Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PMAB acquires 100 percent of the shares in the subsidiary DB in March 31, 20x2. The purchase price is 320. The book value of

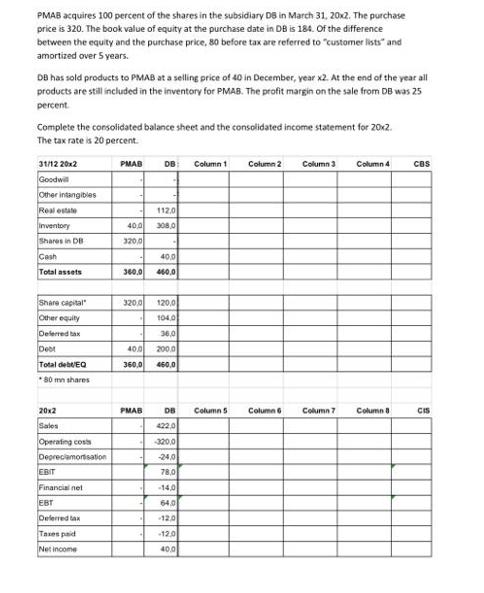

PMAB acquires 100 percent of the shares in the subsidiary DB in March 31, 20x2. The purchase price is 320. The book value of equity at the purchase date in DB is 184. Of the difference between the equity and the purchase price, 80 before tax are referred to "customer lists" and amortized over 5 years. DB has sold products to PMAB at a selling price of 40 in December, year x2. At the end of the year all products are still included in the inventory for PMAB. The profit margin on the sale from DB was 25 percent Complete the consolidated balance sheet and the consolidated income statement for 20x2. The tax rate is 20 percent. 31/12 20x2 Goodwill Other intangibles Real estate Inventory Shares in DB Cash Total assets Share capital Other equity Deferred tax Debt Total de EQ *80 mn shares 20x2 Sales Operating costs Depreciamortisation EBIT Financial net EBT Deferred tax Taxes paid Net income PMAB 40,0 320,0 DB Column 1 320,0 112,0 308,0 40,0 360,0 460,0 PMAB C 120,0 104,0 36,0 400 200.0 360,0 460,0 DB 422,0 -320,0 -24.0 78,0 -14.0 64.0 -12.0 -12.0 40.0 Column 5 Column 2 Column 6 Column 3 Column7 Column 4 Column CBS CIS

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To complete the consolidated balance sheet and the consolidated income statement for 20x2 we can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started