Question

Pollution Prevention, P2 Investment Heaps Company produces jewelry that requires electroplating with gold, silver, and other valuable metals. Electroplating uses large amounts of water and

Pollution Prevention, P2 Investment

Heaps Company produces jewelry that requires electroplating with gold, silver, and other valuable metals. Electroplating uses large amounts of water and chemicals, producing wastewater with a number of toxic residuals. Currently, Heaps uses settlement tanks to remove waste; unfortunately, the approach is inefficient, and much of the toxic residue is left in the water that is discharged into a local river. The amount of toxic discharge exceeds the legal, allowable amounts, and the company is faced with substantial, ongoing environmental fines. The environmental violations are also drawing unfavorable public reaction, and sales are being affected. A lawsuit is also impending, which could prove to be quite costly.

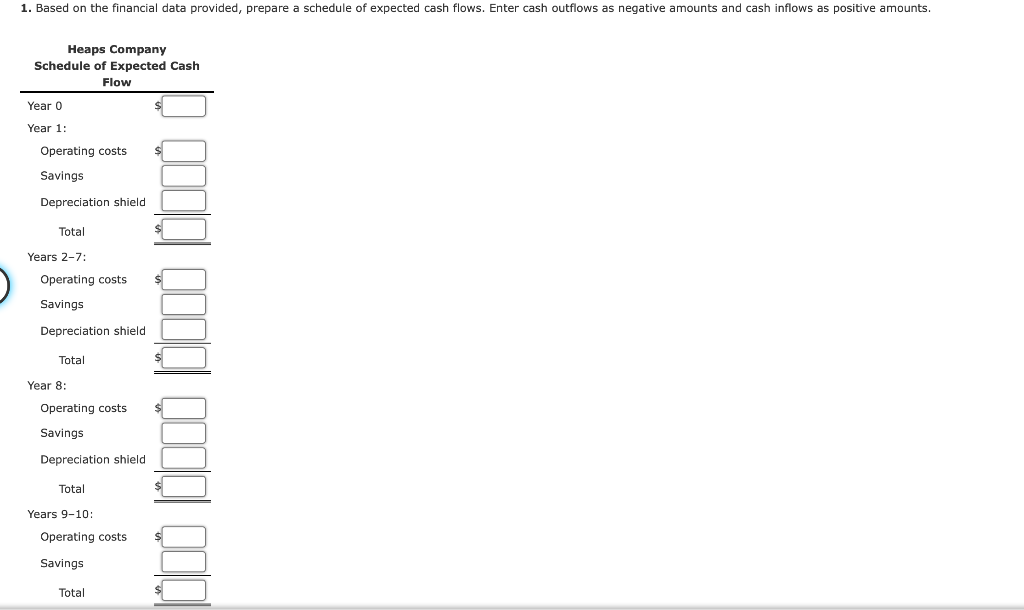

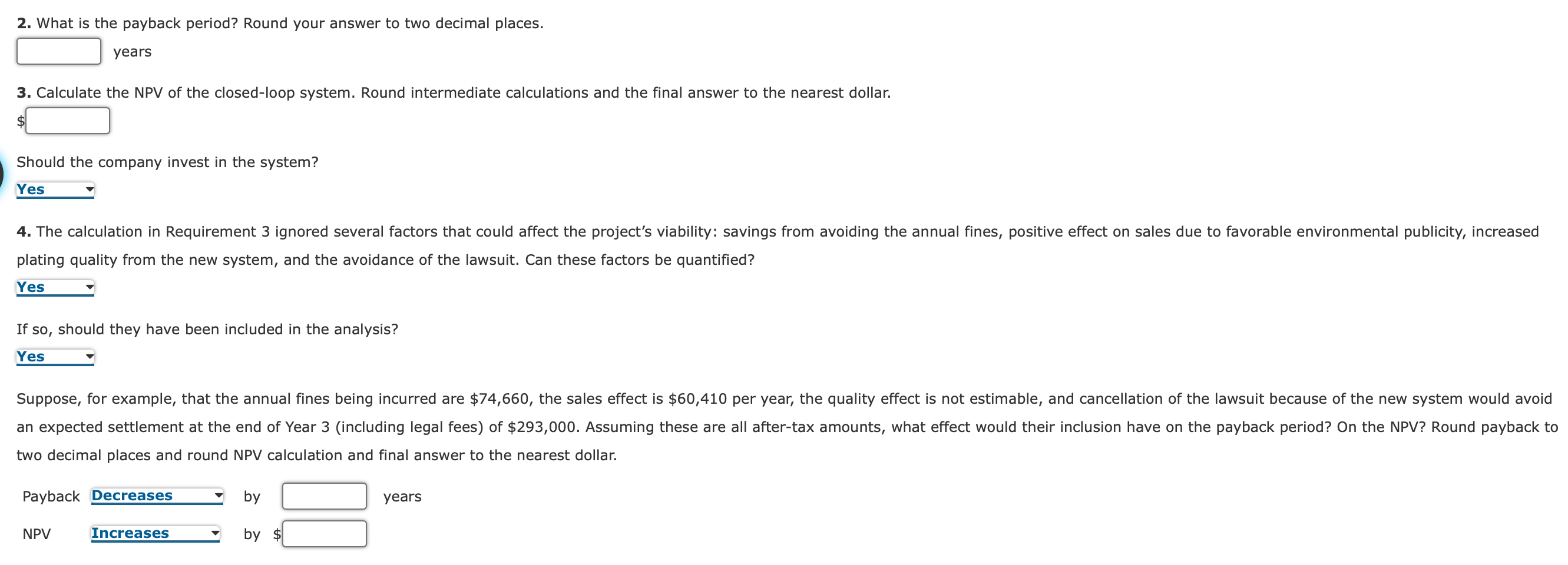

Management is now considering the installation of a zero-discharge, closed-loop system to treat the wastewater. The proposed closed-loop system would not only purify the wastewater, but also produce cleaner water than that currently being used, increasing plating quality. The closed-loop system would produce only four pounds of sludge, and the sludge would be virtually pure metal, with significant market value. The system requires an investment of $625,800 and will cost $45,790 in increased annual operation plus an annual purchase of $7,370 of filtration medium. However, management projects the following savings:

| Water usage | $ | 67,190 |

| Chemical usage | 41,860 | |

| Sludge disposal | 90,130 | |

| Recovered metal sales | 44,740 | |

| Sampling of discharge | 120,200 | |

| Total | $ | 364,120 |

The equipment qualifies as a seven-year MACRS asset. Management has decided to use straight-line depreciation for tax purposes, using the required half-year convention. The tax rate is 40 percent. The projected life of the system is 10 years. The hurdle rate is 16 percent for all capital budgeting projects, although the companys cost of capital is 12 percent.

The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started