POINT OF VIEW: Internal Management tasked with increasing profits over 3 years by 5%

Based off the above, Perform analysis on the three years of Financial Statements provided for Milavec. Produce a summary of your groups conclusion about Milavec, including the recommendation you make for your chosen point of view. (For example, if you are using the Investor POV you would recommend yes, invest or no, do not invest) Provide the analytical tools you used (at least three) that support your conclusion or recommendation. Be sure to include a description of your analysis in addition to the computational work. At least some of your analytics need to include Year 5 performance

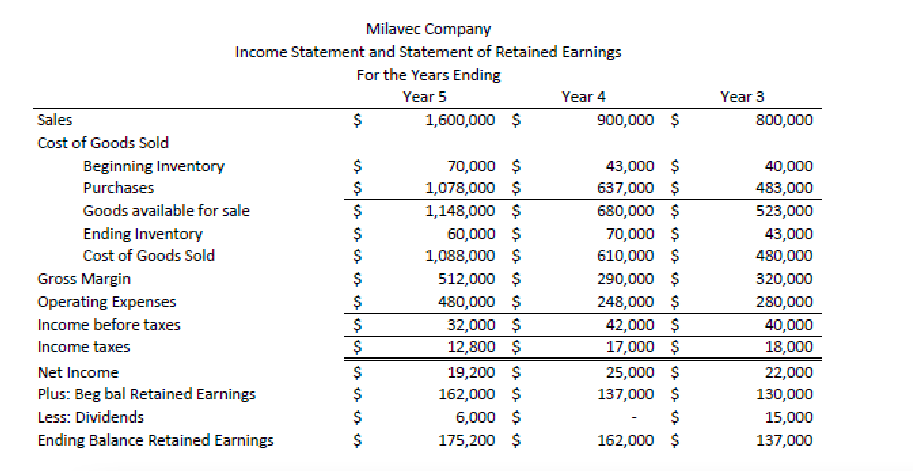

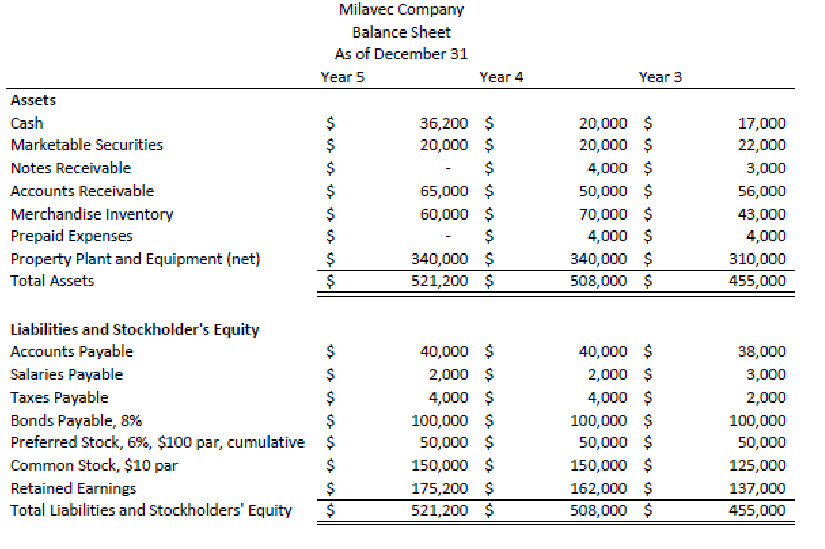

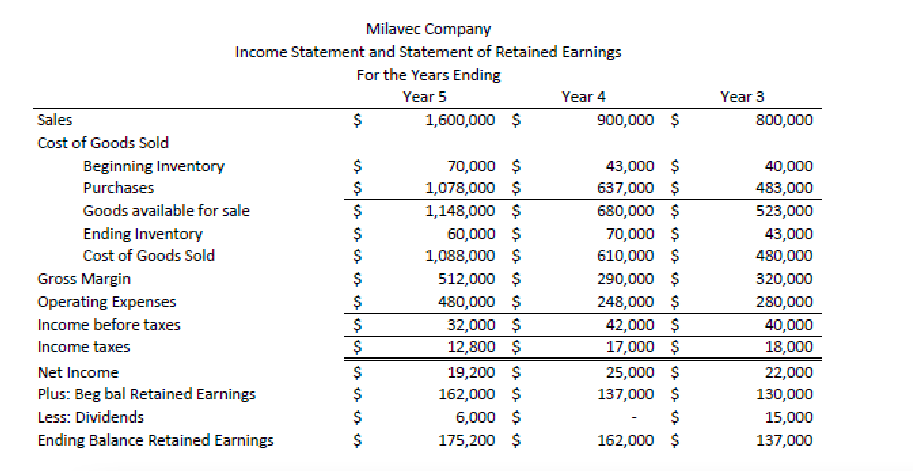

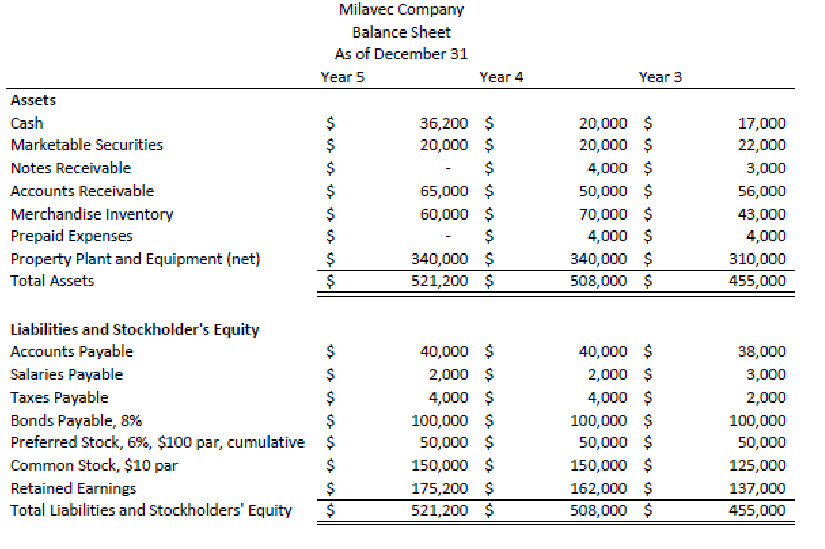

Sales Cost of Goods Sold Milavec Company Income Statement and Statement of Retained Earnings For the Years Ending Year 5 Year 4 1,600,000 $ $ 70,000 $ $ 1,078,000 $ $ 1,148,000 $ 60,000 $ 1,088,000 $ $ 512,000 $ $ 480,000 $ $ 32,000 $ $ 12,800 $ 19,200 $ 162,000 $ 6,000 $ 175,200 $ Beginning Inventory Purchases Goods available for sale Ending Inventory Cost of Goods Sold Gross Margin Operating Expenses Income before taxes Income taxes Net Income Plus: Beg bal Retained Earnings Less: Dividends Ending Balance Retained Earnings 05 05 05 s is is $ 900,000 $ 43,000 $ 637,000 $ 680,000 $ 70,000 $ 610,000 $ 290,000 $ 248,000 $ 42,000 $ 17,000 $ 25,000 $ 137,000 $ $ 162,000 $ Year 3 800,000 40,000 483,000 523,000 43,000 480,000 320,000 280,000 40,000 18,000 22,000 130,000 15,000 137,000 Milavec Company Balance Sheet As of December 31 Year 5 Assets Cash Marketable Securities Notes Receivable Accounts Receivable Merchandise Inventory $ Prepaid Expenses $ $ Property Plant and Equipment (net) Total Assets $ Liabilities and Stockholder's Equity Accounts Payable Salaries Payable Taxes Payable Bonds Payable, 8% Preferred Stock, 6%, $100 par, cumulative $ Common Stock, $10 par Retained Earnings $ Total Liabilities and Stockholders' Equity $ is is is is is us Year 4 36,200 $ 20,000 $ 65,000 $ 60,000 $ $ 340,000 $ 521,200 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 175,200 $ 521,200 $ Year 3 20,000 $ 20,000 $ 4,000 $ 50,000 $ 70,000 $ 4,000 $ 340,000 $ 508,000 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 162,000 $ 508,000 $ 17,000 22,000 3,000 56,000 43,000 4,000 310,000 455,000 38,000 3,000 2,000 100,000 50,000 125,000 137,000 455,000 Sales Cost of Goods Sold Milavec Company Income Statement and Statement of Retained Earnings For the Years Ending Year 5 Year 4 1,600,000 $ $ 70,000 $ $ 1,078,000 $ $ 1,148,000 $ 60,000 $ 1,088,000 $ $ 512,000 $ $ 480,000 $ $ 32,000 $ $ 12,800 $ 19,200 $ 162,000 $ 6,000 $ 175,200 $ Beginning Inventory Purchases Goods available for sale Ending Inventory Cost of Goods Sold Gross Margin Operating Expenses Income before taxes Income taxes Net Income Plus: Beg bal Retained Earnings Less: Dividends Ending Balance Retained Earnings 05 05 05 s is is $ 900,000 $ 43,000 $ 637,000 $ 680,000 $ 70,000 $ 610,000 $ 290,000 $ 248,000 $ 42,000 $ 17,000 $ 25,000 $ 137,000 $ $ 162,000 $ Year 3 800,000 40,000 483,000 523,000 43,000 480,000 320,000 280,000 40,000 18,000 22,000 130,000 15,000 137,000 Milavec Company Balance Sheet As of December 31 Year 5 Assets Cash Marketable Securities Notes Receivable Accounts Receivable Merchandise Inventory $ Prepaid Expenses $ $ Property Plant and Equipment (net) Total Assets $ Liabilities and Stockholder's Equity Accounts Payable Salaries Payable Taxes Payable Bonds Payable, 8% Preferred Stock, 6%, $100 par, cumulative $ Common Stock, $10 par Retained Earnings $ Total Liabilities and Stockholders' Equity $ is is is is is us Year 4 36,200 $ 20,000 $ 65,000 $ 60,000 $ $ 340,000 $ 521,200 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 175,200 $ 521,200 $ Year 3 20,000 $ 20,000 $ 4,000 $ 50,000 $ 70,000 $ 4,000 $ 340,000 $ 508,000 $ 40,000 $ 2,000 $ 4,000 $ 100,000 $ 50,000 $ 150,000 $ 162,000 $ 508,000 $ 17,000 22,000 3,000 56,000 43,000 4,000 310,000 455,000 38,000 3,000 2,000 100,000 50,000 125,000 137,000 455,000