Question

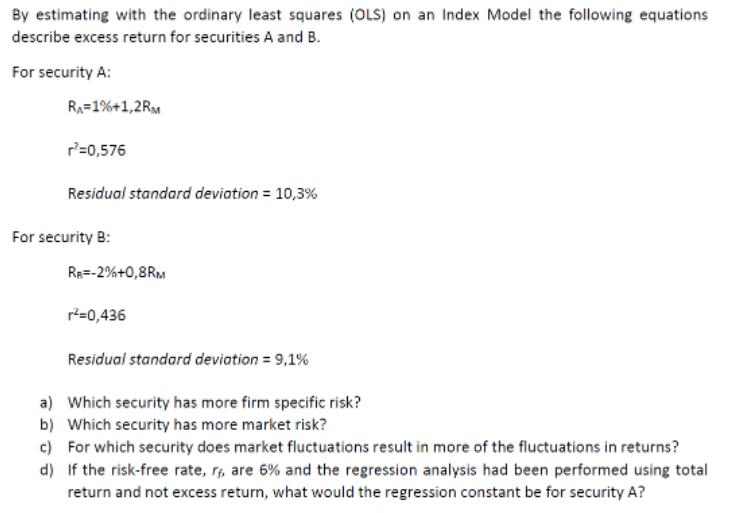

By estimating with the ordinary least squares (OLS) on an Index Model the following equations describe excess return for securities A and B. For

By estimating with the ordinary least squares (OLS) on an Index Model the following equations describe excess return for securities A and B. For security A: RA=1%+1,2RM r'=0,576 Residual standard deviation = 10,3% For security B: Re=-2%+0,8RM r=0,436 Residual standard deviation = 9,1% a) Which security has more firm specific risk? b) Which security has more market risk? c) For which security does market fluctuations result in more of the fiuctuations in returns? d) If the risk-free rate, r, are 6% and the regression analysis had been performed using total return and not excess return, what would the regression constant be for security A?

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Stock A Residual standard deviation is high...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Cost Accounting A Managerial Emphasis

Authors: Srikant M. Datar, Madhav V. Rajan, Louis Beaubien

8th Canadian Edition

134453735, 9780134824680, 134824687, 9780134733081 , 978-0134453736

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App