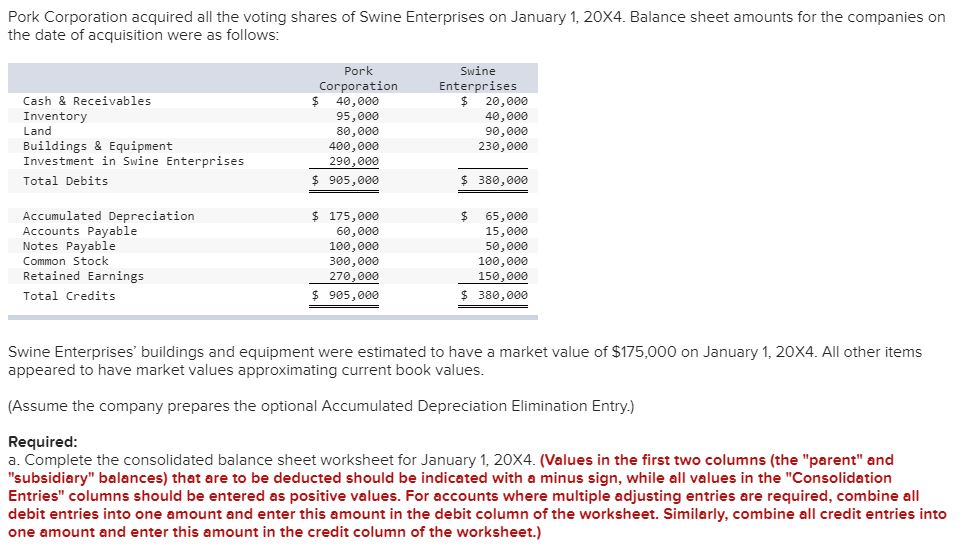

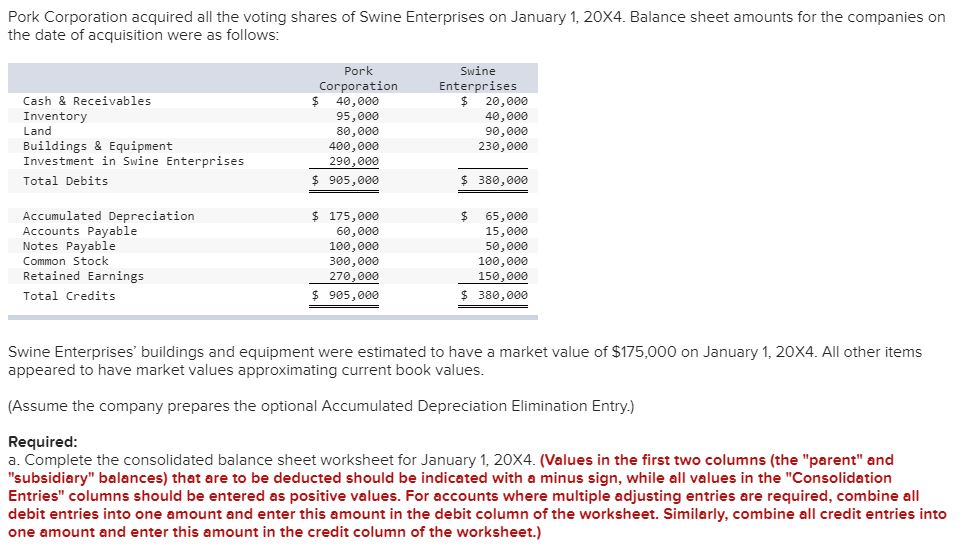

Pork Corporation acquired all the voting shares of Swine Enterprises on January 1, 20X4. Balance sheet amounts for the companies on the date of acquisition were as follows:

