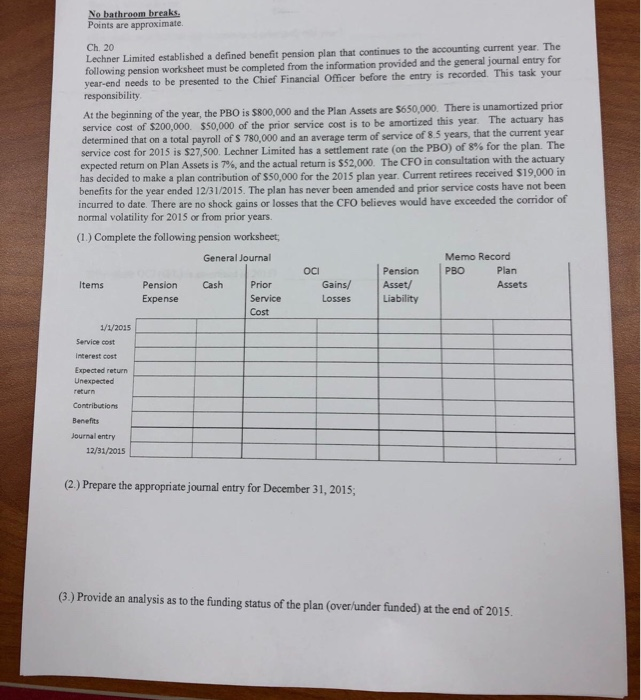

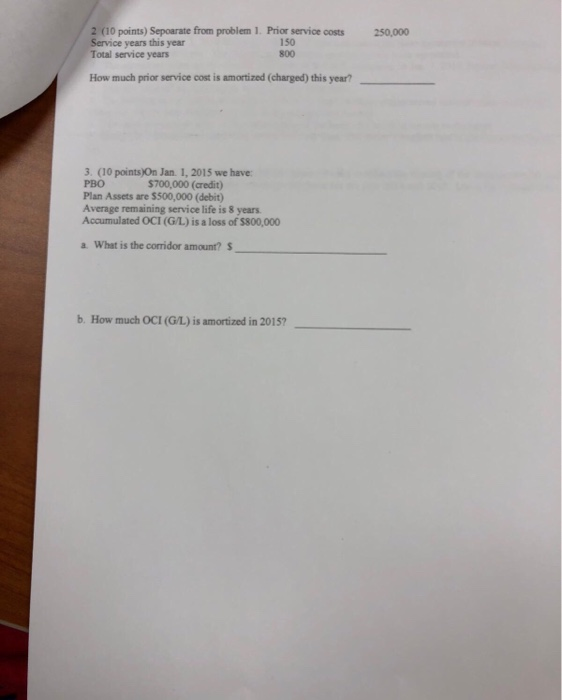

Points are approximate. Ch. 20 ed established a defined benefit pension plan that continues to the accounting current yer. The following pension worksheet must be completed from the information provided and the general journal entry for year-end needs to be presented to the Chief Financial Officer before the entry is recorded. This task your responsibility At the beginning of the year, the PBO is $800,000 and the Plan Assets are $650,000. There is unamortized prior service cost of $200,000. $50,000 of the prior service cost is to be amortized this year. The actuary determined that on a total payroll of S 780,000 and an average service cost for 2015 is $27,500. Lechner Limited has a settlement rate (on the PBO) of 8% for the plan. The expected return on Plan Assets is 7%, and the actual return is $52,000 The CFO in consultation with the actuary has decided to make a plan contribution of $50,000 for the 2015 plan year. Current retirees received $19,000 in benefits for the year ended 12/31/2015. The plan has never been amended and prior service costs have not been incurred to date. There are no shock gains or losses that the CFO believes would have exceeded the corridor of normal volatility for 2015 or from prior years. has term of service of 8.5 years, that the current year (1.) Complete the following pension worksheet, Memo Record General Journal Pension Cash Prior Cost oci Pension PBO Plan Assets Items Expense Service Losses Asset/ Liability 1/1/2015 Service cost interest cost Expected return Unexpected Contributions Benefits Journal entry (2) Prepare the appropriate journal entry for December 31, 2015, (3) Provide an analysis as to the funding status of the plan (overlunder funded) at the end of 2015 2 (10 points) Sepoarate from problem 1. Prior service costs 250,000 Service years this year Total service years 150 800 How much prior service cost is amortized (charged) this year? 3. (10 points)On Jan. 1, 2015 we have Plan Assets are $500,000 (debit) Average remaining service life is 8 years Accumulated OCI (G/L) is a loss of $800,000 $700,000 (credit) a. What is the corridor amount? b. How much OCI (G/L) is amortized in 2015