Answered step by step

Verified Expert Solution

Question

1 Approved Answer

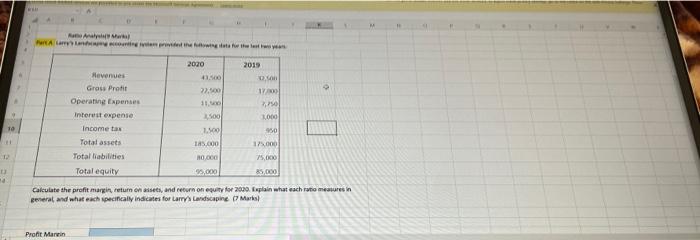

plzz help for upvote RAM Pred that the 2020 2019 41.00 con 22.500 Revenues Gross Prati Operating Expenses Interest expense Income tas Total assets Total

plzz help for upvote

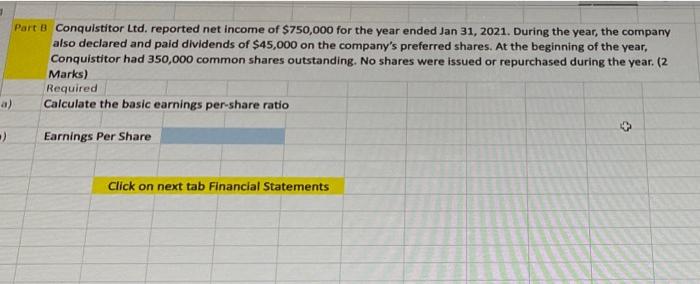

RAM Pred that the 2020 2019 41.00 con 22.500 Revenues Gross Prati Operating Expenses Interest expense Income tas Total assets Total liabilities Total equity 11.40 1,500 1.100 17 2,0 LOGO so 10 125.000 17000 75.000 10,000 95.000 Calculate the profit margin return on asets, and return on equity for 2000. Explain what each ratio matures in general and what each specifically indicates for Larry Landscaping (7 Marts Profit Marvin Return on Auto 30 31 32 3 Return on Equity Part B Conquistitor Ltd. reported net income of $750,000 for the year ended Jan 31, 2021. During the year, the company also declared and paid dividends of $45,000 on the company's preferred shares. At the beginning of the year, Conquistitor had 350,000 common shares outstanding. No shares were issued or repurchased during the year. (2 Marks) Required a) Calculate the basic earnings per-share ratio -) Earnings Per Share Click on next tab Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started