Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plzzz solve on the page both questions 8-10 and 8-11 plzzz solve this question completely b. If Sugita's beta is 1.18 and the risk-free rate

plzzz solve on the page both questions 8-10 and 8-11

plzzz solve this question completely

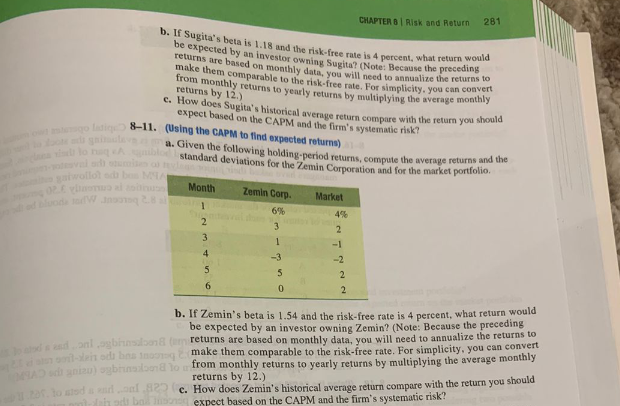

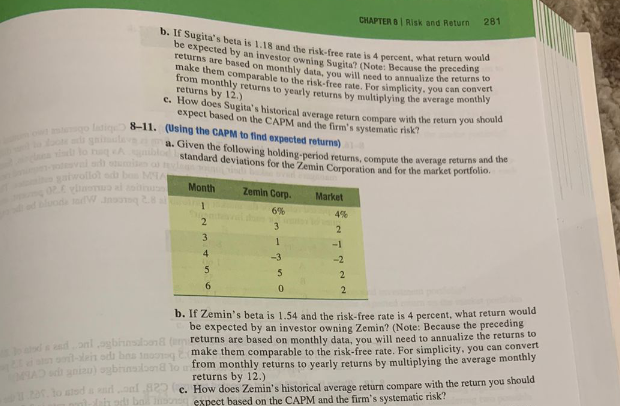

b. If Sugita's beta is 1.18 and the risk-free rate is 4 percent, what return would be expected by an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returnert make them comparable to the risk-free rate. For simplicity, you can convert from monthly returns to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the CAPM and the firm's systematic risk? own astego latiq 8-11. (Using the CAPM to find expected returns)-4 galwollo? ad bas MA voda WJ 2.8 al 11 a. Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market portfolio. Month Zemin Corp. 6% 3 2 sto alodeadonlogbrunsaloon col-leis oda boa noog di nizu) obinson to a in 3 4 5 6 1 -3 5 0 CHAPTER 8 Risk and Return Market 4% 2 281 -1 -2 2 2 b. If Zemin's beta is 1.54 and the risk-free rate is 4 percent, what return would be expected by an investor owning Zemin? (Note: Because the preceding (returns are based on monthly data, you will need to annualize the returns to make them comparable to the risk-free rate. For simplicity, you can convert from monthly returns to yearly returns by multiplying the average monthly returns by 12.) to, to mied a saron 2c. How does Zemin's historical average return compare with the return you should dah pd bak inson expect based on the CAPM and the firm's systematic risk? b. If Sugita's beta is 1.18 and the risk-free rate is 4 percent, what return would be expected by an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returnert make them comparable to the risk-free rate. For simplicity, you can convert from monthly returns to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the CAPM and the firm's systematic risk? own astego latiq 8-11. (Using the CAPM to find expected returns)-4 galwollo? ad bas MA voda WJ 2.8 al 11 a. Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market portfolio. Month Zemin Corp. 6% 3 2 sto alodeadonlogbrunsaloon col-leis oda boa noog di nizu) obinson to a in 3 4 5 6 1 -3 5 0 CHAPTER 8 Risk and Return Market 4% 2 281 -1 -2 2 2 b. If Zemin's beta is 1.54 and the risk-free rate is 4 percent, what return would be expected by an investor owning Zemin? (Note: Because the preceding (returns are based on monthly data, you will need to annualize the returns to make them comparable to the risk-free rate. For simplicity, you can convert from monthly returns to yearly returns by multiplying the average monthly returns by 12.) to, to mied a saron 2c. How does Zemin's historical average return compare with the return you should dah pd bak inson expect based on the CAPM and the firm's systematic risk? CHAPTER 8 Risk and Return 281 b. If Sugita's beta is 1.18 and the risk-free rate is 4 percent, what return would be expected by an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable to the risk-free rate. For simplicity, you can co from monthly returns to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the CAPM and the firm's systematic risk? qoladiq 8-11. (Using the CAPM to find tStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started