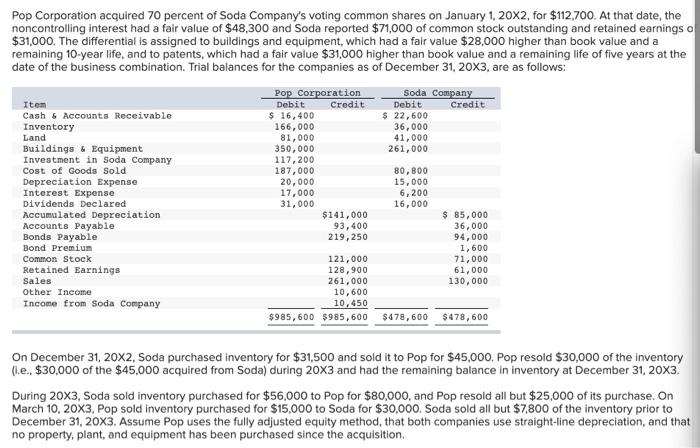

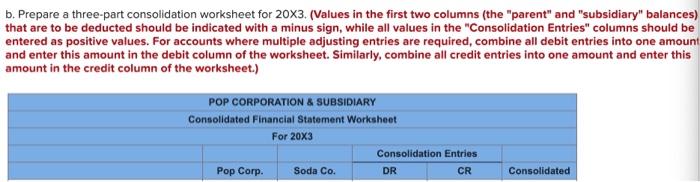

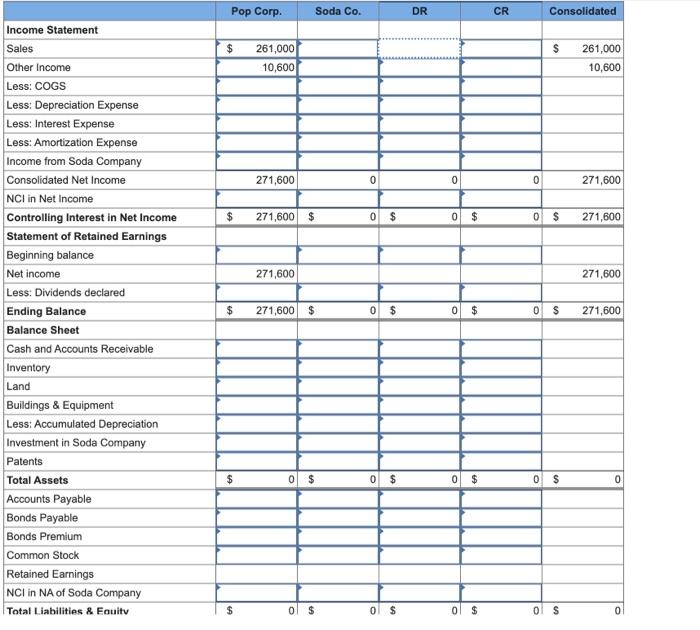

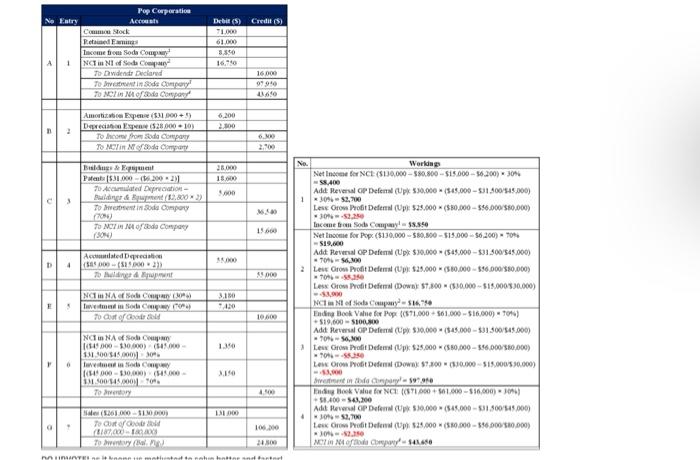

Pop Corporation acquired 70 percent of Soda Company's voting common shares on January 1, 20x2, for $112,700. At that date, the noncontrolling interest had a fair value of $48,300 and Soda reported $71,000 of common stock outstanding and retained earnings o $31,000. The differential is assigned to buildings and equipment, which had a fair value $28,000 higher than book value and a remaining 10-year life, and to patents, which had a fair value $31.000 higher than book value and a remaining life of five years at the date of the business combination. Trial balances for the companies as of December 31, 20X3, are as follows: Pop Corporation Soda Company Item Debit Credit Debit Credit Cash & Accounts Receivable $ 16,400 $ 22,600 Inventory 166,000 36,000 Land 81,000 41,000 Buildings & Equipment 350,000 261,000 Investment in Soda Company 117,200 Cost of Goods Sold 187,000 80, 800 Depreciation Expense 20,000 15,000 Interest Expense 17,000 6,200 Dividends Declared 31,000 16,000 Accumulated Depreciation $141,000 $ 85,000 Accounts Payable 93,400 36,000 Bonds Payable 219, 250 94,000 Bond Premium 1,600 Common Stock 121,000 71,000 Retained Earnings 128,900 61,000 Sales 261,000 130,000 Other Income 10,600 Income from Soda Company 10,450 $985,600 $985,600 $478,600 $478,600 On December 31, 20x2, Soda purchased inventory for $31,500 and sold it to Pop for $45,000. Pop resold $30,000 of the inventory fi.e., $30,000 of the $45,000 acquired from Soda) during 20x3 and had the remaining balance in inventory at December 31, 20x3. During 20x3, Soda sold inventory purchased for $56,000 to Pop for $80,000, and Pop resold all but $25,000 of its purchase. On March 10, 20X3. Pop sold inventory purchased for $15,000 to Soda for $30,000. Soda sold all but $7,800 of the inventory prior to December 31, 20x3. Assume Pop uses the fully adjusted equity method, that both companies use straight-line depreciation, and that no property, plant, and equipment has been purchased since the acquisition. b. Prepare a three-part consolidation worksheet for 20X3. