Answered step by step

Verified Expert Solution

Question

1 Approved Answer

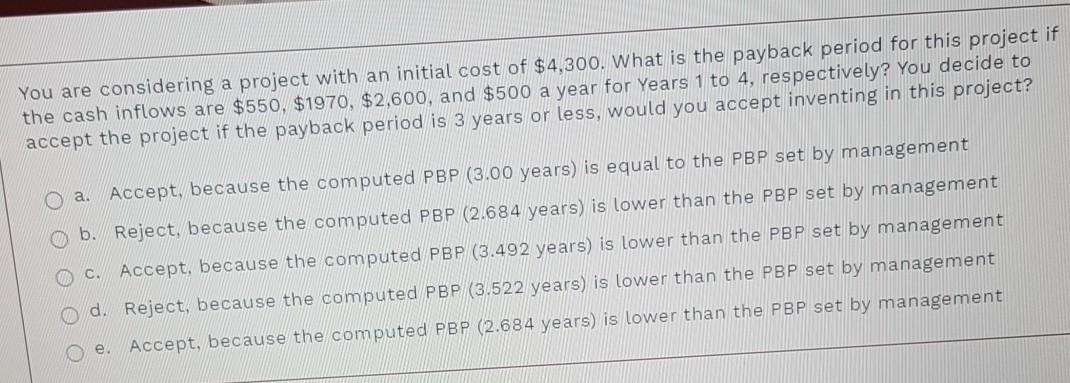

plz urgent solve all accurately and completely. You are considering a project with an initial cost of $4,300. What is the payback period for this

plz urgent solve all accurately and completely.

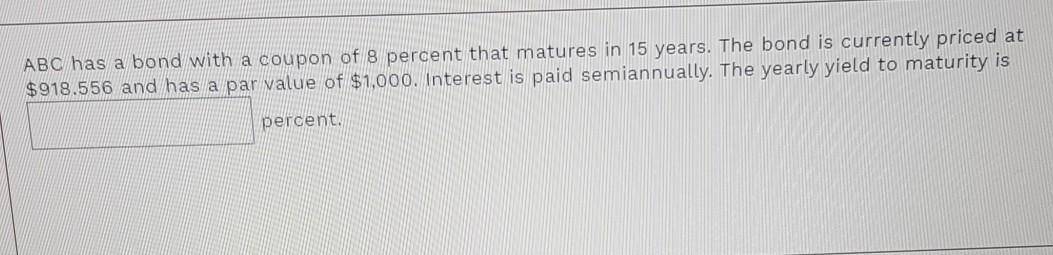

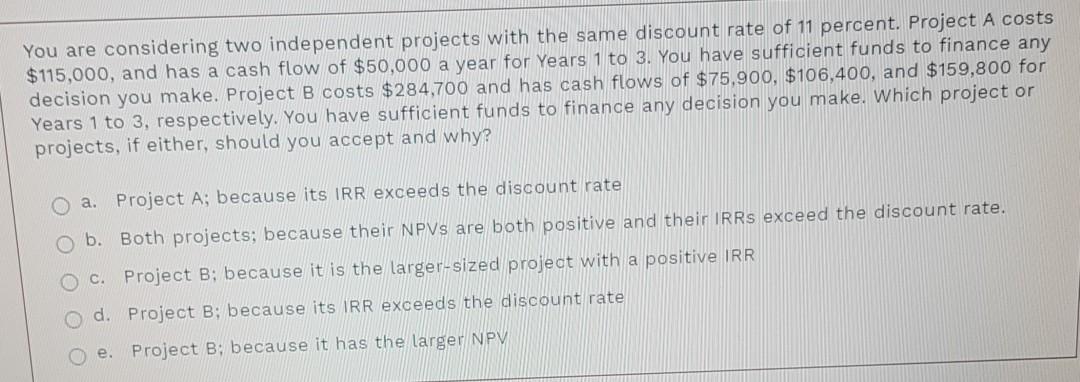

You are considering a project with an initial cost of $4,300. What is the payback period for this project if the cash inflows are $550, $1970, $2,600, and $500 a year for Years 1 to 4, respectively? You decide to accept the project if the payback period is 3 years or less, would you accept inventing in this project? a. Accept, because the computed PBP (3.00 years) is equal to the PBP set by management ob. Reject, because the computed PBP (2.684 years) is lower than the PBP set by management O c. Accept, because the computed PBP (3.492 years) is lower than the PBP set by management O d. Reject, because the computed PBP (3.522 years) is lower than the PBP set by management O e. Accept, because the computed PBP (2.684 years) is lower than the PBP set by management ABC has a bond with a coupon of 8 percent that matures in 15 years. The bond is currently priced at $918.556 and has a par value of $1,000. Interest is paid semiannually. The yearly yield to maturity is percent. You are considering two independent projects with the same discount rate of 11 percent. Project A costs $115,000, and has a cash flow of $50,000 a year for Years 1 to 3. You have sufficient funds to finance any decision you make. Project B costs $284,700 and has cash flows of $75,900, $106,400, and $159,800 for Years 1 to 3, respectively. You have sufficient funds to finance any decision you make. Which project or projects, if either, should you accept and why? O a. Project A; because its IRR exceeds the discount rate O b. Both projects, because their NPVs are both positive and their IRRs exceed the discount rate. O c. Project B; because it is the larger-sized project with a positive IRR d. Project B; because its IRR exceeds the discount rate O e. Project B; because it has the larger NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started