Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pointless Luxuries Inc. ( PLI ) produces unusual gifts targeted at wealthy consumers. The firm is analyzing the possibility of introducing a new device designed

Pointless Luxuries Inc. PLI produces unusual gifts targeted at wealthy consumers. The firm is analyzing the possibility of

introducing a new device designed to attach to the color of a cat or dog. The device emits sonic waves that neutralize

airplane engine noise, so that pets traveling with their owners can enjoy a more peaceful ride. PLI estimates that

developing this product will require upfront capital expenditures of $ million. These costs will be depreciated on a

MACRS year schedule. PLI believes that it can sell the product initially for $ The selling price will increase to $

in years and before falling to $ and $ in years and respectively. After five years the company will

withdraw the product from the market and replace it with something else. Upon withdrawal, the firm believes that the

salvage value of the equipment would be $ Variable costs are $ per unit. PLI forecasts sales volume of

units in the first year, with subsequent increases of year year year and year

The firm expects operating expenses, other than depreciation, to be $ for all five years. PLI is currently in the

tax bracket.

The working capital needs are the following...

Year $

Year $

Year $

Year $

Year $

Year $

Pointless Luxuries Inc. currently has a $ stock price and shares outstanding. In addition, the firm

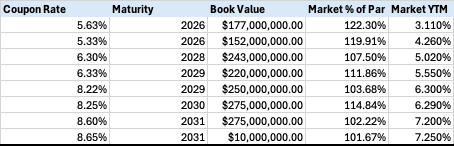

currently has a Beta of and has eight different debt issues outstanding. The details of those debt issues are

presented below. in image

The relevant Treasury yield is and the anticipated market risk premium is

Calculate the NPV IRR, and PI for the project.

Create a NPV matrix assuming a plus or minus adjustment to the following four inputs:

Purchase Price of Capital Asset

Salvage Value

Variable Cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started