Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ponsible for the preparation of the end of the year management accounts has unfor Een ill . The financial director requests your assistance to finalise

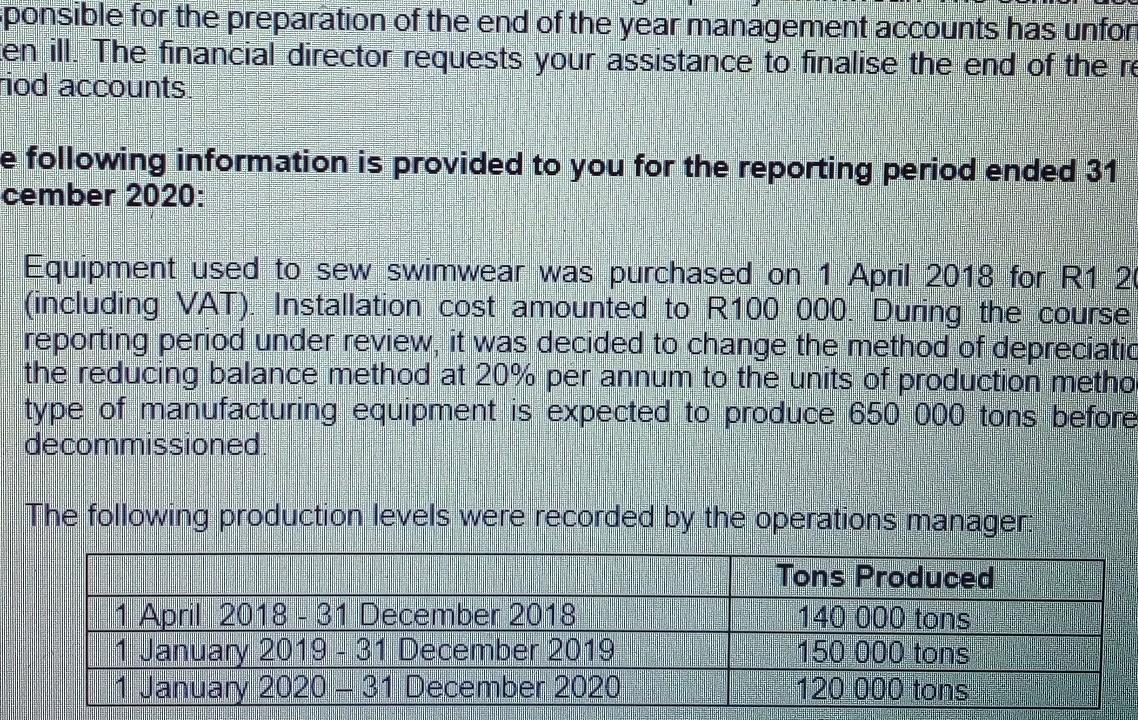

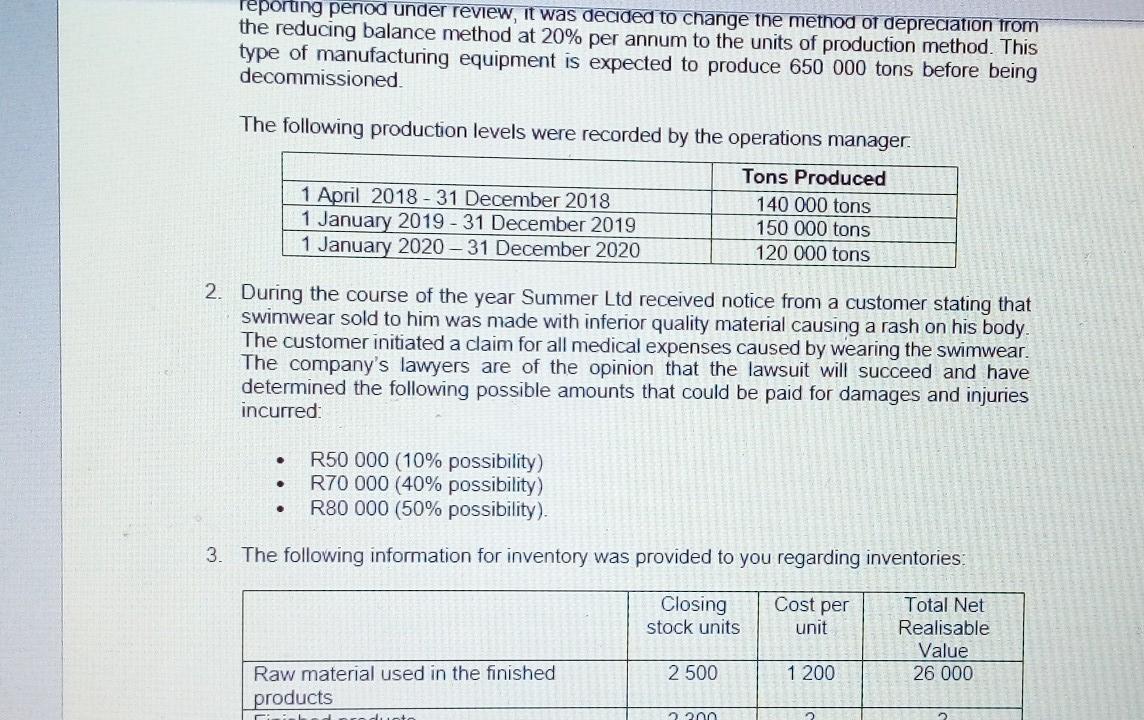

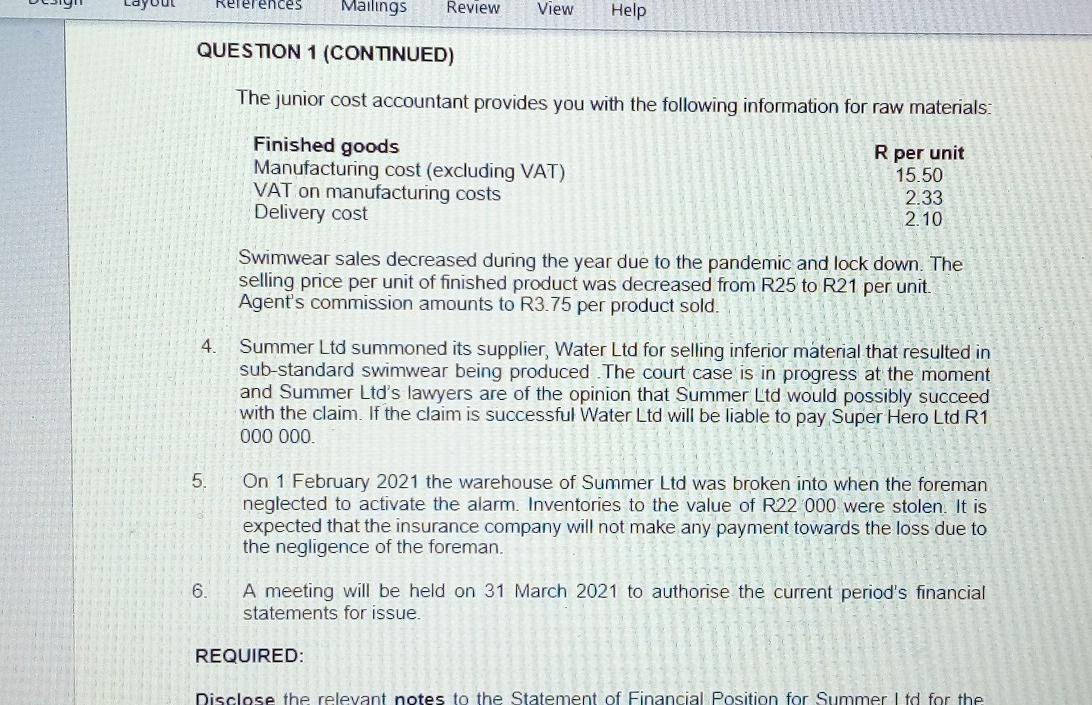

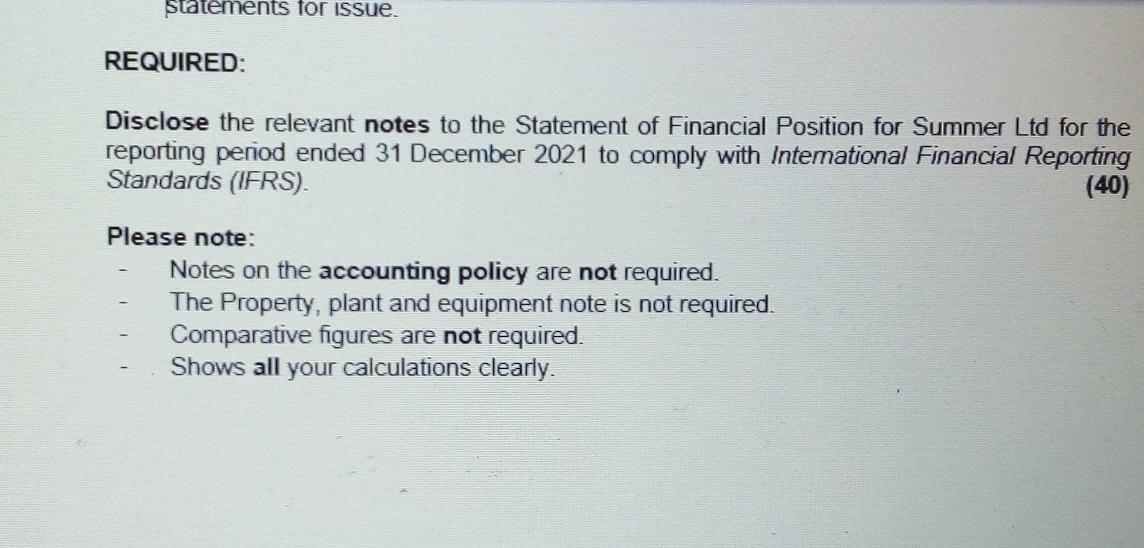

ponsible for the preparation of the end of the year management accounts has unfor Een ill . The financial director requests your assistance to finalise the end of the re riod accounts. e following information is provided to you for the reporting period ended 31 cember 2020: Equipment used to sew swimwear was purchased on 1 April 2018 for R1 20 (including VAT). Installation cost amounted to R100 000. During the course reporting period under review, it was decided to change the method of depreciatic the reducing balance method at 20% per annum to the units of production metho type of manufacturing equipment is expected to produce 650 000 tons before decommissioned. The following production levels were recorded by the operations manager: 1 April 2018 - 31 December 2018 1 January 2019 - 31 December 2019 1 January 2020 - 31 December 2020 Tons Produced 140 000 tons 150 000 tons 120 000 tons reporting period under review, it was decided to change the method of depreciation from the reducing balance method at 20% per annum to the units of production method. This type of manufacturing equipment is expected to produce 650 000 tons before being decommissioned The following production levels were recorded by the operations manager. Tons Produced 1 April 2018 - 31 December 2018 140 000 tons 1 January 2019 - 31 December 2019 150 000 tons 1 January 2020 - 31 December 2020 120 000 tons 2. During the course of the year Summer Ltd received notice from a customer stating that swimwear sold to him was made with inferior quality material causing a rash on his body. The customer initiated a claim for all medical expenses caused by wearing the swimwear. The company's lawyers are of the opinion that the lawsuit will succeed and have determined the following possible amounts that could be paid for damages and injuries incurred: R50 000 (10% possibility) R70 000 (40% possibility) R80 000 (50% possibility). 