Answered step by step

Verified Expert Solution

Question

1 Approved Answer

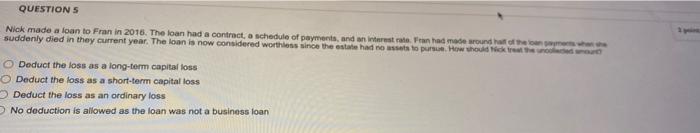

plzz help QUESTIONS Nick made a loan to Fran in 2016. The loan had a contract, a schedule of payments, and an interest rate Fran

plzz help

QUESTIONS Nick made a loan to Fran in 2016. The loan had a contract, a schedule of payments, and an interest rate Fran had made round of the suddenly died in they current year. The loan is now considered worthless since the estate had no assets to pursue. How would like to Deduct the loss as a long-term capital loss Deduct the loss as a short-term capital loss Deduct the loss as an ordinary loss No deduction is allowed as the loan was not a business loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started