories by reconciling the balances to the appropriate job cost sheets. E Prepare a manufacturing statement and a partial income statement through gross profit) for the year 2020. Exercise 3 Raw Materials Inventory Factory Payroll Work In Process Inventory Finished Goods Inventory Cost of Goods Sold Expense Factory Overhead JOB NO. Beg DM DL Total JOB NO. Beg DM DL Total JOB NO. Beg DM DL OH Total JOB NO. Beg DM DL OH Total JOB NO. Beg DM DL OH Total JOB NO. Beg DM DI OH Total JOB NO. Beg DM DI OH Total JOB NO. Beg DM DL OH Total GENERAL JOURNAL GENERAL JOURNAL Manufacturing Schedule Partial Income Statement Exercise 3 a. Toner Industries had the following information available on January 1, 2020: Raw Materials $27,450 Work in Process $7,800 Finished Goods $19,200 The beginning work-in-process consisted of two jobs, AJ-10 54,100 and AJ-11 53,700. The beginning finished goods consisted of one job, AJ-3 519,200. Toner industries uses a normal costing system based on direct labor hours. The budget for overhead for 2020 was $70,000 and the budget for direct labor hours for 2020 was 1,400 hours. The following transactions took place during 2020: Raw materials costing $30,000 were purchased on account. b. Total factory labor charges accrued were $40,000 A summary of material requisitions and time tickets: Time Tickets Material Direct Labor Job No. Requisitions Hours Cost AJ-10 $4,500 220 $4,400 AJ-11 5,200 250 5.000 AJ-12 3,200 180 3,600 AJ-13 2,900 175 3,500 AJ-14 4,600 115 2,300 AJ-15 5,400 260 5.200 AJ-16 3.100 140 2.800 sub-total $28,900 1,340 $26.800 Indirect 8,100 13,200 Total $37,000 $40.000 C. a d. Other factory costs include: $30,000 depreciation, 8,000 expired insurance, 56,000 accrued property taxes, and $7,700 miscellaneous costs paid in cash. e. Jobs AJ-10, AJ-11, AJ-12, AJ-13, and AJ-15 were completed. f. Jobs AJ-3, AJ-IO, AJ-11, and AJ-15 were sold for $160,000 cash. REQUIRED: A. What is the pre-determined overhead rate? B. Complete the attached cost flow diagram and job order cost sheets. Be sure to enter the beginning balances of the inventory accounts and be sure to compute ending balances for all accounts C. Prepare the necessary journal entries for the year 2020 in the attached general journal. D. Verify the ending balance of the work-in-process and finished goods inventories by reconciling the balances to the appropriate job cost sheets. E Prepare a manufacturing statement and a partial income statement through gross profit) for the year 2020. Exercise 3 Raw Materials Inventory Factory Payroll Work In Process Inventory Finished Goods Inventory Cost of Goods Sold Expense Factory Overhead JOB NO. Beg DM DL Total JOB NO. Beg DM DL Total JOB NO. Beg DM DL OH Total JOB NO. Beg DM DL OH Total JOB NO. Beg DM DL OH Total JOB NO. Beg DM DI OH Total JOB NO. Beg DM DI OH Total JOB NO. Beg DM DL OH Total GENERAL JOURNAL GENERAL JOURNAL Manufacturing Schedule Partial Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started