Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz urgent solve all accurately and completely. XYZ recently paid a per share dividend of $1.48. Dividends are expected to increase by 2.5 percent annually.

plz urgent solve all accurately and completely.

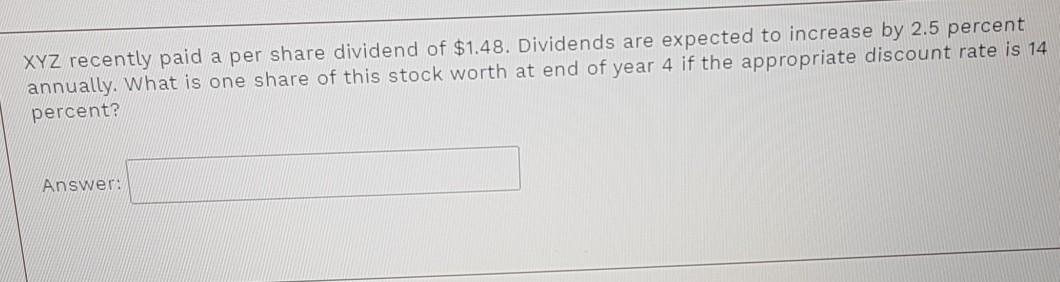

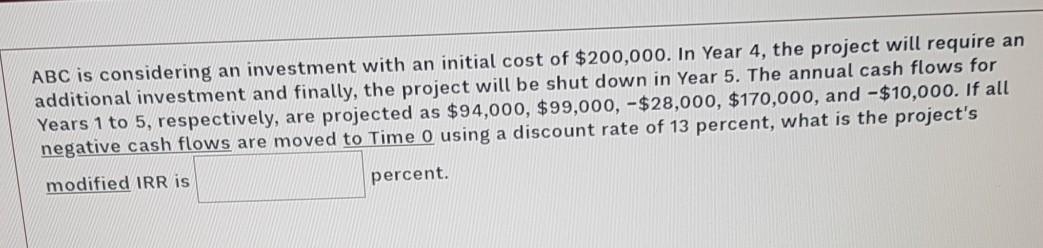

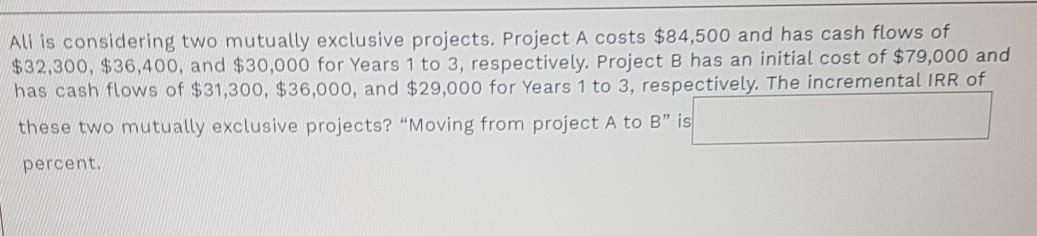

XYZ recently paid a per share dividend of $1.48. Dividends are expected to increase by 2.5 percent annually. What is one share of this stock worth at end of year 4 if the appropriate discount rate is 14 percent? Answers ABC is considering an investment with an initial cost of $200,000. In Year 4, the project will require an additional investment and finally, the project will be shut down in Year 5. The annual cash flows for Years 1 to 5, respectively, are projected as $94,000, $99,000,-$28,000, $170,000, and -$10,000. If all negative cash flows are moved to Time O using a discount rate of 13 percent, what is the project's modified IRR is percent. Ali is considering two mutually exclusive projects. Project A costs $84,500 and has cash flows of $32,300, $36,400, and $30,000 for Years 1 to 3, respectively. Project B has an initial cost of $79,000 and has cash flows of $31,300, $36,000, and $29,000 for Years 1 to 3, respectively. The incremental IRR of these two mutually exclusive projects? "Moving from project A to B" is percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started