Answered step by step

Verified Expert Solution

Question

1 Approved Answer

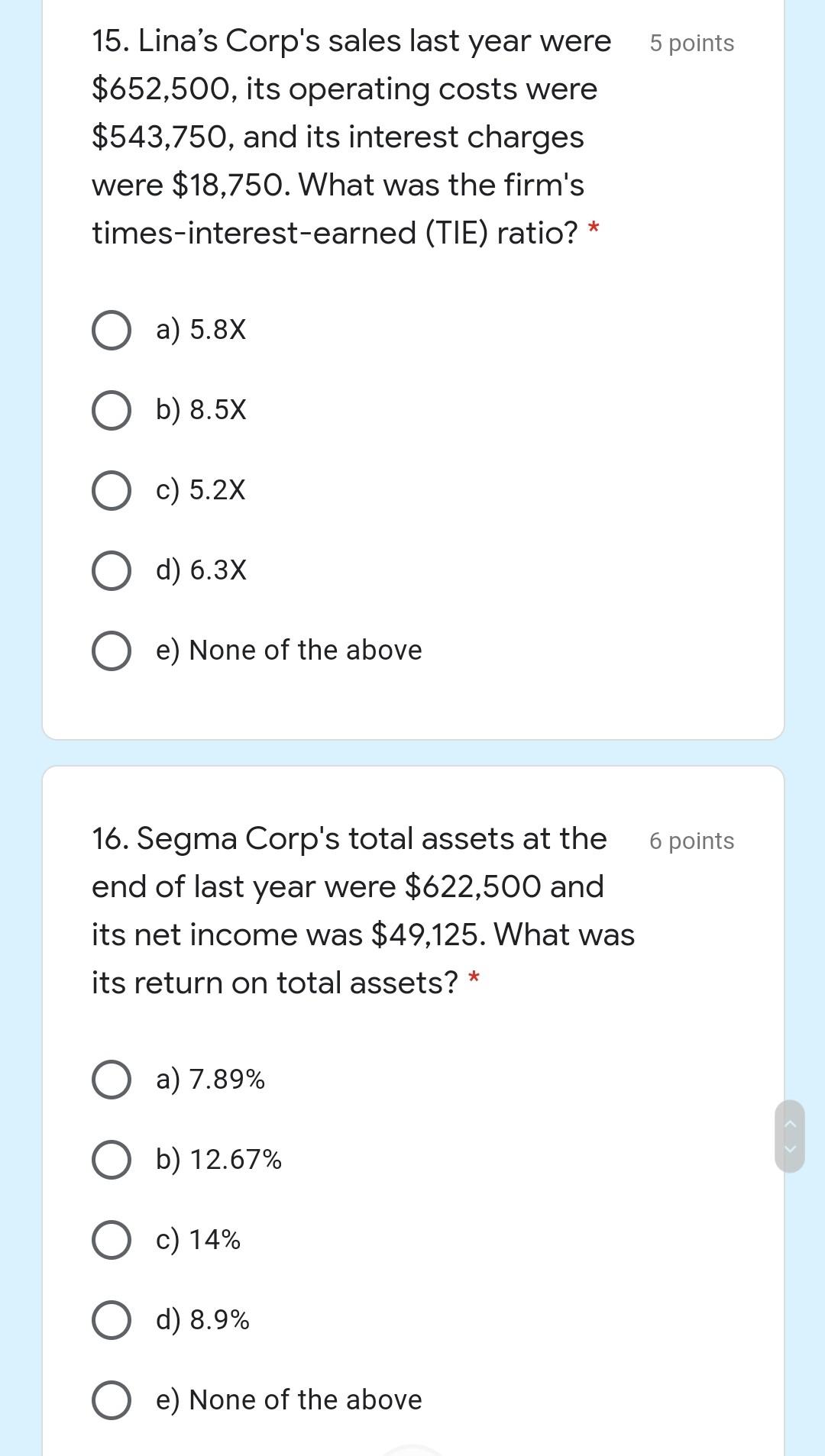

points 15. Lina's Corp's sales last year were $652,500, its operating costs were $543,750, and its interest charges were $18,750. What was the firm's times-interest-earned

