Answered step by step

Verified Expert Solution

Question

1 Approved Answer

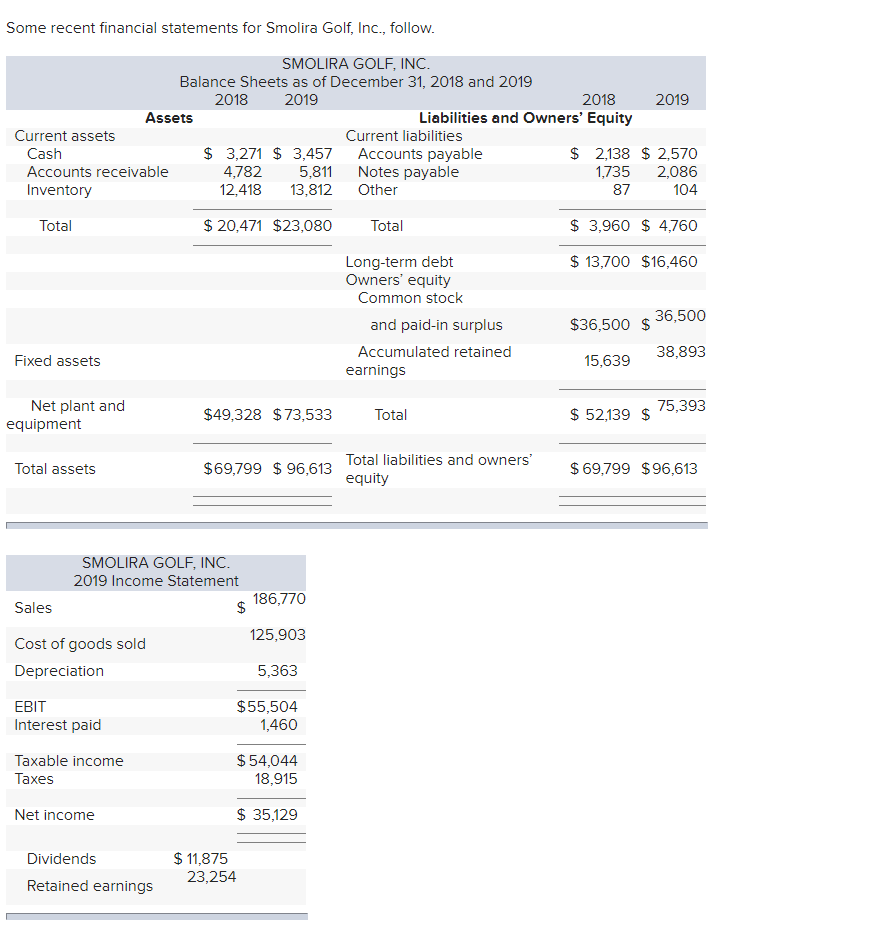

plz write clearly Some recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC. Balance Sheets as of December 31, 2018 and 2019 2018

plz write clearly

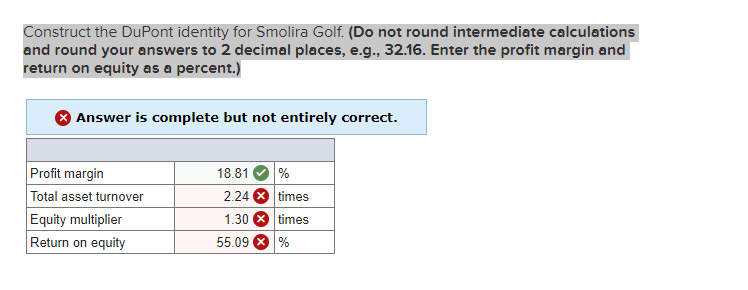

Some recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC. Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 3,271 $ 3,457 Accounts payable $ 2,138 $ 2,570 Accounts receivable 4,782 5,811 Notes payable 1,735 2,086 Inventory 12,418 13,812 Other 87 104 Total $ 20,471 $23,080 Total $ 3,960 $ 4,760 $ 13,700 $16,460 Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings $36,500 $ 36,500 38,893 15,639 Fixed assets Net plant and equipment $49,328 $ 73,533 Total $ 52,139 $ 75,393 Total assets $69,799 $ 96,613 Total liabilities and owners' equity $ 69,799 $ 96,613 SMOLIRA GOLF, INC. 2019 Income Statement $ 186,770 Sales 125,903 Cost of goods sold Depreciation 5,363 EBIT Interest paid $55,504 1,460 Taxable income Taxes $ 54,044 18,915 Net income $ 35,129 Dividends Retained earnings $ 11,875 23,254 Construct the DuPont identity for Smolira Golf. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter the profit margin and return on equity as a percent.) Answer is complete but not entirely correct. Profit margin Total asset turnover Equity multiplier Return on equity 18.81 % 2.24 times 1.30 times 55.09 % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started