Answered step by step

Verified Expert Solution

Question

1 Approved Answer

por favor ayudenme a solucionar estos problemas The capital accounts of Mike Cash and Ed Doerr have balance sheets of $56,000 and $100,000 respectively. Paula

por favor ayudenme a solucionar estos problemas

The capital accounts of Mike Cash and Ed Doerr have balance sheets of $56,000 and $100,000 respectively. Paula Goles and Julia Howel are going to be admitted to society. Goals buy 1/4 of Cash's interest for $22,000 and 1/5 of Doerr's interest for $30,000. Howel contributes $60,000 for which he will receive an interest of $60,000. (5 pts)

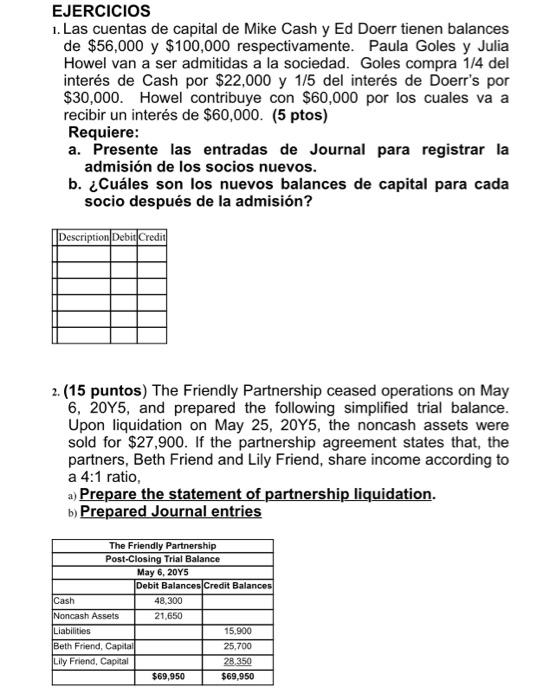

Requires:

A. Submit Journal entries to register the admission of new members.

B. What are the new capital balance sheets for each member after admission?

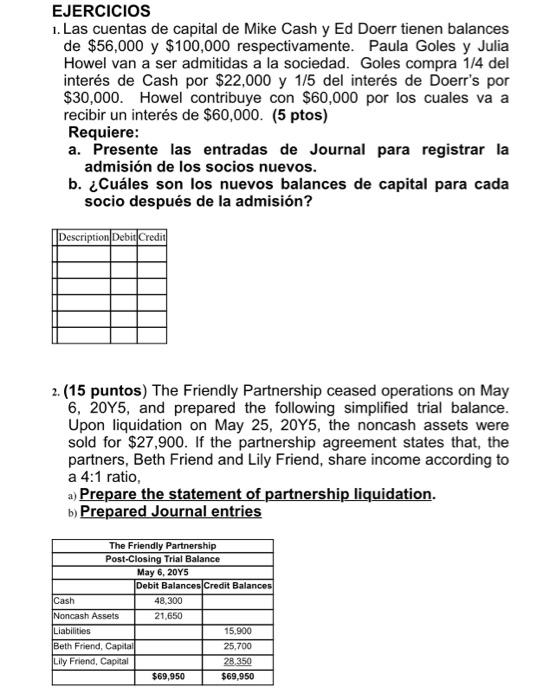

2-The Friendly Partnership ceased operations on May 6, 20Y5, and prepared the following simplified trial balance. Upon liquidation on May 25, 20Y5, the noncash assets were sold for $27,900. If the partnership agreement states that, the partners, Beth Friend and Lily Friend, share income according to a 4:1 ratio,

a) Prepare the statement of partnership liquidation.

b) Prepared Journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started