3. The following information for inventory was provided to you regarding inventories Closing stock units Cost per unit Total Net Realisable Value 26 000 2 500 1 200 Raw material used in the finished products 2nn Rererences Mailings Review View Help QUESTION 1 (CONTINUED) The junior cost accountant provides you with the following information for raw materials: Finished goods Manufacturing cost (excluding VAT) VAT on manufacturing costs Delivery cost R per unit 15.50 2.33 2.10 Swimwear sales decreased during the year due to the pandemic and lock down. The selling price per unit of finished product was decreased from R25 to R21 per unit. Agent's commission amounts to R3.75 per product sold. 4. Summer Ltd summoned its supplier, Water Ltd for selling inferior material that resulted in sub-standard swimwear being produced. The court case is in progress at the moment and Summer Ltd's lawyers are of the opinion that Summer Ltd would possibly succeed with the claim. If the claim is successful Water Ltd will be liable to pay Super Hero Ltd R1 000 000 5 On 1 February 2021 the warehouse of Summer Ltd was broken into when the foreman neglected to activate the alarm. Inventories to the value of R22 000 were stolen. It is expected that the insurance company will not make any payment towards the loss due to the negligence of the foreman. 6. A meeting will be held on 31 March 2021 to authorise the current period's financial statements for issue. REQUIRED: Disclose the relevant notes to the Statement of Financial Position for Summer Ltd for the statements for issue. REQUIRED: Disclose the relevant notes to the Statement of Financial Position for Summer Ltd for the reporting period ended 31 December 2021 to comply with International Financial Reporting Standards (IFRS). (40) Please note: Notes on the accounting