Question

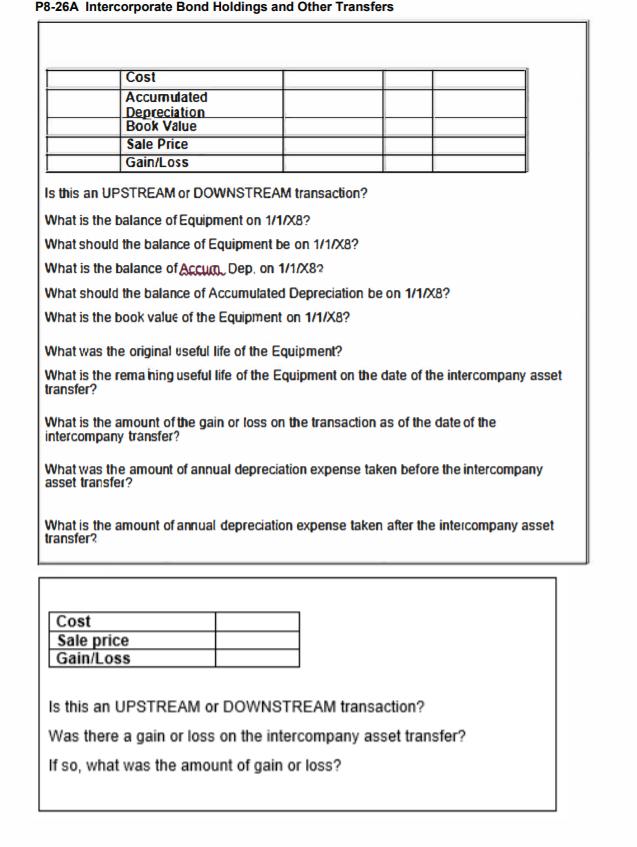

1. Pond sold a building to skate for $78,000 on December 31, 20X7. Pond had purchased the building for $138,000 and was depreciating it on

1. Pond sold a building to skate for $78,000 on December 31, 20X7. Pond had purchased the building for $138,000 and was depreciating it on the straight-line basis over 25 years. At the time of sale, Pond reported accumulated depreciation of $75,000 and a remaining life of 10 years. Assume Pond uses the fully adjusted equity method.

2. On July 1, 20X6, Skate sold land that had purchased for $22,000 to Pond for $35,000.Pond is planning to build a new warehouse on the property prior to the end of 20X9.

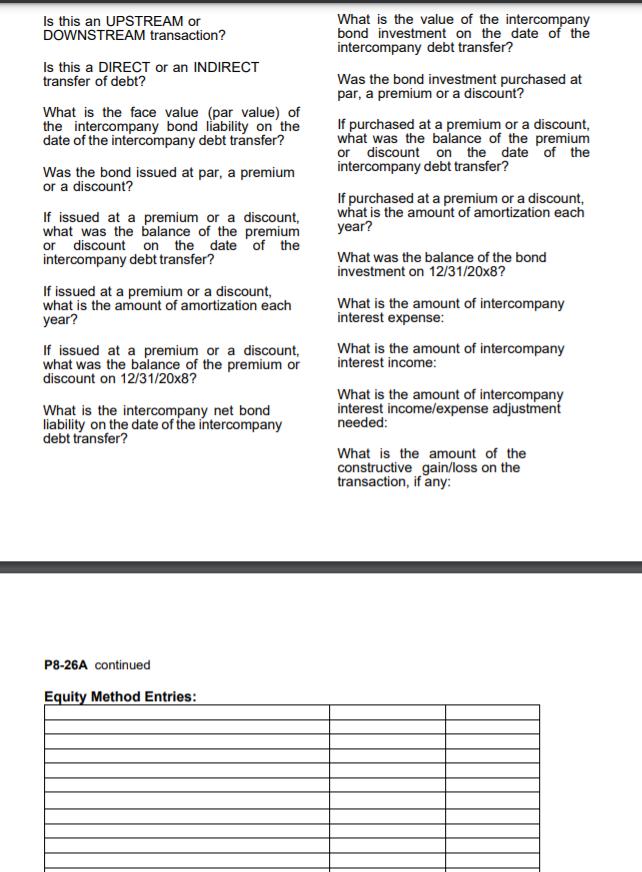

3. Skate issued $100,000, par value 10-year bonds with a coupon rate of 10 percent onJanuary 1, 20X5, at $95,000. On December 31, 20X7, Pond purchases $40,000 par valueof Skate’s bonds for $42,800. Both companies amortize the bond premiums and discountson a straight-line basis. Interest payments are made on July 1 and January 1.

