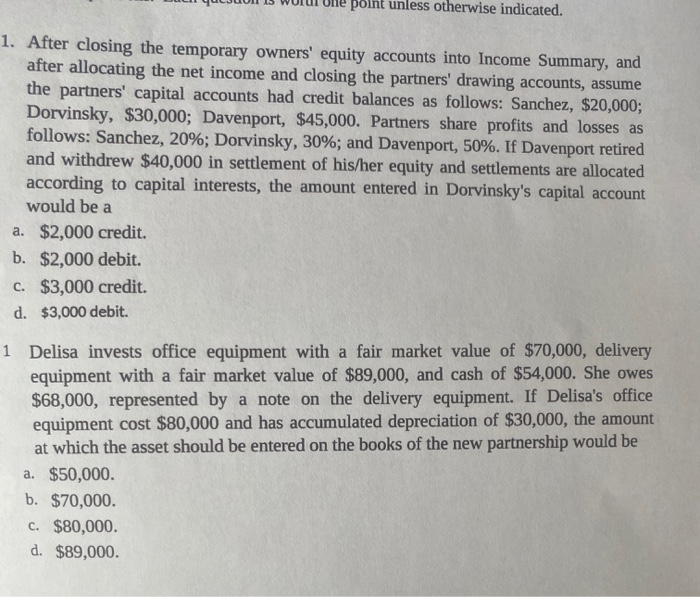

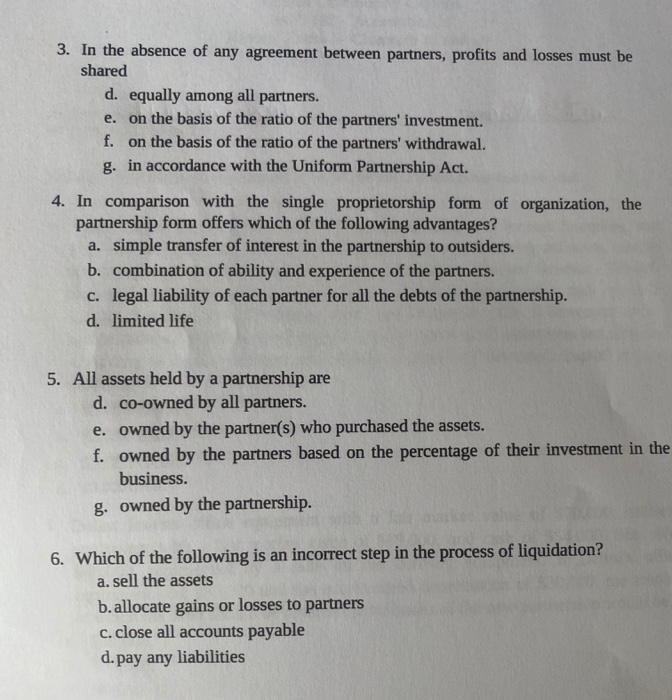

point unless otherwise indicated. 1. After closing the temporary owners' equity accounts into Income Summary, and after allocating the net income and closing the partners' drawing accounts, assume the partners' capital accounts had credit balances as follows: Sanchez, $20,000; Dorvinsky, $30,000; Davenport, $45,000. Partners share profits and losses as follows: Sanchez, 20%; Dorvinsky, 30%; and Davenport, 50%. If Davenport retired and withdrew $40,000 in settlement of his/her equity and settlements are allocated according to capital interests, the amount entered in Dorvinsky's capital account would be a a. $2,000 credit. b. $2,000 debit. C. $3,000 credit. d. $3,000 debit. 1 Delisa invests office equipment with a fair market value of $70,000, delivery equipment with a fair market value of $89,000, and cash of $54,000. She owes $68,000, represented by a note on the delivery equipment. If Delisa's office equipment cost $80,000 and has accumulated depreciation of $30,000, the amount at which the asset should be entered on the books of the new partnership would be a. $50,000. b. $70,000. C. $80,000 d. $89,000. 3. In the absence of any agreement between partners, profits and losses must be shared d. equally among all partners. e. on the basis of the ratio of the partners' investment. f. on the basis of the ratio of the partners' withdrawal. g. in accordance with the Uniform Partnership Act. 4. In comparison with the single proprietorship form of organization, the partnership form offers which of the following advantages? a. simple transfer of interest in the partnership to outsiders. b. combination of ability and experience of the partners. c. legal liability of each partner for all the debts of the partnership. d. limited life 5. All assets held by a partnership are d. co-owned by all partners. e. owned by the partner(s) who purchased the assets. f. owned by the partners based on the percentage of their investment in the business. g. owned by the partnership. 6. Which of the following is an incorrect step in the process of liquidation? a. sell the assets b.allocate gains or losses to partners c. close all accounts payable d. pay any liabilities