policy are not required. The Property, plant and equipment note is not required. Comparative figures are not required. Shows all your calculations clearly. ponsible for the preparation of the end of the year management accounts has unfor Een ill . The financial director requests your assistance to finalise the end of the re riod accounts. e following information is provided to you for the reporting period ended 31 cember 2020: Equipment used to sew swimwear was purchased on 1 April 2018 for R1 20 (including VAT). Installation cost amounted to R100 000. During the course reporting period under review, it was decided to change the method of depreciatic the reducing balance method at 20% per annum to the units of production metho type of manufacturing equipment is expected to produce 650 000 tons before decommissioned. The following production levels were recorded by the operations manager: 1 April 2018 - 31 December 2018 1 January 2019 - 31 December 2019 1 January 2020 - 31 December 2020 Tons Produced 140 000 tons 150 000 tons 120 000 tons reporting period under review, it was decided to change the method of depreciation from the reducing balance method at 20% per annum to the units of production method. This type of manufacturing equipment is expected to produce 650 000 tons before being decommissioned The following production levels were recorded by the operations manager. Tons Produced 1 April 2018 - 31 December 2018 140 000 tons 1 January 2019 - 31 December 2019 150 000 tons 1 January 2020 - 31 December 2020 120 000 tons 2. During the course of the year Summer Ltd received notice from a customer stating that swimwear sold to him was made with inferior quality material causing a rash on his body. The customer initiated a claim for all medical expenses caused by wearing the swimwear. The company's lawyers are of the opinion that the lawsuit will succeed and have determined the following possible amounts that could be paid for damages and injuries incurred: R50 000 (10% possibility) R70 000 (40% possibility) R80 000 (50% possibility). 