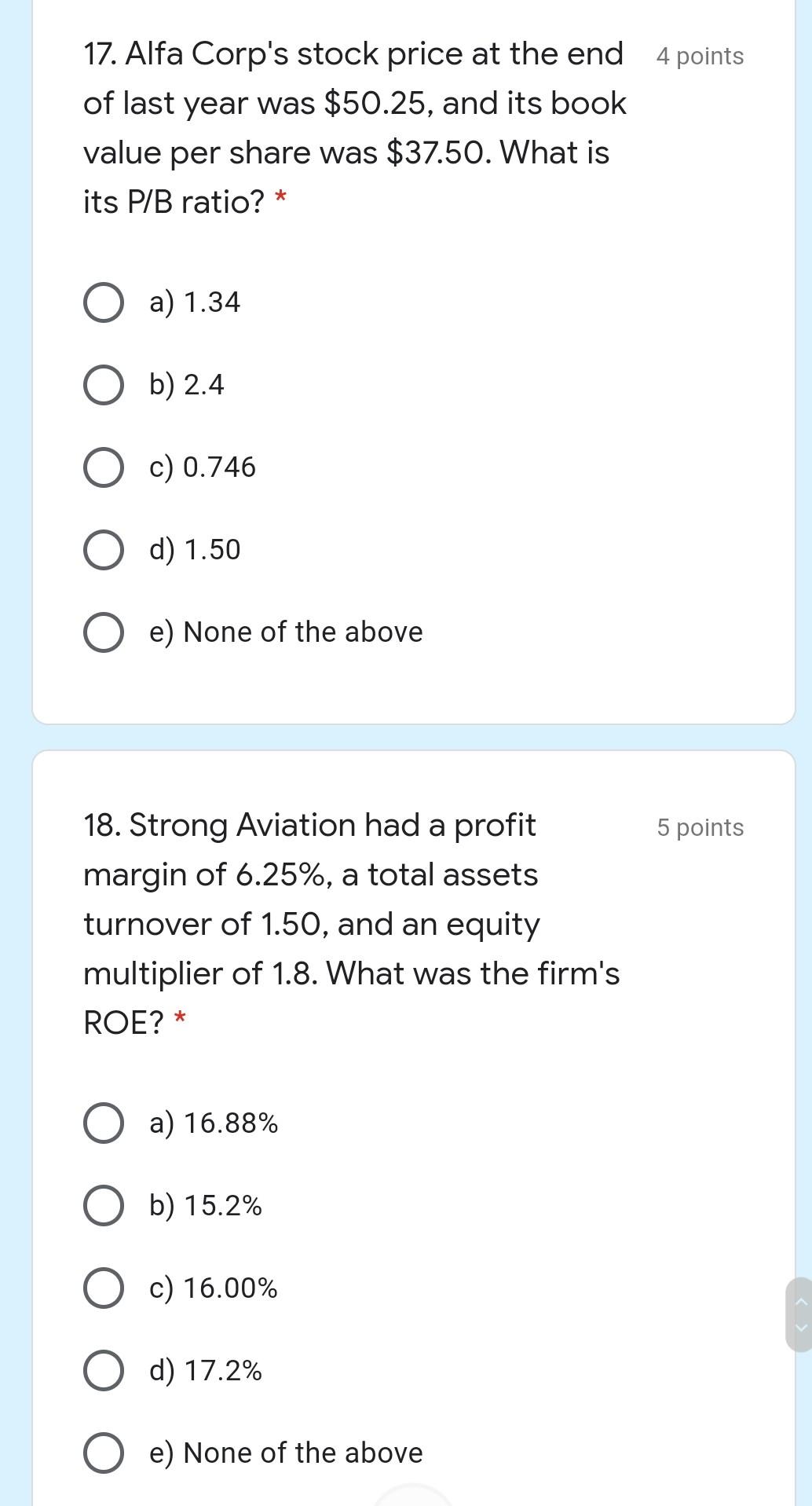

points 15. Lina's Corp's sales last year were $652,500, its operating costs were $543,750, and its interest charges were $18,750. What was the firm's times-interest-earned (TIE) ratio? * a) 5.8x b) 8.5x c) 5.2x d) 6.3x e) None of the above 6 points 16. Segma Corp's total assets at the end of last year were $622,500 and its net income was $49,125. What was its return on total sets? a) 7.89% O b) 12.67% c) 14% d) 8.9% O e) None of the above 17. Alfa Corp's stock price at the end 4 points of last year was $50.25, and its book value per share was $37.50. What is its P/B ratio? * a) 1.34 O b) 2.4 c) 0.746 d) 1.50 e) None of the above 5 points 18. Strong Aviation had a profit margin of 6.25%, a total assets turnover of 1.50, and an equity multiplier of 1.8. What was the firm's ROE? * a) 16.88% O b) 15.2% O c) 16.00% d) 17.2% O e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started