Question

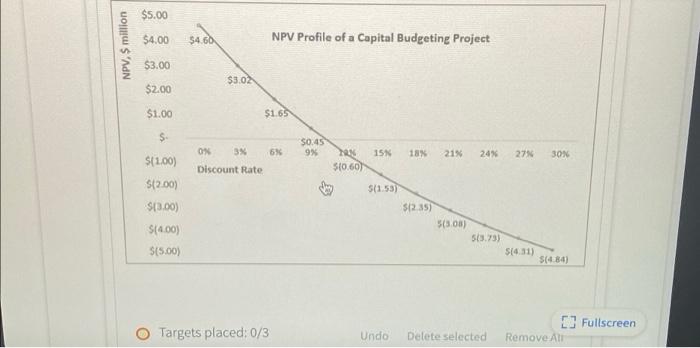

Point at the NPV (on the NPV profile curve) corresponding to the project's IRR S $5.00 $4.00 $4.60 NPV Profile of a Capital Budgeting

Point at the NPV (on the NPV profile curve) corresponding to the project's IRR S $5.00 $4.00 $4.60 NPV Profile of a Capital Budgeting Project $3.00 53.0 $2.00 $100 S165 50.45 ON 15% 18% 21N 24% 27% 30% S(1.00) S(0.60 Discount Rate $(2.00) S300) S(2.35) S.08) S(4.00) E Fullscreen S(3.73) NPV, $ million $5.00 $4.00 $4.60 NPV Profile of a Capital Budgeting Project $3.00 $3.02 $2.00 $1.00 $1.65 $- $0.45 9% ON 3% 6% 15% 18% 21% 24% 27% 30% $(1.00) S10.60) Discount Rate $(2.00) S(1.53) S(3.00) $12.35) 5(3.08) $(4.00) Si3.73) $(5.00) S(4.31) $(4.84) E Fullscreen Targets placed: 0/3 Undo Delete selected Remove At NPV, $ million

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

IRR is the rate at which Projects NPV is Zero The Projects IRR is where NPV curve ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

CFIN

Authors: Scott Besley, Eugene Brigham

5th edition

1305661656, 9781305888036 , 978-1305666870

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App