3. The following information for inventory was provided to you regarding inventories Closing stock units Cost per unit Total Net Realisable Value 26 000 2 500 1 200 Raw material used in the finished products 2nn Rererences Mailings Review View Help QUESTION 1 (CONTINUED) The junior cost accountant provides you with the following information for raw materials: Finished goods Manufacturing cost (excluding VAT) VAT on manufacturing costs Delivery cost R per unit 15.50 2.33 2.10 Swimwear sales decreased during the year due to the pandemic and lock down. The selling price per unit of finished product was decreased from R25 to R21 per unit. Agent's commission amounts to R3.75 per product sold. 4. Summer Ltd summoned its supplier, Water Ltd for selling inferior material that resulted in sub-standard swimwear being produced. The court case is in progress at the moment and Summer Ltd's lawyers are of the opinion that Summer Ltd would possibly succeed with the claim. If the claim is successful Water Ltd will be liable to pay Super Hero Ltd R1 000 000 5 On 1 February 2021 the warehouse of Summer Ltd was broken into when the foreman neglected to activate the alarm. Inventories to the value of R22 000 were stolen. It is expected that the insurance company will not make any payment towards the loss due to the negligence of the foreman. 6. A meeting will be held on 31 March 2021 to authorise the current period's financial statements for issue. REQUIRED: Disclose the relevant notes to the Statement of Financial Position for Summer Ltd for the statements for issue. REQUIRED: Disclose the relevant notes to the Statement of Financial Position for Summer Ltd for the reporting period ended 31 December 2021 to comply with International Financial Reporting Standards (IFRS). (40) Please note: Notes on the accounting policy are not required. The Property, plant and equipment note is not required. Comparative figures are not required. Shows all your calculations clearly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started