Answered step by step

Verified Expert Solution

Question

1 Approved Answer

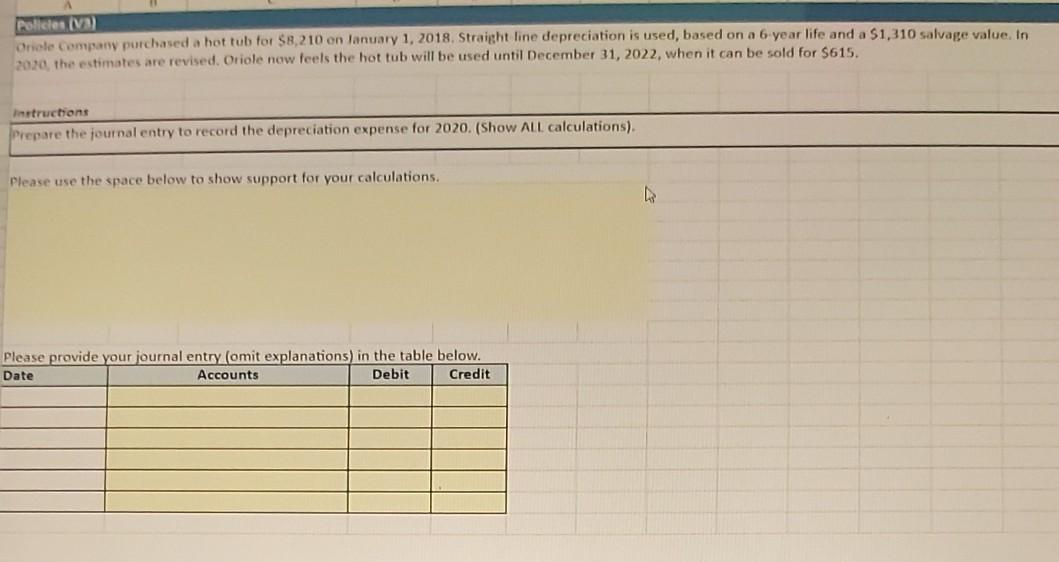

Policies (3) Onsole Company purchased a hot tub for $8,210 on January 1, 2018. Straight line depreciation is used, based on a 6 year life

Policies (3) Onsole Company purchased a hot tub for $8,210 on January 1, 2018. Straight line depreciation is used, based on a 6 year life and a $1,310 salvage value. In 2020, the estimates are revised. Oriole now feels the hot tub will be used until December 31, 2022, when it can be sold for $615. Instructions Prepare the journal entry to record the depreciation expense for 2020. (Show ALL calculations). Please use the space below to show support for your calculations. Please provide your journal entry (omit explanations) in the table below. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started