4. Pond and Skate paid dividends of $30,000 and $10,000, respectively, in 20X8.

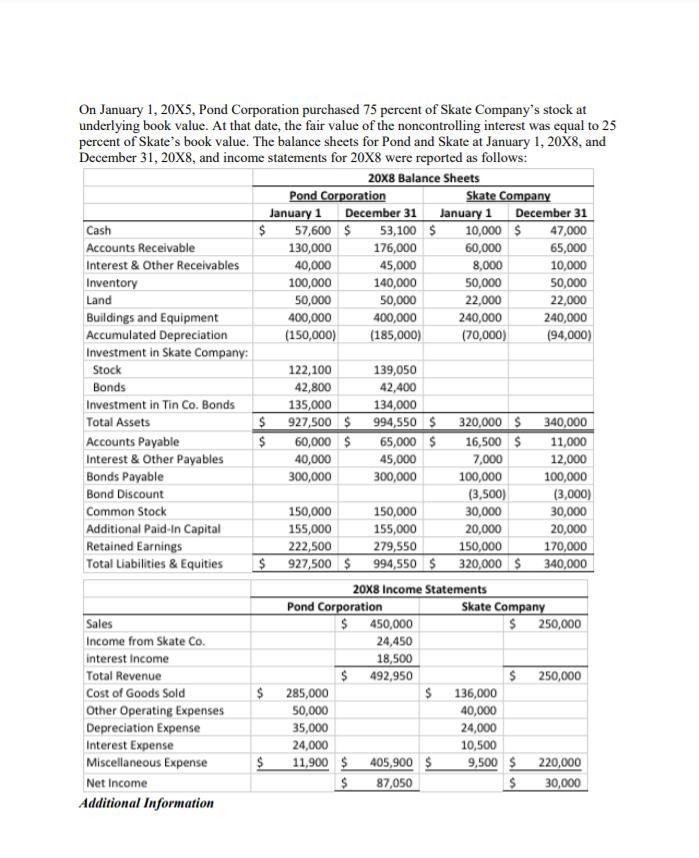

P8-26A Intercorporate Bond Holdings and Other Transfers (Straight-Line Method) On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company's stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate's book value. The balance sheets for Pond and Skate at January 1, 20X8, and December 31, 20X8, and income statements for 20X8 were reported as follows: 20X8 Balance Sheets Pond Corporation Skate Company January 1 December 31 January 1 December 31 10,000 $ 47,000 65,000 Cash 57,600 $ 53,100 $ Accounts Receivable 130,000 176,000 60,000 Interest & Other Receivables 40,000 45,000 8,000 10,000 Inventory 100,000 140,000 50,000 50,000 Land 50,000 50,000 22,000 22,000 Buildings and Equipment 400,000 400,000 240,000 240,000 Accumulated Depreciation (150,000) (185,000) (70,000) (94,000) Investment in Skate Company: Stock 122,100 139,050 Bonds 42,800 42,400 Investment in Tin Co. Bonds 135,000 927,500 $ 134,000 994,550 $ Total Assets 320,000 $ 340,000 60,000 $ 40,000 16,500 $ 7,000 Accounts Payable 65,000 $ 11,000 Interest & Other Payables 45,000 12,000 Bonds Payable 300,000 300,000 100,000 100,000 Bond Discount (3,000) (3,500) 30,000 Common Stock Additional Paid-In Capital 150,000 150,000 30,000 155,000 222,500 927,500 $ 994,550 $ 155,000 20,000 20,000 Retained Earnings 279,550 150,000 170,000 320,000 $ 340,000 Total Liabilities & Equities 20X8 Income Statements Pond Corporation Skate Company $250,000 Sales 450,000 Income from Skate Co. 24,450 interest Income 18,500 Total Revenue 492,950 $ 250,000 Cost of Goods Sold 285,000 136,000 Other Operating Expenses 50,000 40,000 Depreciation Expense 35,000 24,000 Interest Expense 24,000 10,500 9,500 $ 220,000 11,900 $ 405,900 S 87,050 Miscellaneous Expense Net Income 30,000 Additional Information

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started