Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pm Points 100 Submitting a file upload Covers Chapters 9 and Yo-Homework Assignments General Instructions Chapter 9: Go to a source that allows you to

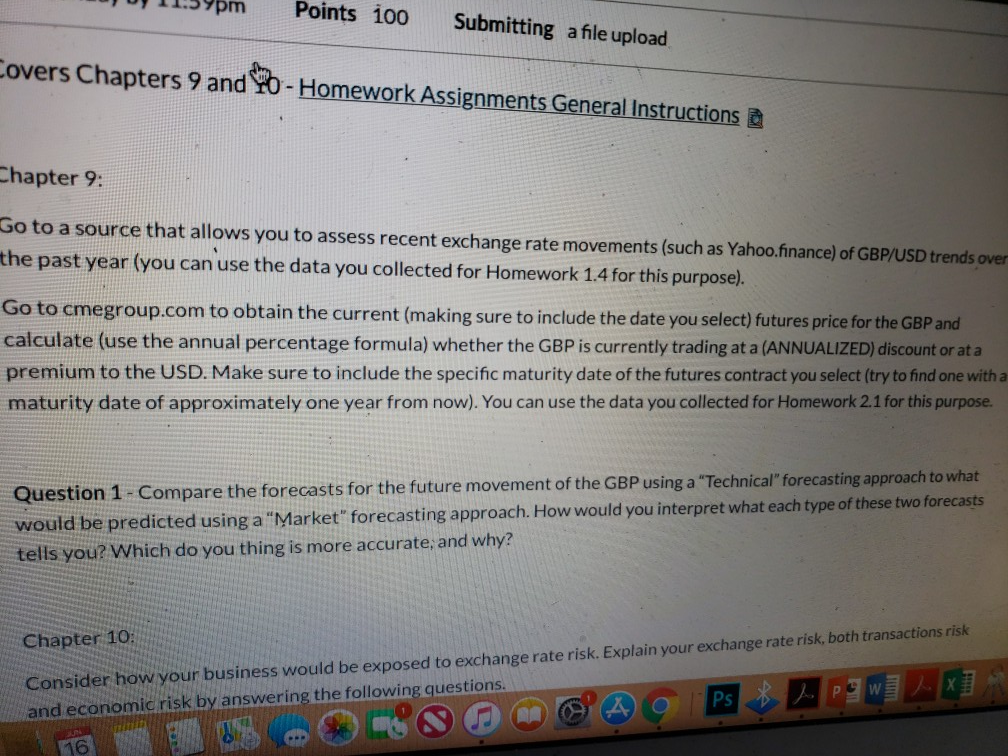

pm Points 100 Submitting a file upload Covers Chapters 9 and Yo-Homework Assignments General Instructions Chapter 9: Go to a source that allows you to assess recent exchange rate movements (such as Yahoo.finance) of GBP/USD trends over the past year (you can use the data you collected for Homework 1.4 for this purpose). Go to cmegroup.com to obtain the current (making sure to include the date you select) futures price for the GBP and calculate (use the annual percentage formula) whether the GBP is currently trading at a (ANNUALIZED) discount or at a premium to the USD. Make sure to include the specific maturity date of the futures contract you select (try to find one with a maturity date of approximately one year from now). You can use the data you collected for Homework 2.1 for this purpose Compare the forecasts for the future movement of the GBP using a "Technical" forecasting approach to what Question 1 would be predicted using a "Market" forecasting approach. How would you interpret what each type of these two forecasts tells you? Which do you thing is more accurate; and why? Chapter 10: Consider how your business would be exposed to exchange rate risk. Explain your exchange rate risk, both transactions risk and economic risk by answering the following questions. 16 pm Points 100 Submitting a file upload Covers Chapters 9 and Yo-Homework Assignments General Instructions Chapter 9: Go to a source that allows you to assess recent exchange rate movements (such as Yahoo.finance) of GBP/USD trends over the past year (you can use the data you collected for Homework 1.4 for this purpose). Go to cmegroup.com to obtain the current (making sure to include the date you select) futures price for the GBP and calculate (use the annual percentage formula) whether the GBP is currently trading at a (ANNUALIZED) discount or at a premium to the USD. Make sure to include the specific maturity date of the futures contract you select (try to find one with a maturity date of approximately one year from now). You can use the data you collected for Homework 2.1 for this purpose Compare the forecasts for the future movement of the GBP using a "Technical" forecasting approach to what Question 1 would be predicted using a "Market" forecasting approach. How would you interpret what each type of these two forecasts tells you? Which do you thing is more accurate; and why? Chapter 10: Consider how your business would be exposed to exchange rate risk. Explain your exchange rate risk, both transactions risk and economic risk by answering the following questions. 16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started