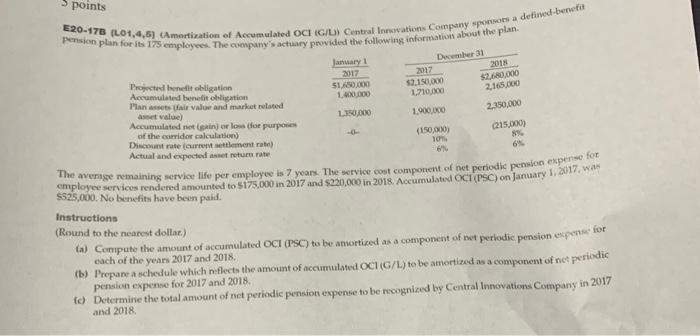

points E20-173 (L01,4,5) Amortization of Accumulated OCI G/L) Central Innovations Company sponsor a defined benefit Pension plan for its 175 employees. The company's actuary provided the following information about the plan. January 1 2017 Projected benefit obligation 51./80,000 Accumulated benefit obligation 1.000000 Plants fair value and market related value) 1.900.000 Accumulated net (in) or loss for purpose of the corridor calculation (150,000) Discount rate (current settlement rate) Actual and expected return rate December 31 2037 IN 2.150.000 $2,680,000 1.710,000 2,165.000 L150.000 2.350,000 (225.000) 10 employee services rendered amoun rest.co in 2017 and con 2015. Accumulated och ersc) on January 1, 2017, wan The average remaining service tifo per employee in 7 years. The stvice cost component of net periodic pennon expense for 5525,000. No benefits have been paid. Instructions (Round to the nearest dollar) (a) Compute the amount of accumulated OCI (PSC) to be an ortized as a component of net periodic pension expense for cach of the years 2017 and 2018 (b) Prepare a schedule which reflects the amount of accumulated OCH G/L) to be amortized as a component of net periodic pension expense for 2017 and 2015 d) Determine the total amount of niet periodic pension expense to be recognized by Central Innovations Company in 2017 and 2018 points E20-173 (L01,4,5) Amortization of Accumulated OCI G/L) Central Innovations Company sponsor a defined benefit Pension plan for its 175 employees. The company's actuary provided the following information about the plan. January 1 2017 Projected benefit obligation 51./80,000 Accumulated benefit obligation 1.000000 Plants fair value and market related value) 1.900.000 Accumulated net (in) or loss for purpose of the corridor calculation (150,000) Discount rate (current settlement rate) Actual and expected return rate December 31 2037 IN 2.150.000 $2,680,000 1.710,000 2,165.000 L150.000 2.350,000 (225.000) 10 employee services rendered amoun rest.co in 2017 and con 2015. Accumulated och ersc) on January 1, 2017, wan The average remaining service tifo per employee in 7 years. The stvice cost component of net periodic pennon expense for 5525,000. No benefits have been paid. Instructions (Round to the nearest dollar) (a) Compute the amount of accumulated OCI (PSC) to be an ortized as a component of net periodic pension expense for cach of the years 2017 and 2018 (b) Prepare a schedule which reflects the amount of accumulated OCH G/L) to be amortized as a component of net periodic pension expense for 2017 and 2015 d) Determine the total amount of niet periodic pension expense to be recognized by Central Innovations Company in 2017 and 2018