Answered step by step

Verified Expert Solution

Question

1 Approved Answer

points] Please enter the following information, taken at month-end, in the trial balance by entering the letter (on the left) and amount (on the right)

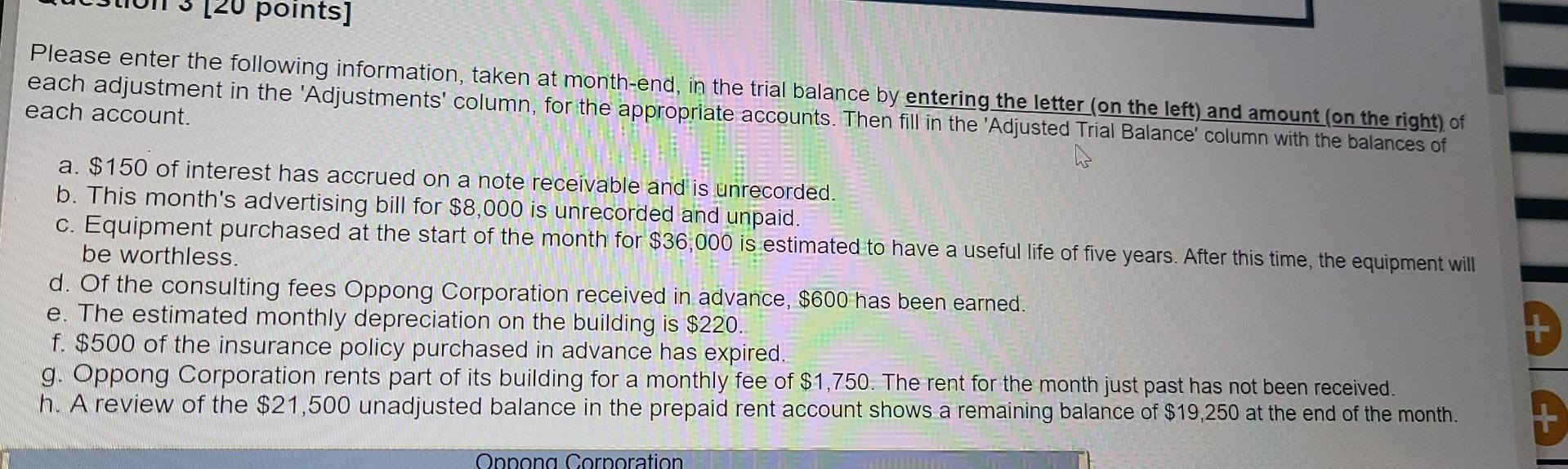

points] Please enter the following information, taken at month-end, in the trial balance by entering the letter (on the left) and amount (on the right) of each adjustment in the 'Adjustments' column, for the appropriate accounts. Then fill in the 'Adjusted Trial Balance column with the balances of each account. a. $150 of interest has accrued on a note receivable and is unrecorded. b. This month's advertising bill for $8,000 is unrecorded and unpaid. c. Equipment purchased at the start of the month for $36,000 is estimated to have a useful life of five years. After this time, the equipment will be worthless. d. Of the consulting fees Oppong Corporation received in advance, $600 has been earned. e. The estimated monthly depreciation on the building is $220. f. $500 of the insurance policy purchased in advance has expired. g. Oppong Corporation rents part of its building for a monthly fee of $1,750. The rent for the month just past has not been received. h. A review of the $21,500 unadjusted balance in the prepaid rent account shows a remaining balance of $19,250 at the end of the month. + + Oppong Corporation points] Please enter the following information, taken at month-end, in the trial balance by entering the letter (on the left) and amount (on the right) of each adjustment in the 'Adjustments' column, for the appropriate accounts. Then fill in the 'Adjusted Trial Balance column with the balances of each account. a. $150 of interest has accrued on a note receivable and is unrecorded. b. This month's advertising bill for $8,000 is unrecorded and unpaid. c. Equipment purchased at the start of the month for $36,000 is estimated to have a useful life of five years. After this time, the equipment will be worthless. d. Of the consulting fees Oppong Corporation received in advance, $600 has been earned. e. The estimated monthly depreciation on the building is $220. f. $500 of the insurance policy purchased in advance has expired. g. Oppong Corporation rents part of its building for a monthly fee of $1,750. The rent for the month just past has not been received. h. A review of the $21,500 unadjusted balance in the prepaid rent account shows a remaining balance of $19,250 at the end of the month. + + Oppong Corporation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started