Answered step by step

Verified Expert Solution

Question

1 Approved Answer

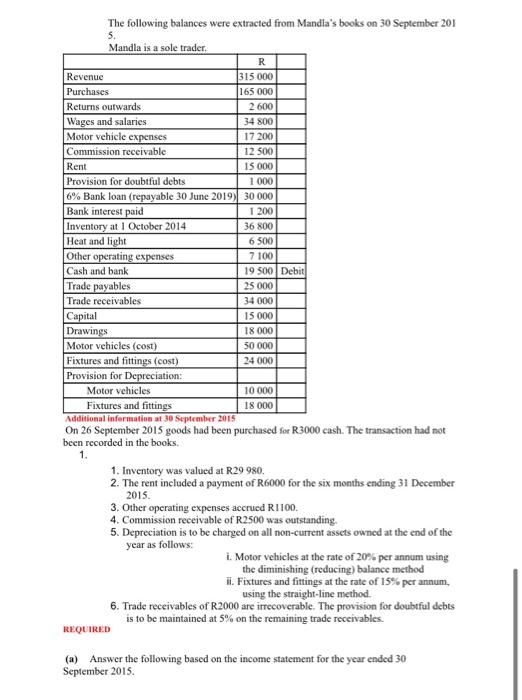

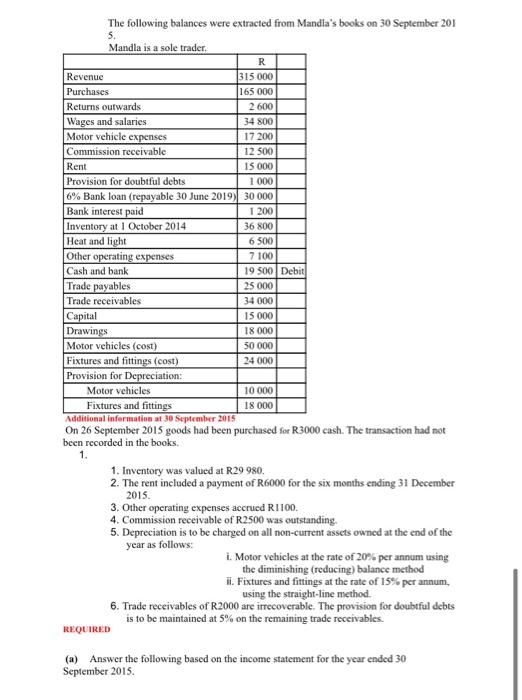

pmaQ11 The following balances were extracted from Mandia's books on 30 September 201 5. Mandla is a sole trader R Revenue 315 000 Purchases 165

pmaQ11

The following balances were extracted from Mandia's books on 30 September 201 5. Mandla is a sole trader R Revenue 315 000 Purchases 165 000 Returns outwards 2 600 Wages and salaries 34 800 Motor vehicle expenses 17200 Commission receivable 12 500 Rent 15 000 Provision for doubtful debts 1 000 6% Bank loan (repayable 30 June 2019) 30 000 Bank interest paid 1 200 Inventory at 1 October 2014 36 800 Heat and light 6 500 Other operating expenses 7100 Cash and bank 19 500 Debit Trade payables 25 000 Trade receivables 34 000 Capital 15 000 Drawings 18 000 Motor vehicles (cost) 50 000 Fixtures and fittings (cost) 24 000 Provision for Depreciation: Motor vehicles 10 000 Fixtures and fittings 18 000 Additional information at 30 September 2015 On 26 September 2015 goods had been purchased for R3000 cash. The transaction had not been recorded in the books. 1. 1. Inventory was valued at R29980. 2. The rent included a payment of R6000 for the six months ending 31 December 2015. 3. Other operating expenses accrued R1100. 4. Commission receivable of R2500 was outstanding. 5. Depreciation is to be charged on all non-current assets owned at the end of the year as follows: 1. Motor vehicles at the rate of 20% per annum using the diminishing (reducing) balance method ii. Fixtures and fittings at the rate of 15% per annum, using the straight-line method. 6. Trade receivables of R2000 are irrecoverable. The provision for doubtful debts is to be maintained at 5% on the remaining trade receivables. REQUIRED (a) Answer the following based on the income statement for the year ended 30 September 2015 The following balances were extracted from Mandia's books on 30 September 201 5. Mandla is a sole trader R Revenue 315 000 Purchases 165 000 Returns outwards 2 600 Wages and salaries 34 800 Motor vehicle expenses 17200 Commission receivable 12 500 Rent 15 000 Provision for doubtful debts 1 000 6% Bank loan (repayable 30 June 2019) 30 000 Bank interest paid 1 200 Inventory at 1 October 2014 36 800 Heat and light 6 500 Other operating expenses 7100 Cash and bank 19 500 Debit Trade payables 25 000 Trade receivables 34 000 Capital 15 000 Drawings 18 000 Motor vehicles (cost) 50 000 Fixtures and fittings (cost) 24 000 Provision for Depreciation: Motor vehicles 10 000 Fixtures and fittings 18 000 Additional information at 30 September 2015 On 26 September 2015 goods had been purchased for R3000 cash. The transaction had not been recorded in the books. 1. 1. Inventory was valued at R29980. 2. The rent included a payment of R6000 for the six months ending 31 December 2015. 3. Other operating expenses accrued R1100. 4. Commission receivable of R2500 was outstanding. 5. Depreciation is to be charged on all non-current assets owned at the end of the year as follows: 1. Motor vehicles at the rate of 20% per annum using the diminishing (reducing) balance method ii. Fixtures and fittings at the rate of 15% per annum, using the straight-line method. 6. Trade receivables of R2000 are irrecoverable. The provision for doubtful debts is to be maintained at 5% on the remaining trade receivables. REQUIRED (a) Answer the following based on the income statement for the year ended 30 September 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started