Answered step by step

Verified Expert Solution

Question

1 Approved Answer

POOL CORP NEW LOADING EQUIP Pool Corporation, Inc, is the world's largest wholesale distributor of swimming pool supplies and equipment. Assume Pool Corporation purchased for

POOL CORP NEW LOADING EQUIP

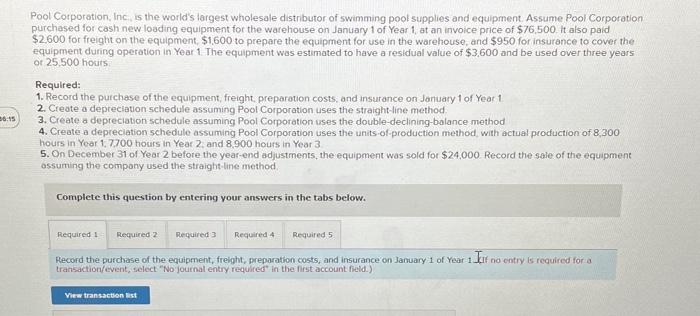

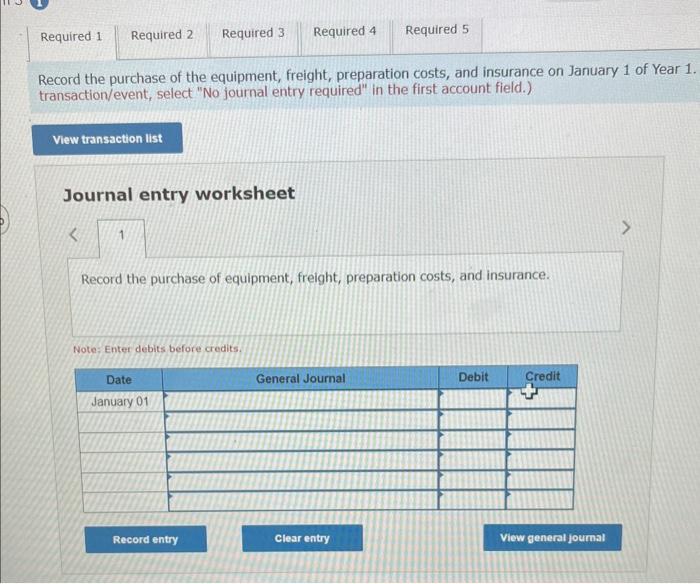

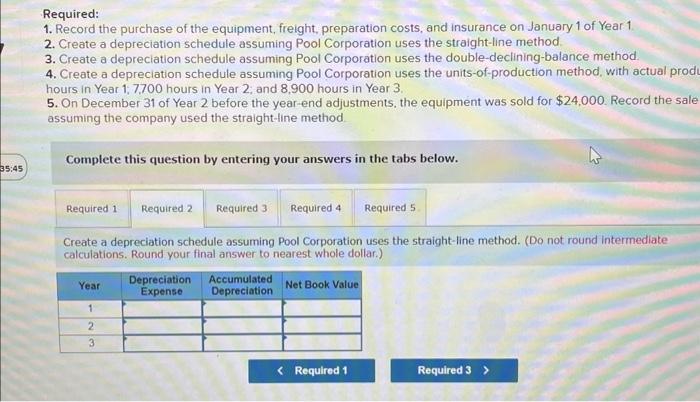

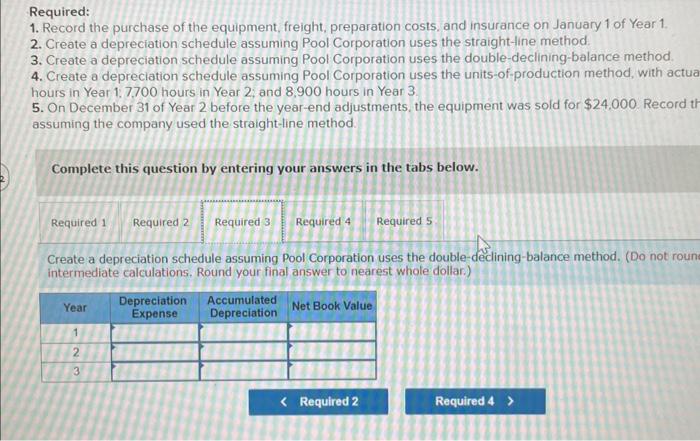

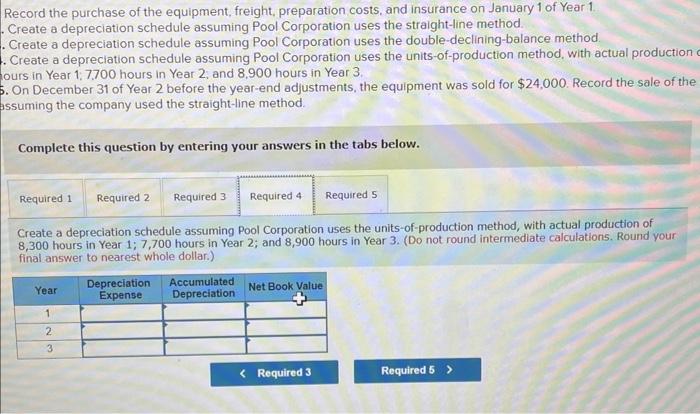

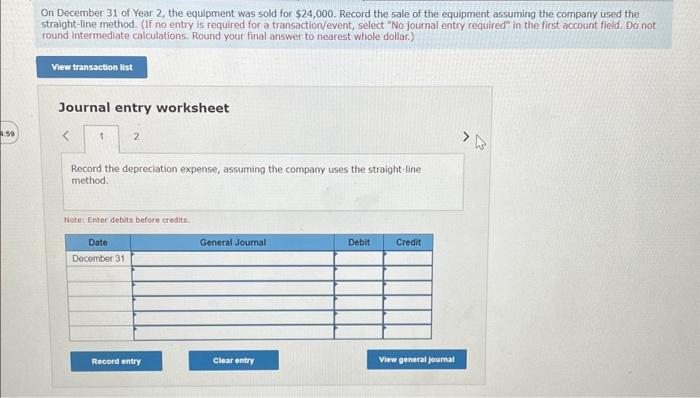

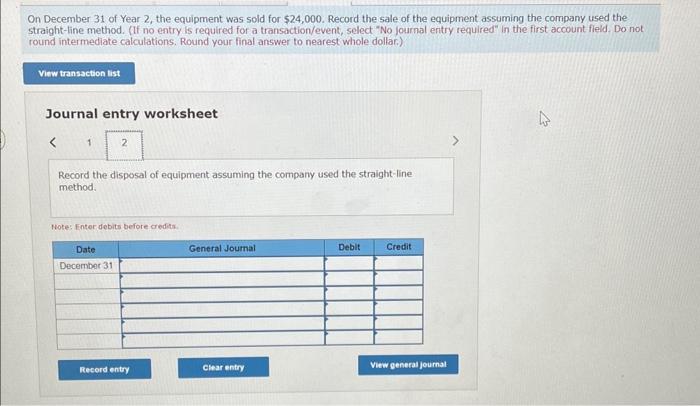

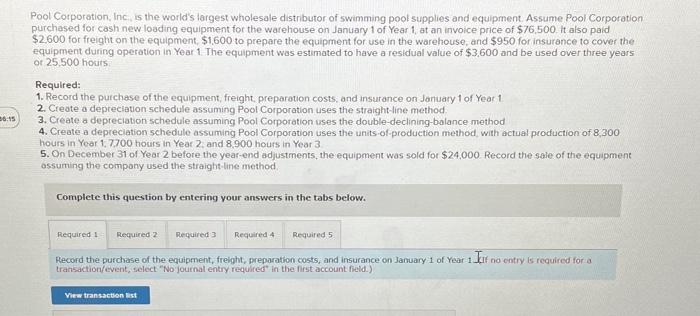

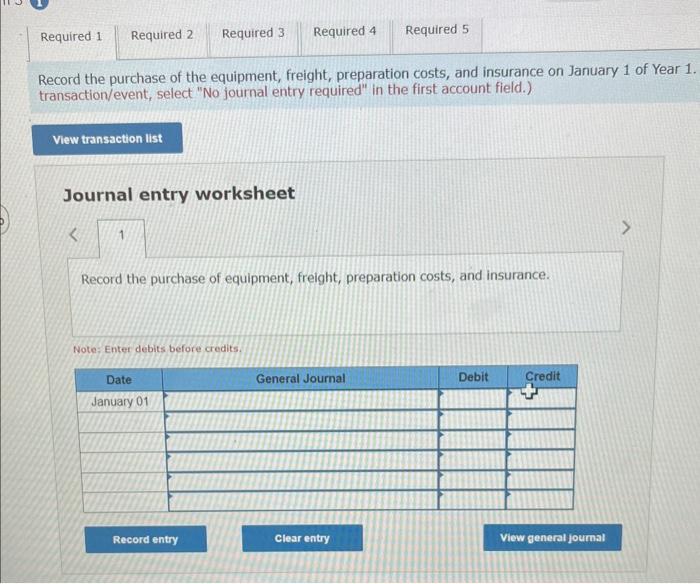

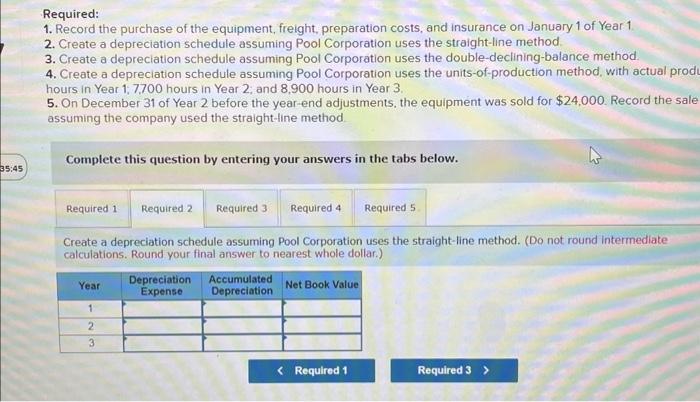

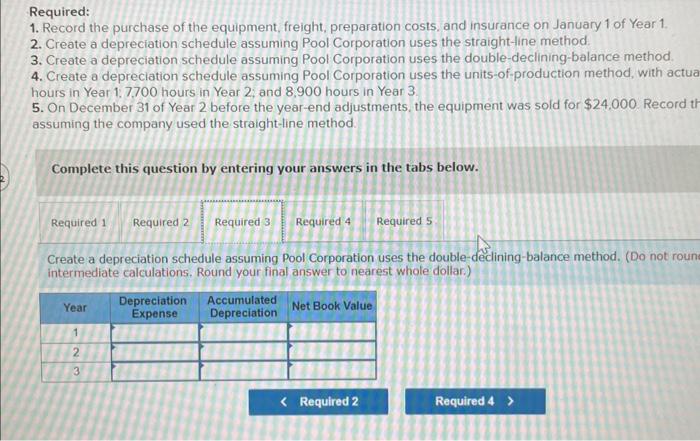

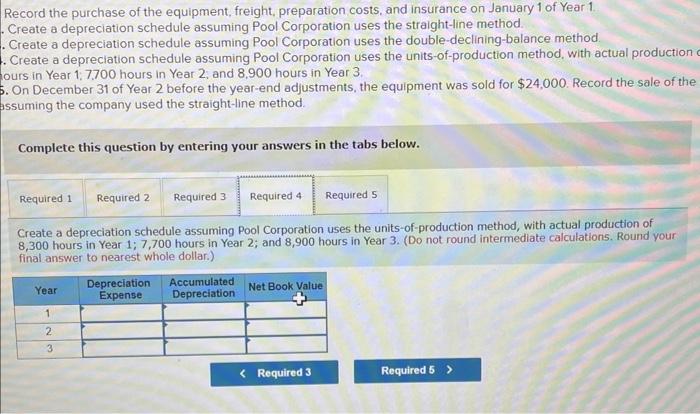

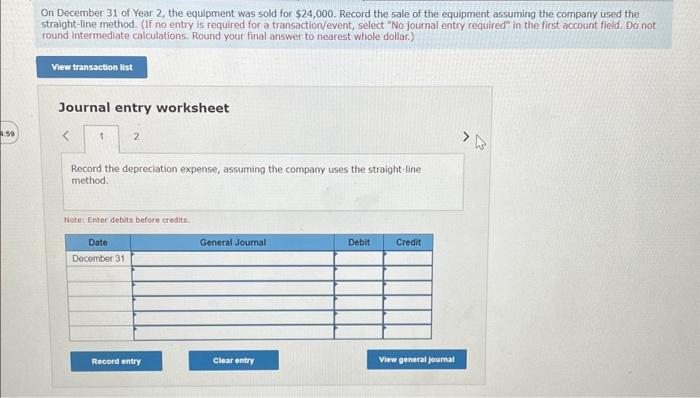

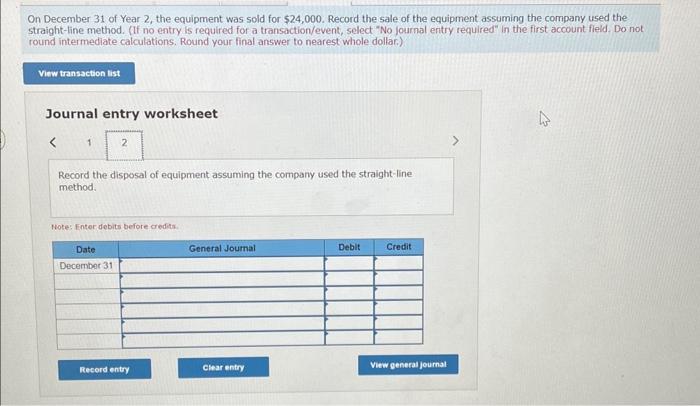

Pool Corporation, Inc, is the world's largest wholesale distributor of swimming pool supplies and equipment. Assume Pool Corporation purchased for cash new loading equipment for the warehouse on January 1 of Year 1 , at an invoice price of $76,500. it also paid $2,600 for freight on the equipment, $1,600 to prepare the equipment for use in the warehouse, and $950 for insurance to cover the equipment during operation in Year 1 . The equipment was estimated to have a residual value of $3,600 and be used over three years or 25.500 hosis Required: 1. Record the purchase of the equipment, freight, preparation costs, and insurance on Jantuary 1 of Yeat 1 2. Create a depreclation schedule assuming Pool Corporation uses the straight-line method. 