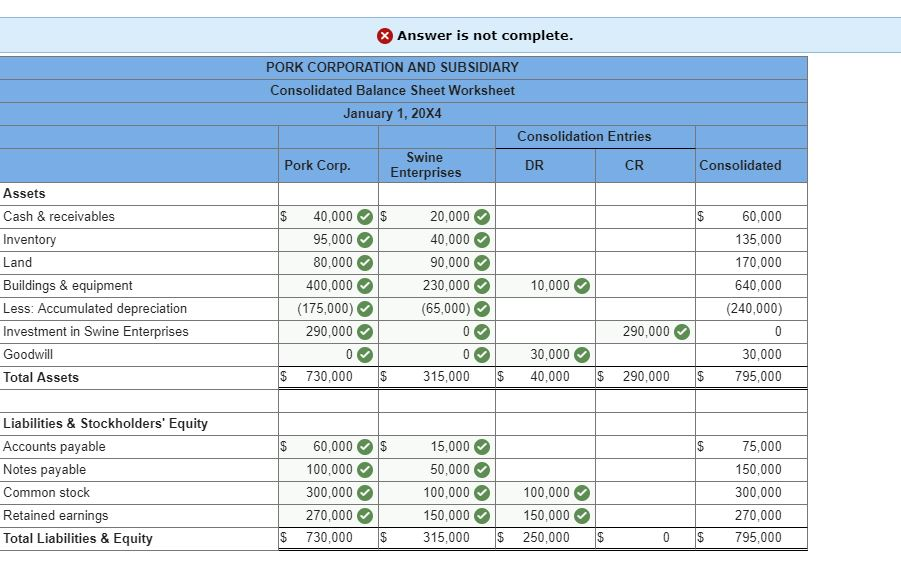

Swine Enterprises buildings and equipment were estimated to have a market value of $175,000 on January 1, 20X4. All other items appeared to have market values approximating current book values. (Assume the company prepares the optional Accumulated Depreciation Elimination Entry.) Required: a. Complete the consolidated balance sheet worksheet for January 1, 20X4.

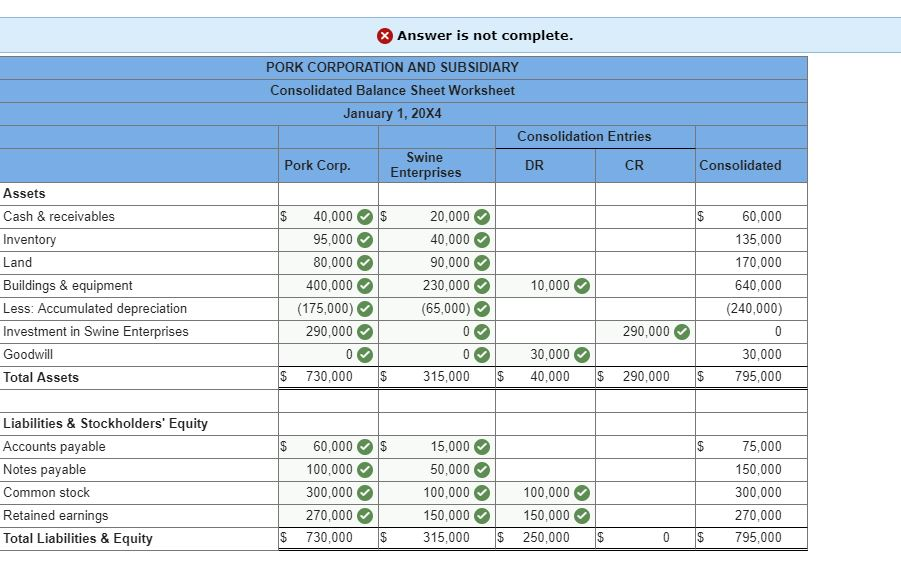

What am I missing in the answer displayed below:

Pork Corporation acquired all the voting shares of Swine Enterprises on January 1, 20x4. Balance sheet amounts for the companies on the date of acquisition were as follows Pork Corporation Swine Enterprises Cash & Receivables Inventory Land Buildings & Equipment Investment in Swine Enterprises Total Debits $ 40,000 95,000 80,000 400,000 290,000 $ 905,000 $ 20,000 40,000 90,000 230,000 $ 380,000 Accumulated Depreciation Accounts Payable Notes Payable Common Stock Retained Earnings Total Credits $175,000 60,000 100,000 300,000 270,000 $ 65,000 15,000 50,000 100,000 150,000e $ 380,000 $ 905,000 Swine Enterprises' buildings and equipment were estimated to have a market value of $175,000 on January 1, 20X4. All other items appeared to have market values approximating current book values (Assume the company prepares the optional Accumulated Depreciation Elimination Entry.) Required a. Complete the consolidated balance sheet worksheet for January 1, 20X4. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Answer is not complete PORK CORPORATION AND SUBSIDIARY Consolidated Balance Sheet Worksheet January 1, 20X4 Consolidation Entries Swine Enterprises Pork Corp DR CR Consolidated Assets Cash & receivables Inventory Land Buildings & equipment Less: Accumulated depreciation Investment in Swine Enterprises Goodwil Total Assets $40,000 S 95,000 80,000 400,000 (175,000) 290,000 20,000 40,000 90,000 230,000 (65,000) 60,000 135,000 170,000 640,000 (240,000) 10,000 290,000 30,000 290,000 795,000 30,000 $ 730,000 S 315,000$40,000 Liabilities & Stockholders' Equity Accounts payable Notes payable Common stock Retained earnings Total Liabilities & Equity $60,000S 100,000 300,000 270,000 $ 730,000 S 15,000 50,000 100,000 150,000 75,000 150,000 300,000 270,000 795,000 100,000 150,000 315,000 $ 250,000 $ 0