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) POP CORPORATION & SUBSIDIARY Consolidated Financial Statement Worksheet For 20X3 Consolidation Entries Pop Corp. Soda Co. CR DR Consolidated Pop Corp. Soda Co. DR CR Consolidated $ 261,000 $ 261,000 10,600 10,600 271,600 0 0 0 271,600 $ 271,600 $ 0 $ 0 $ 0 $ 271,600 271,600 271,600 $ 271,600 $ 0 $ 0 $ 0 s 271,600 Income Statement Sales Other Income Less: COGS Less: Depreciation Expense Less: Interest Expense Less: Amortization Expense Income from Soda Company Consolidated Net Income NCI in Net Income Controlling Interest in Net Income Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Cash and Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Soda Company Patents Total Assets Accounts Payable Bonds Payable Bonds Premium Common Stock Retained Earnings NCI in NA of Soda Company Total Liabilities & Equity $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 Pop Corporation Ne Entry Act Cock Redmi Income from Soda Copy 1 NCTINIS Tower Declared Te Benin id compory! TO MIM Consult Deb (5) Credil (5) 100 61.000 3840 16.10 16000 0790 16 6.100 100 2 Amortization Expense ($11.000 Dereito R$28.000 10 To holonde Canary TO ME de Canyon 6.ME 2.100 Bell Patents($31.000-1.2002) 70 Aded Depreciation Bu >> TO in de compory 25.000 15.000 8.000 TO MIMO do Compory EN 19660 D 4 Acciated que 8000 (2003 To Alle 45000 M 1 m Meu la 141 Dovement in San Tout of 3.100 1.120 $ No. World Net Income for NCE ($130.000 - 580.800 - $15.000 - 56.200) 30% 58.400 Add Reversal OP Deferal Upx 330.000 - 1545.000 - $1.00/545.000) 1 30%2.700 Less Grom ProtDeferal (pl: 525.000 (S80.000 - 556.000 580.000) 30.5.250 Income to comode $8.390 Net Income for Pop (5130.000 - 580.00 - $15.000-56,200)- 70% -519.000 Adit Reversal OP Defem (Up $10.000 (545.000-1300/545.000) -709,00 2 Les Gran Profit Deer (Up $20.000 (580.000 - 596.000/580.000) T. Les Oro Prodit Deferal (Down 57.800 (530.000 - 515.000 330.000) $3,000 NCHINI - 516,10 Ending Book Value for Pope (571,000 - $61.000 - 516,000 TOM) - $19.000 - 100.00 Adit Reversal OP Deferal $30,000 ($45.000 - $31300/545.000) -70756.00 Lew Groot Deens (Up $35.000 (5.80,000 - $56.000/380.000) 01.30 Les Oro Pote Dow 7.300 110.000 - 515,000 30.000) 53,000 de hacial Td Book Value for NC (ST1000 61.000 - 386.000) 1095 58.400 543,200 Adt Beveral OP Deferal (570.000 (15.000 - 531500545.000) 303,700 Les Groot Deel 525.000 50.000 - 596.000 10.000) n r 1.360 0 NI NANCY (549.000 $10,000) 145.000 33100 48.000 ludin (149000 - $30,000) (14.000 11.004.200701 TO 100 (1361000-1100 To como BAT Town 24 HIVY th