3. Create a depreciation schedule assuming Pool Corporation uses the double-declining-balance method 4. Create a depreciation schedule assuming Pool Corporation uses the units of-production method, with actual production of 8,300 hours in Year 1,7,700 hours in Year 2 and 8,900 hours in Yeor 3 5. On December 3 of Year 2 before the year-end adjustments, the equipment was sold for $24.000. Record the sale of the equipment assuming the compony used the straight-line method. Complete this question by entering your answers in the tabs below. Record the purchase of the equipment, frelght, preparation costs, and insurance on January 1 of Year 1 Jalf no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record the purchase of the equipment, freight, preparation costs, and insurance on January 1 of Year 1 transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the purchase of equipment, freight, preparation costs, and insurance. Note: Enter debits before credits. Required: 1. Record the purchase of the equipment, freight, preparation costs, and insurance on January 1 of Year 1. 2. Create a depreciation schedule assuming Pool Corporation uses the straight-line method. 3. Create a depreciation schedule assuming Pool Corporation uses the double-declining-balance method. 4. Create a depreciation schedule assuming Pool Corporation uses the units-of-production method, with actual prod hours in Year 1; 7,700 hours in Year 2; and 8,900 hours in Year 3. 5. On December 31 of Year 2 before the year-end adjustments, the equipment was sold for $24,000. Record the sale assuming the company used the straight-line method Complete this question by entering your answers in the tabs below. Create a depreciation schedule assuming Pool Corporation uses the straight-line method. (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Required: 1. Record the purchase of the equipment, freight, preparation costs, and insurance on January 1 of Year 1. 2. Create a depreciation schedule assuming Pool Corporation uses the straight-line method. 3. Create a depreciation schedule assuming Pool Corporation uses the double-declining-balance method. 4. Create a depreciation schedule assuming Pool Corporation uses the units-of-production method, with actu hours in Year 1, 7,700 hours in Year 2; and 8,900 hours in Year 3. 5. On December 31 of Year 2 before the year-end adjustments, the equipment was sold for $24,000 Record t assuming the company used the straight-line method. Complete this question by entering your answers in the tabs below. Create a depreciation schedule assuming Pool Corporation uses the double-declining-balance method. (Do not rour intermediate calculations. Round your final answer to nearest whole dollar.) Record the purchase of the equipment, freight, preparation costs, and insurance on January 1 of Year 1. Create a depreciation schedule assuming Pool Corporation uses the straight-line method. - Create a depreciation schedule assuming Pool Corporation uses the double-declining-balance method. Create a depreciation schedule assuming Pool Corporation uses the units-of-production method, with actual production ours in Year 1;7,700 hours in Year 2; and 8,900 hours in Year 3. 5. On December 31 of Year 2 before the year-end adjustments, the equipment was sold for $24,000. Record the sale of the assuming the company used the straight-line method. Complete this question by entering your answers in the tabs below. Create a depreciation schedule assuming Pool Corporation uses the units-of-production method, with actual production of 8,300 hours in Year 1; 7,700 hours in Year 2; and 8,900 hours in Year 3. (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) On December 31 of Year 2 , the equipment was sold for $24,000. Record the sale of the equipment assuming the company used the straight-line method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Journal entry worksheet 2 Record the depreclation expense, assuming the company uses the straight-line method. Hote: Euter debits before eredits. On December 31 of Year 2, the equipment was sold for $24,000. Record the sale of the equipment assuming the company used the straight-line method. (If no entry is required for a transaction/event, select "No fournal entry required" In the first account field. Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Journal entry worksheet Record the disposal of equipment assuming the company used the straight-line method. Wote: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started