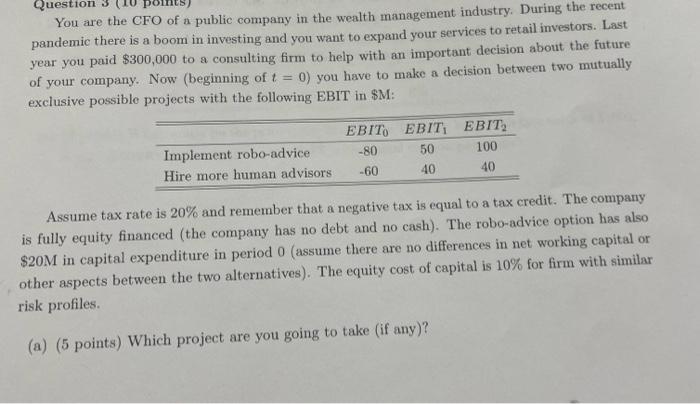

points Question You are the CFO of a public company in the wealth management industry. During the recent pandemic there is a boom in investing and you want to expand your services to retail investors. Last year you paid $300,000 to a consulting firm to help with an important decision about the future of your company. Now (beginning of t = 0) you have to make a decision between two mutually exclusive possible projects with the following EBIT in $M: Implement robo-advice Hire more human advisors EBIT, EBIT; EBIT, -80 50 100 -60 40 40 Assume tax rate is 20% and remember that a negative tax is equal to a tax credit. The company is fully equity financed (the company has no debt and no cash). The robo-advice option has also $20M in capital expenditure in period o assume there are no differences in net working capital or other aspects between the two alternatives). The equity cost of capital is 10% for firm with similar risk profiles. (a) (5 points) Which project are you going to take (if any)? 2 points) The CEO is worried that some projects may take too long to puyback the but investment. How would your answer to a) change if the decision is based on minum by the CEOY (A couple of sentenwe are enough for the second part of the question) (C) (3 points) You convince the CEO to follow your approach in point a). Assume also that the free cash flow from year three (t = 3) onward increase at a rate of 3% thanks to the implementation of the project (ie. FCF3 = FCF2 x (1 +9)). Suppose the company current stock price per share is $100 and there are 10 million share outstanding. What will be the new stock price per share today after the public announcement of the project? X points Question You are the CFO of a public company in the wealth management industry. During the recent pandemic there is a boom in investing and you want to expand your services to retail investors. Last year you paid $300,000 to a consulting firm to help with an important decision about the future of your company. Now (beginning of t = 0) you have to make a decision between two mutually exclusive possible projects with the following EBIT in $M: Implement robo-advice Hire more human advisors EBIT, EBIT; EBIT, -80 50 100 -60 40 40 Assume tax rate is 20% and remember that a negative tax is equal to a tax credit. The company is fully equity financed (the company has no debt and no cash). The robo-advice option has also $20M in capital expenditure in period o assume there are no differences in net working capital or other aspects between the two alternatives). The equity cost of capital is 10% for firm with similar risk profiles. (a) (5 points) Which project are you going to take (if any)? 2 points) The CEO is worried that some projects may take too long to puyback the but investment. How would your answer to a) change if the decision is based on minum by the CEOY (A couple of sentenwe are enough for the second part of the question) (C) (3 points) You convince the CEO to follow your approach in point a). Assume also that the free cash flow from year three (t = 3) onward increase at a rate of 3% thanks to the implementation of the project (ie. FCF3 = FCF2 x (1 +9)). Suppose the company current stock price per share is $100 and there are 10 million share outstanding. What will be the new stock price per share today after the public announcement of the project? X