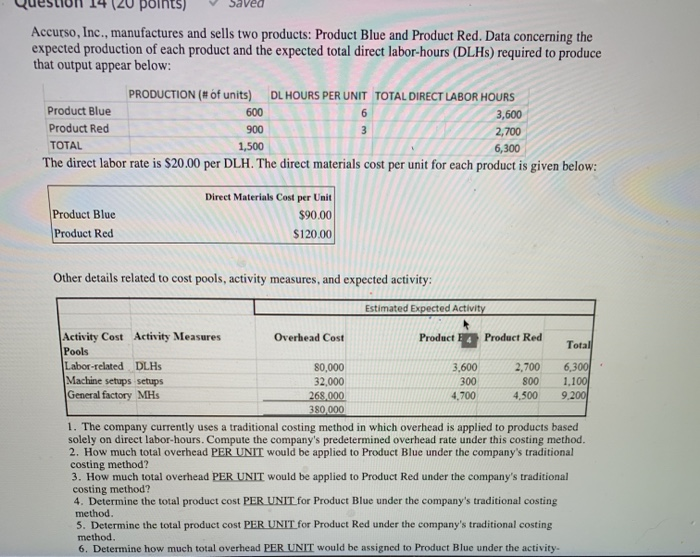

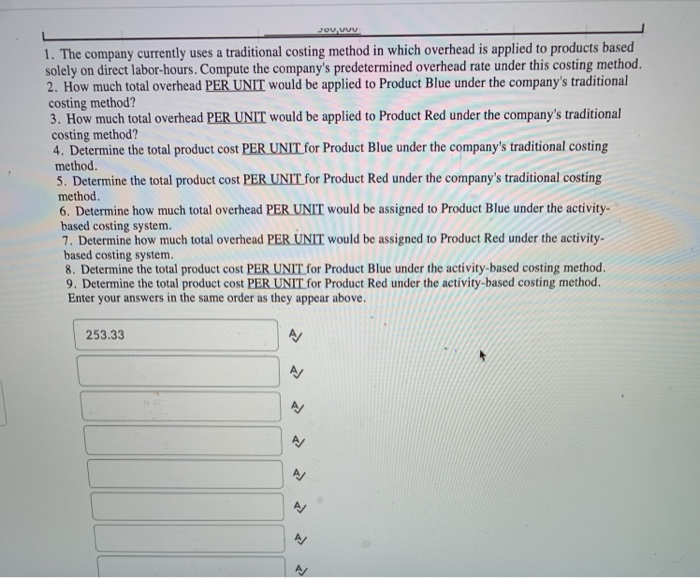

points) Accurso, Inc., manufactures and sells two products: Product Blue and Product Red. Data concerning the expected production of each product and the expected total direct labor-hours (DLHS) required to produce that output appear below: PRODUCTION (# of units) DL HOURS PER UNIT TOTAL DIRECT LABOR HOURS Product Blue 600 6 3,600 Product Red 3 2,700 1,500 6,300 The direct labor rate is $20.00 per DLH. The direct materials cost per unit for each product is given below: 900 TOTAL Product Blue Product Red Direct Materials Cost per Unit $90.00 $120.00 Other details related to cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Activity Measures Overhead Cost Product 14 Product Red Total Pools Labor-related DLHs 80,000 3,600 2,700 6,3001 Machine setups setups 32,000 300 800 1.100 General factory MHs 268.000 4,700 4,500 9.2001 380.000 1. The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours. Compute the company's predetermined overhead rate under this costing method. 2. How much total overhead PER UNIT would be applied to Product Blue under the company's traditional costing method? 3. How much total overhead PER UNIT would be applied to Product Red under the company's traditional costing method? 4. Determine the total product cost PER UNIT for Product Blue under the company's traditional costing method. 5. Determine the total product cost PER UNIT for Product Red under the company's traditional costing method. 6. Determine how much total overhead PER UNIT would be assigned to Product Blue under the activity- JOU, 1. The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours. Compute the company's predetermined overhead rate under this costing method. 2. How much total overhead PER UNIT would be applied to Product Blue under the company's traditional costing method? 3. How much total overhead PER UNIT would be applied to Product Red under the company's traditional costing method? 4. Determine the total product cost PER UNIT for Product Blue under the company's traditional costing method. 5. Determine the total product cost PER UNIT for Product Red under the company's traditional costing method. 6. Determine how much total overhead PER UNIT would be assigned to Product Blue under the activity based costing system. 7. Determine how much total overhead PER UNIT would be assigned to Product Red under the activity- based costing system. 8. Determine the total product cost PER UNIT for Product Blue under the activity-based costing method. 9. Determine the total product cost PER UNIT for Product Red under the activity-based costing method. Enter your answers in the same order as they appear above. 253.33 A N A/ AJ