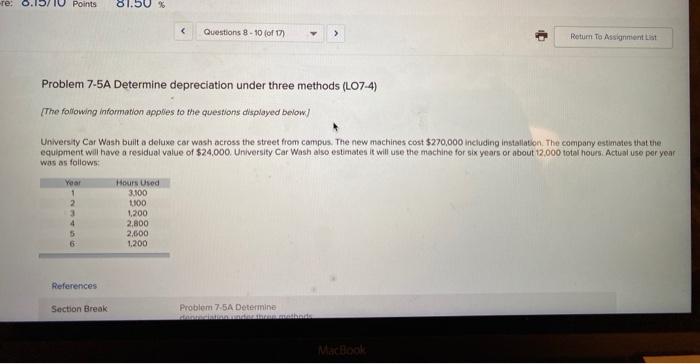

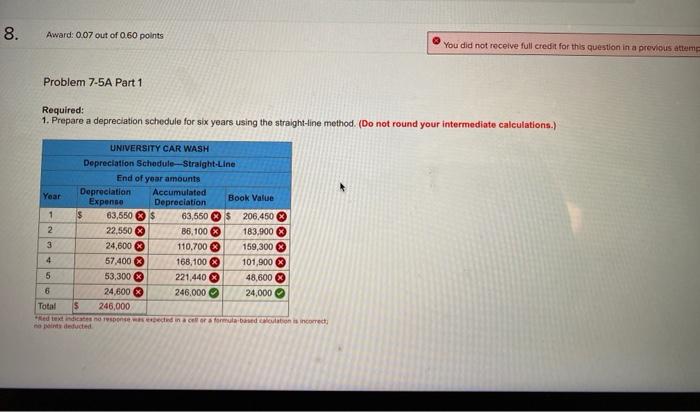

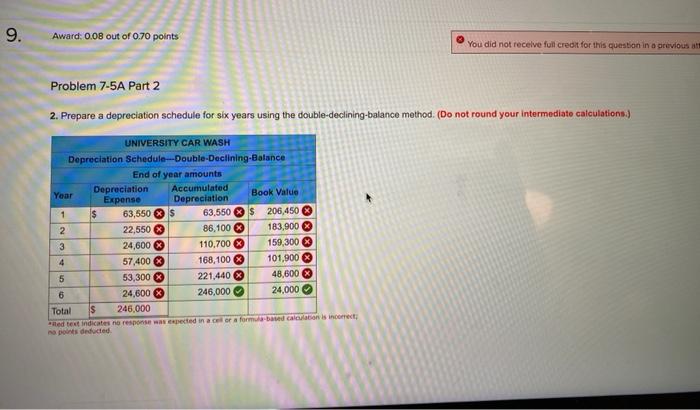

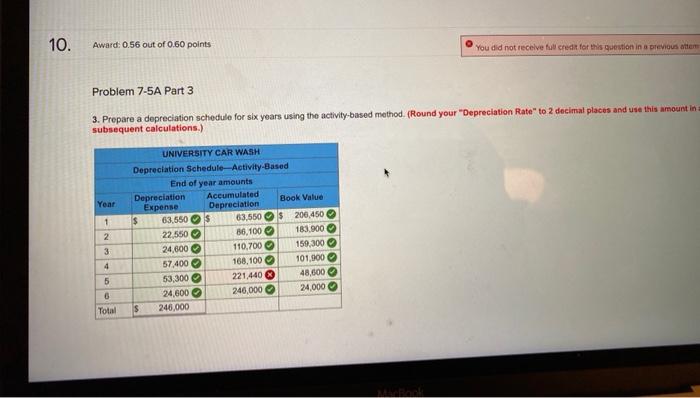

Points 81.54 Questions 8 - 10 of 17) 1 Return To Assignments Problem 7-5A Determine depreciation under three methods (L07-4) The following information applies to the questions displayed below) University Car Wash built a deluxe car wash across the street from campus. The new machines cost $270,000 including installation. The company estimates that the equipment will have a residual value of $24,000. University Car Wash also estimates it will use the machine for six years or about 12.000 total hours Actual use per year was as follows: Year Hours Used 1 3.100 2 100 1200 4 2,800 2.500 1.200 References Section Break Problem 7-5A Determine had MacBook 8. Award: 0.07 out of 0.60 points You did not receive full credit for this question in a previous attem Problem 7-5A Part 1 Required: 1. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) UNIVERSITY CAR WASH Depreciation Schedule-Straight-Line End of year amounts Year Depreciation Accumulated Expense Depreciation Book Value 1 $ 63,550 $ 63,550 $ 206.450 2 22,550 86.100 183.900 3 24,600 110.700 159,300 4 57.400 168,100 101,900 5 53,300 221,440 48,600 6 24,600 246.000 24,000 Total 246,000 Red texts no response aspected in a formula based on is incorrect na pointe deducted O 9. Award: 0.00 out of 0.70 points You did not receive full credit for this question in a previous at Problem 7-5A Part 2 2. Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations) UNIVERSITY CAR WASH Depreciation Schedule--Double-Declining-Balance End of year amounts Year Depreciation Accumulated Expense Depreciation Book Value 1 $ 63,550 $ 63,550 $ 206,450 2 22,550 X 86.100 183,900 3 24,600 110,700 159,300 4 57,400 168,100 101,900 5 53,300 221,440 X 48,600 6 24,600 $ 246,000 24,000 Total Is 246,000 ited text indicates no response was expected in a celor a formula band calculation is incorrect na pot deducted 10. Award: 0.56 out of 0.60 points You did not receive credit for this question in a previous attem Problem 7-5A Part 3 3. Prepare a depreciation schedule for six years using the activity-based method. (Round your "Depreciation Rate" to 2 decimal places and use this amount in subsequent calculations.) Year 1 UNIVERSITY CAR WASH Depreciation Schedule Activity-Based End of year amounts Depreciation Accumulated Book Value Expense Depreciation $ 63,550 $ 63,550 $ 206,450 22,550 86.100 183.900 24,600 110,700 159,300 57,400 168,100 101,900 53,300 221,440 48,000 24,600 246,000 24,000 $ 245.000 2 3 4 5 6 Total