Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Points written in Instructions are to be find. Axon Battery is a public traded company and earned above average revenue consistently over a decade. The

Points written in Instructions are to be find.

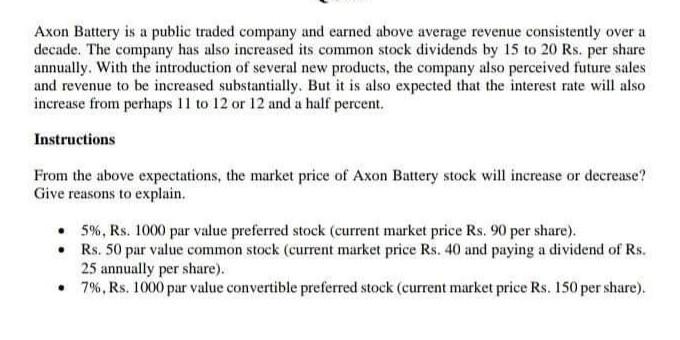

Axon Battery is a public traded company and earned above average revenue consistently over a decade. The company has also increased its common stock dividends by 15 to 20 Rs. per share annually. With the introduction of several new products, the company also perceived future sales and revenue to be increased substantially. But it is also expected that the interest rate will also increase from perhaps 11 to 12 or 12 and a half percent. Instructions From the above expectations, the market price of Axon Battery stock will increase or decrease? Give reasons to explain. 5%, Rs. 1000 par value preferred stock (current market price Rs. 90 per share). Rs. 50 par value common stock (current market price Rs. 40 and paying a dividend of Rs. 25 annually per share). 7%, Rs. 1000 par value convertible preferred stock (current market price Rs. 150 per share). Axon Battery is a public traded company and earned above average revenue consistently over a decade. The company has also increased its common stock dividends by 15 to 20 Rs. per share annually. With the introduction of several new products, the company also perceived future sales and revenue to be increased substantially. But it is also expected that the interest rate will also increase from perhaps 11 to 12 or 12 and a half percent. Instructions From the above expectations, the market price of Axon Battery stock will increase or decrease? Give reasons to explain. 5%, Rs. 1000 par value preferred stock (current market price Rs. 90 per share). Rs. 50 par value common stock (current market price Rs. 40 and paying a dividend of Rs. 25 annually per share). 7%, Rs. 1000 par value convertible preferred stock (current market price Rs. 150 per share)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started