Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plz use excel Question 11 5 pts John makes a lot of money as an ISE 2040 TA. His paychecks come in every two weeks

plz use excel

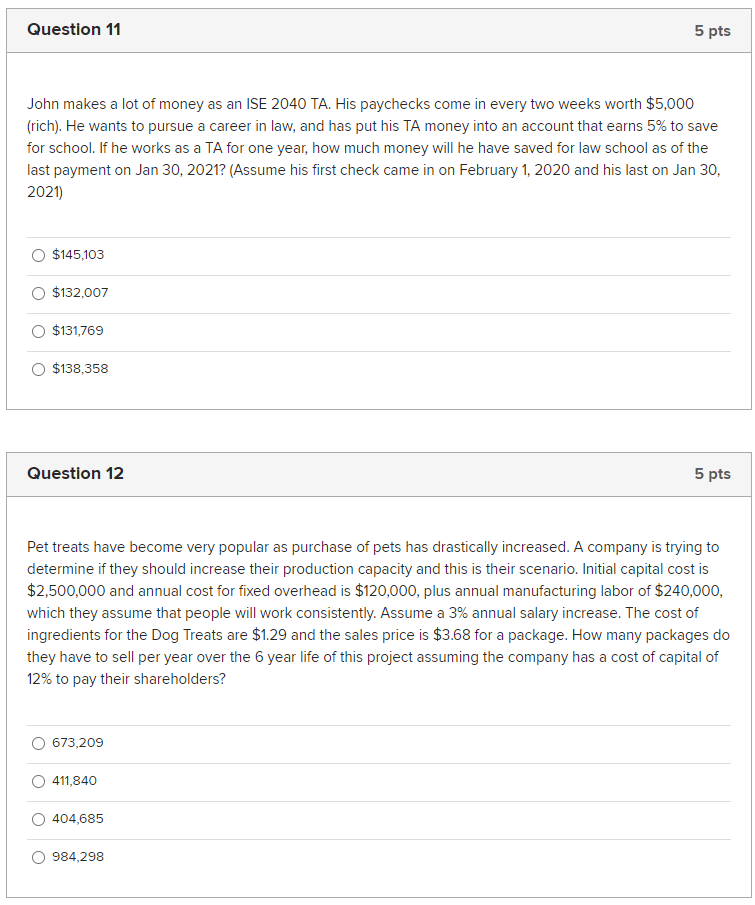

Question 11 5 pts John makes a lot of money as an ISE 2040 TA. His paychecks come in every two weeks worth $5,000 (rich). He wants to pursue a career in law, and has put his TA money into an account that earns 5% to save for school. If he works as a TA for one year, how much money will he have saved for law school as of the last payment on Jan 30, 2021? (Assume his first check came in on February 1, 2020 and his last on Jan 30, 2021) $145,103 $132,007 $131,769 O $138,358 Question 12 5 pts Pet treats have become very popular as purchase of pets has drastically increased. A company is trying to determine if they should increase their production capacity and this is their scenario. Initial capital cost is $2,500,000 and annual cost for fixed overhead is $120,000, plus annual manufacturing labor of $240,000, which they assume that people will work consistently. Assume a 3% annual salary increase. The cost of ingredients for the Dog Treats are $1.29 and the sales price is $3.68 for a package. How many packages do they have to sell per year over the 6 year life of this project assuming the company has a cost of capital of 12% to pay their shareholders? O 673,209 O 411,840 404,685 984,298 Question 11 5 pts John makes a lot of money as an ISE 2040 TA. His paychecks come in every two weeks worth $5,000 (rich). He wants to pursue a career in law, and has put his TA money into an account that earns 5% to save for school. If he works as a TA for one year, how much money will he have saved for law school as of the last payment on Jan 30, 2021? (Assume his first check came in on February 1, 2020 and his last on Jan 30, 2021) $145,103 $132,007 $131,769 O $138,358 Question 12 5 pts Pet treats have become very popular as purchase of pets has drastically increased. A company is trying to determine if they should increase their production capacity and this is their scenario. Initial capital cost is $2,500,000 and annual cost for fixed overhead is $120,000, plus annual manufacturing labor of $240,000, which they assume that people will work consistently. Assume a 3% annual salary increase. The cost of ingredients for the Dog Treats are $1.29 and the sales price is $3.68 for a package. How many packages do they have to sell per year over the 6 year life of this project assuming the company has a cost of capital of 12% to pay their shareholders? O 673,209 O 411,840 404,685 984,298Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started